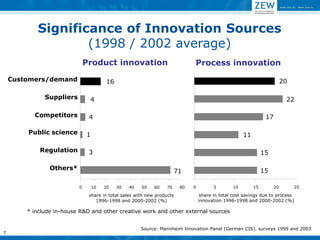

The document explores the role of public procurement of innovation (PPI) in driving innovation in firms, using data from the German innovation surveys. It identifies various external sources of innovation, analyzes their significance, and assesses the impact of PPI on firms' innovation performance. Furthermore, it discusses the strengths and limitations of the methodology used to gather innovation-related data.