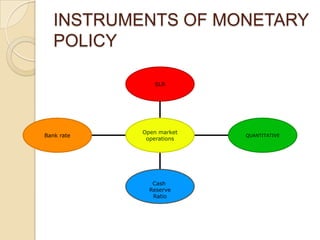

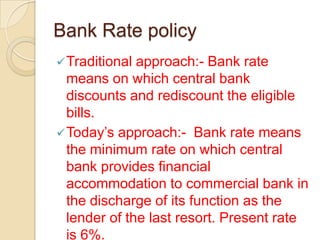

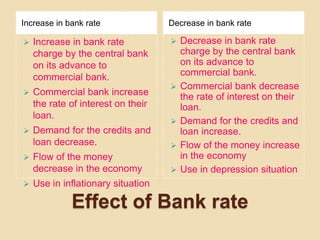

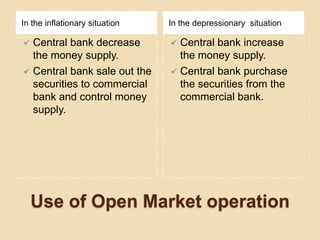

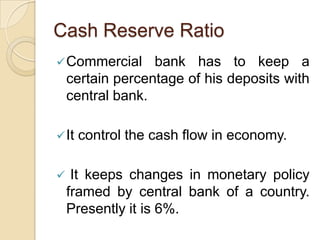

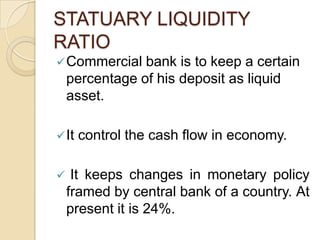

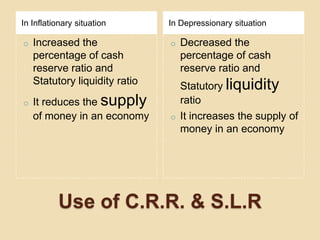

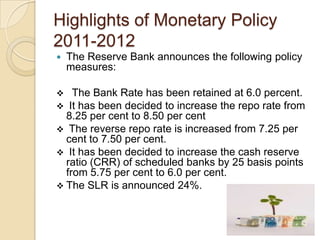

The document discusses various aspects of monetary policy in India including the objectives, instruments, and highlights of the Reserve Bank of India's monetary policy for 2011-2012 which increased key policy rates like the repo rate and reverse repo rate while also raising the cash reserve ratio. It also outlines some limitations of monetary policy like time lags in implementation and issues related to forecasting economic conditions.