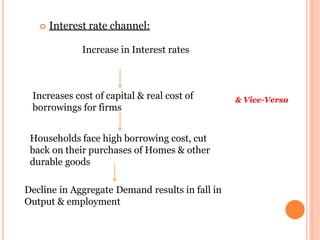

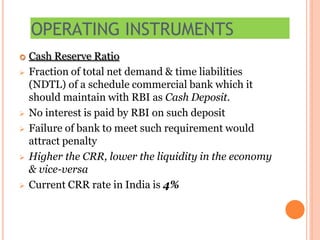

The document discusses monetary policy, which involves the use of various instruments by central banks to manage the money supply and credit in an economy, with the aim of promoting economic growth. It outlines the objectives of monetary policy, such as maintaining economic stability and controlling inflation, and explains the mechanisms - including interest rate, exchange rate, and asset price channels - through which it influences macroeconomic variables. Additionally, the document details the operating procedures and instruments used by central banks, such as the cash reserve ratio, statutory liquidity ratio, and liquidity adjustment facilities.