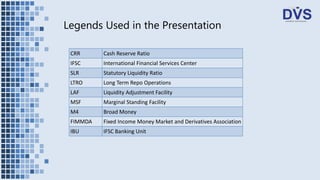

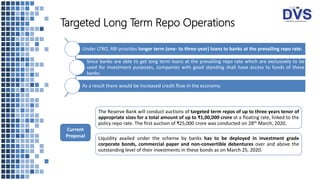

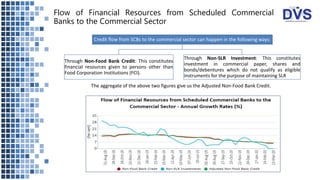

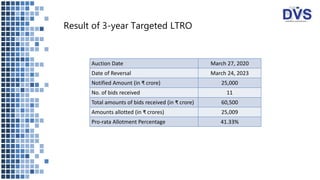

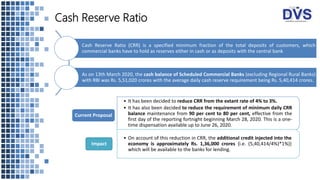

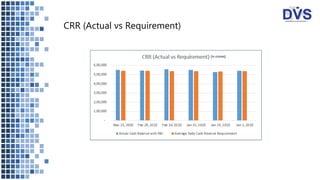

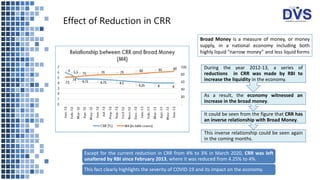

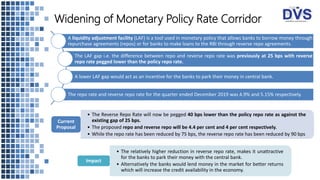

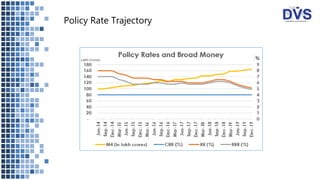

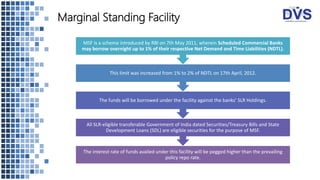

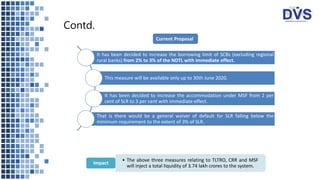

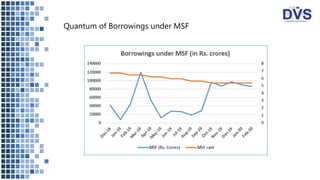

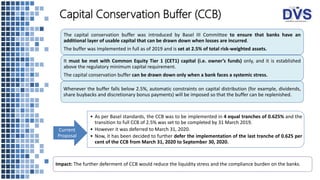

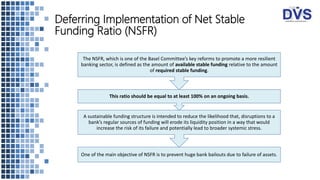

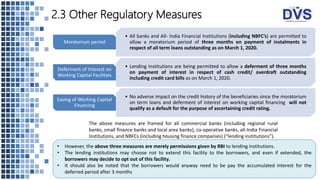

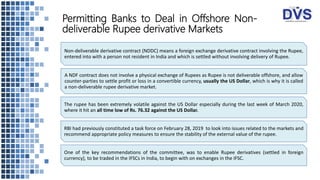

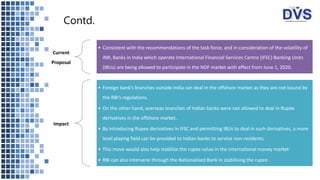

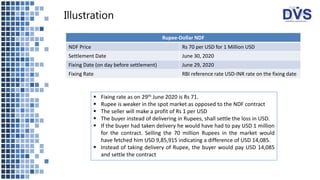

The document outlines various liquidity measures and regulatory policies implemented by the Reserve Bank of India (RBI) in response to economic challenges, particularly due to the COVID-19 pandemic. Key measures include adjustments in the Cash Reserve Ratio (CRR), implementation of Long-Term Repo Operations (LTRO), and deferral of regulatory requirements like the Capital Conservation Buffer (CCB) and Net Stable Funding Ratio (NSFR) to ease liquidity stress in the banking sector. Additionally, RBI has permitted banks to engage in offshore non-deliverable rupee derivative markets to stabilize the currency and provide a level playing field for Indian banks in servicing non-residents.