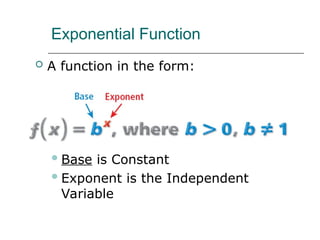

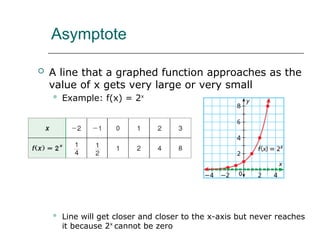

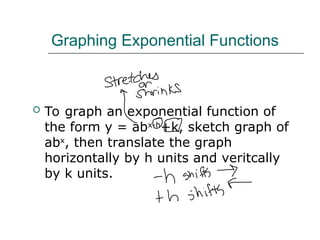

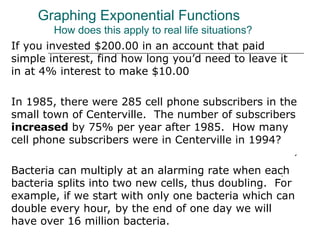

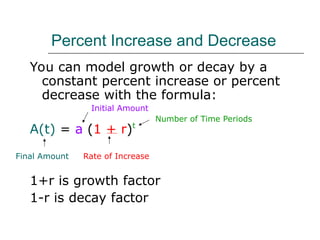

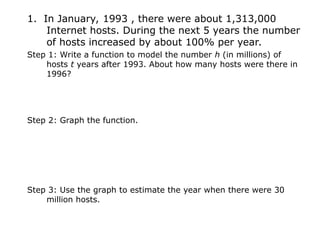

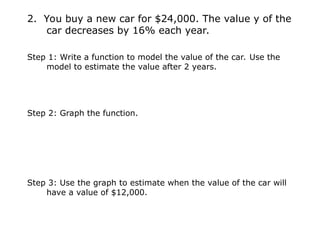

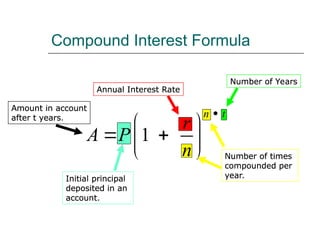

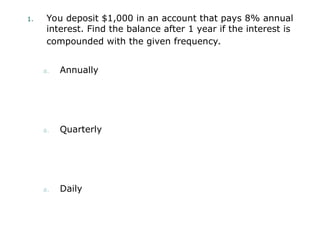

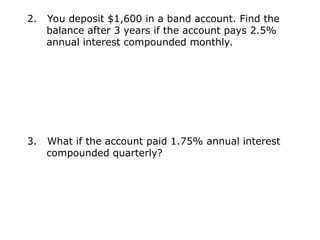

The document discusses exponential functions, specifically focusing on modeling real-life situations involving growth and decay. It includes explanations of graphing these functions, examples of interest calculations, and practical applications such as the growth of cell phone subscribers and the depreciation of a car's value. Additionally, the document provides formulas for compound interest and examples of calculating account balances based on different compounding frequencies.