Embed presentation

Download to read offline

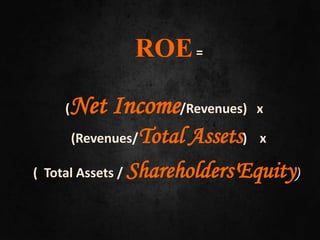

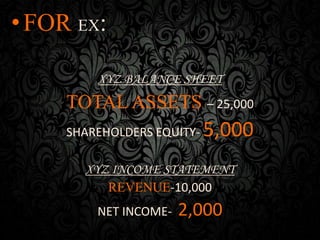

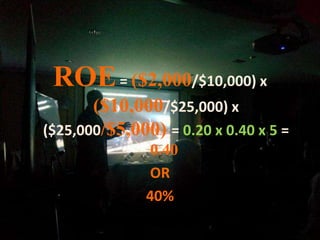

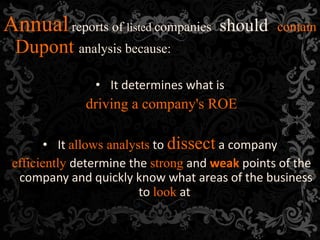

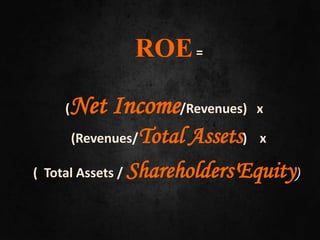

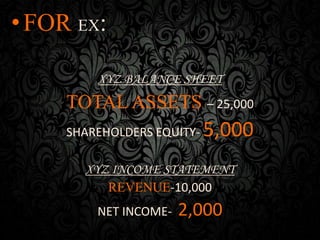

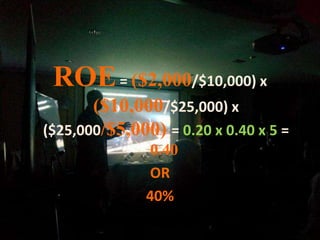

This document discusses ratio analysis and DuPont analysis. Ratio analysis is used to analyze information in financial statements to judge efficiency, locate weaknesses, and compare plans. DuPont analysis examines return on equity (ROE) by analyzing profit margin, asset turnover, and financial leverage. It breaks down ROE to determine what is driving a company's performance and allows analysts to efficiently determine its strong and weak points. DuPont analysis helps investors thoroughly evaluate a company before investing and helps companies increase their ROE.