This document provides an annual report and analysis of Raymond Textiles for 2010-2011. Key points include:

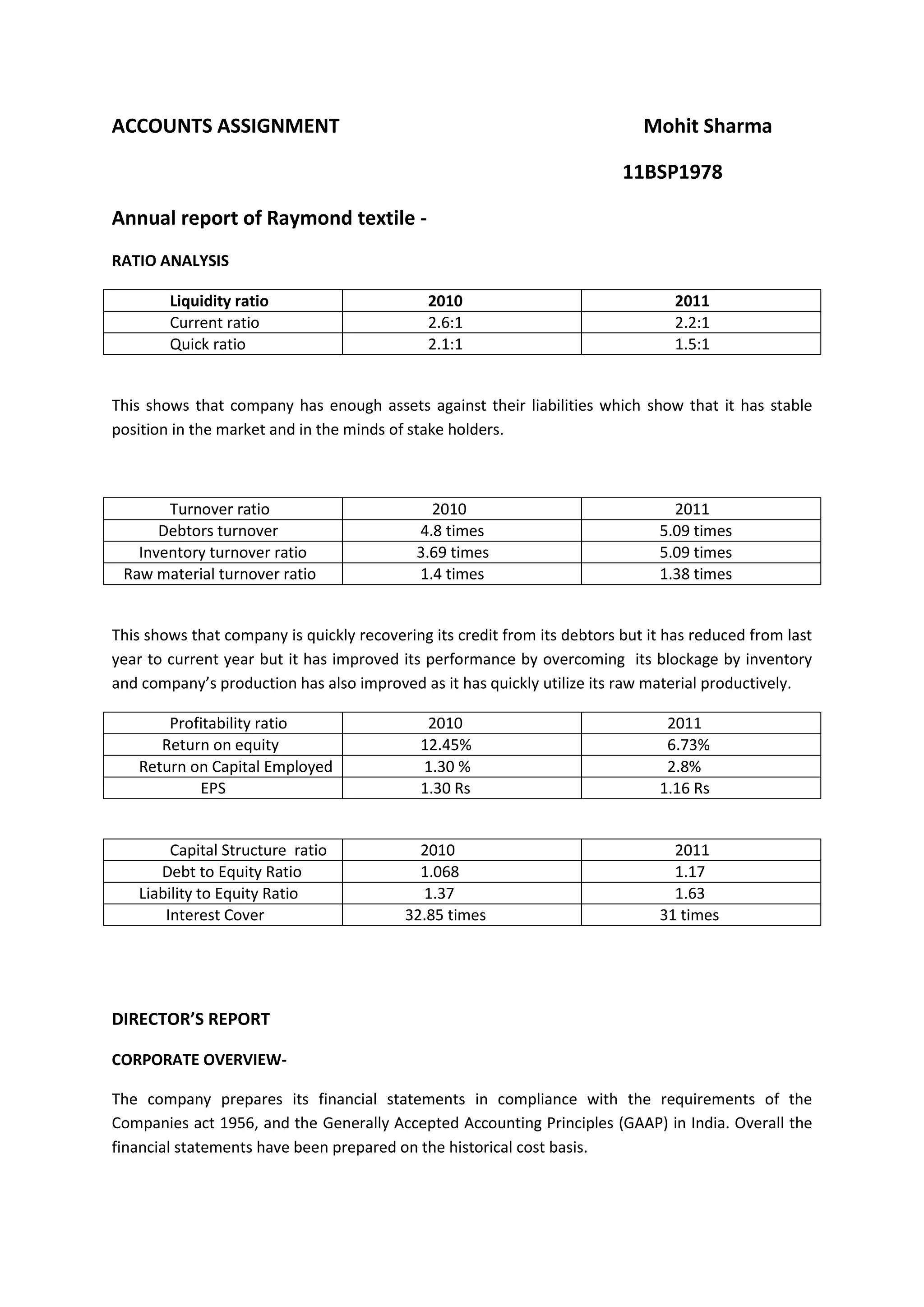

- Liquidity and turnover ratios show the company has stable financial position and is recovering credits and utilizing raw materials efficiently.

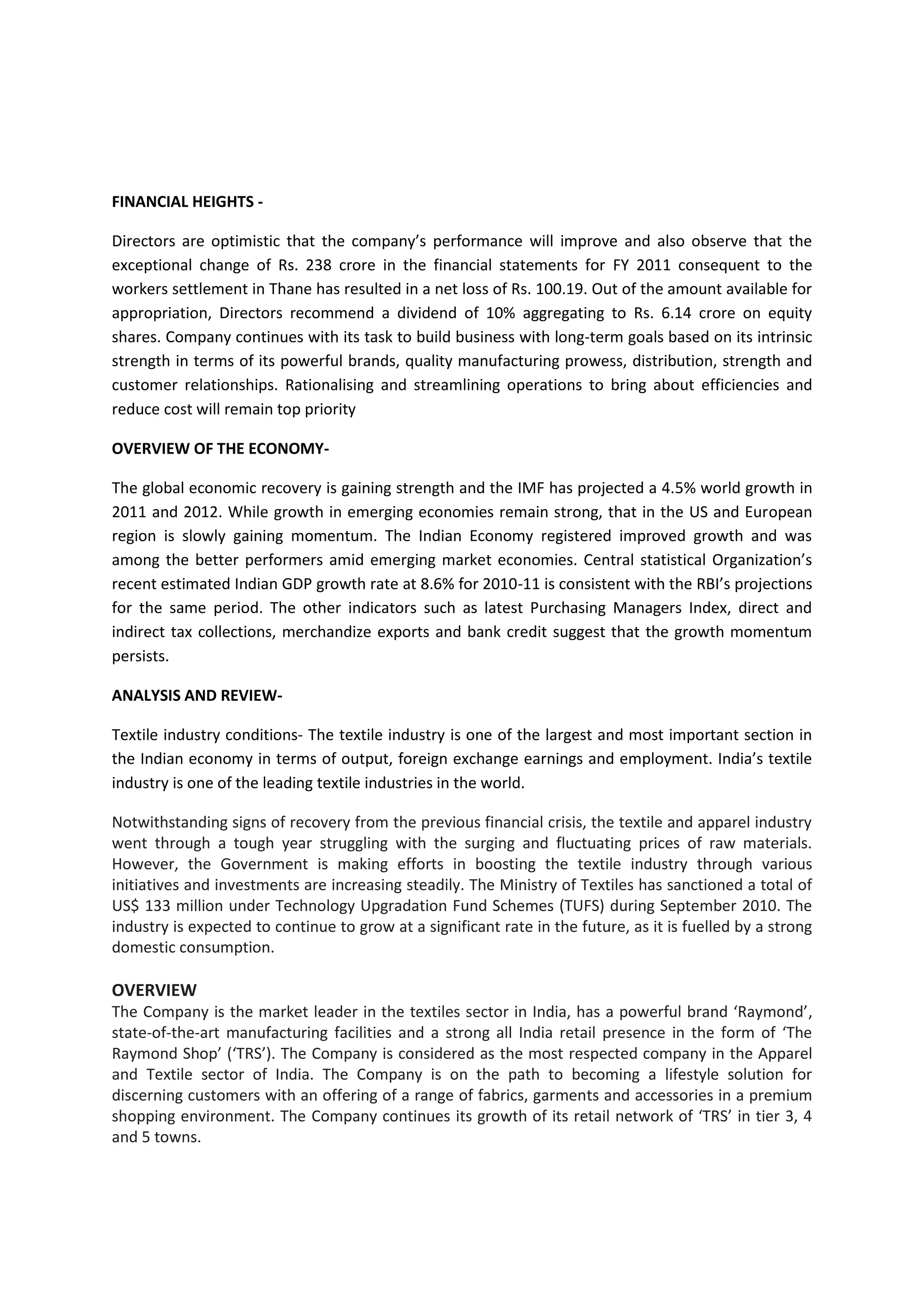

- Profitability declined from 2010 to 2011 due to a workers' settlement cost.

- The textile industry faced challenges from fluctuating raw material prices but government initiatives are boosting growth.

- Raymond remains the market leader in India and is expanding its retail network and market share. Exports remained flat due to competition and input cost rises.

- The company manages risks from foreign exchange, interest rates, and commodity prices and ensures environmental and safety compliance.