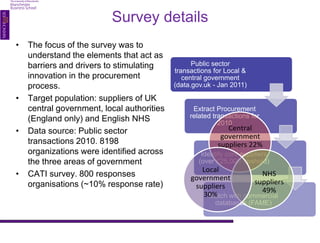

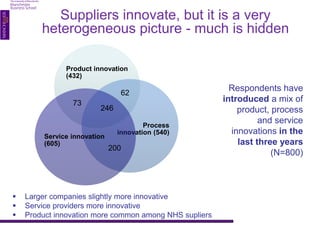

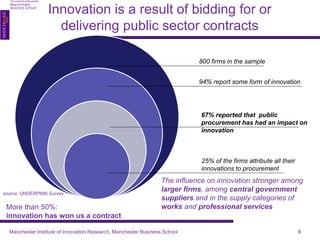

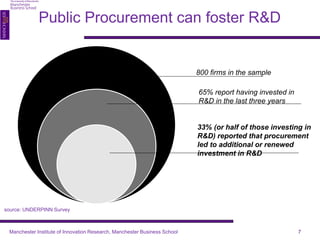

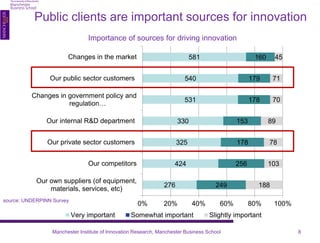

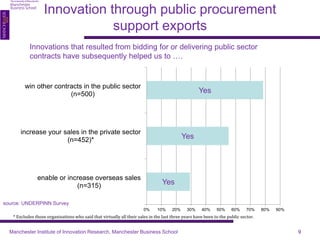

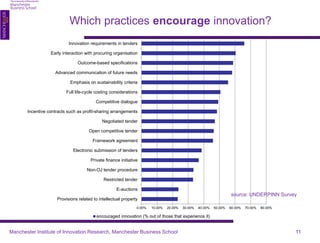

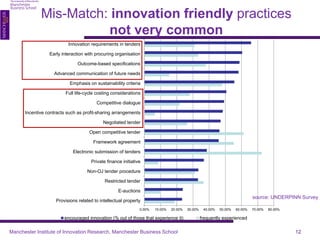

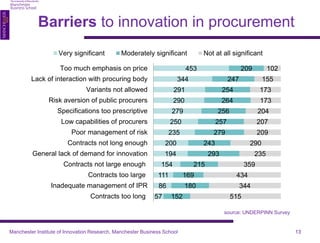

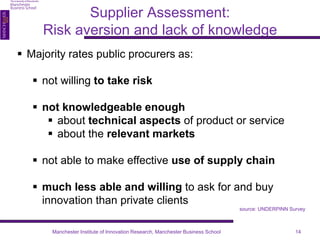

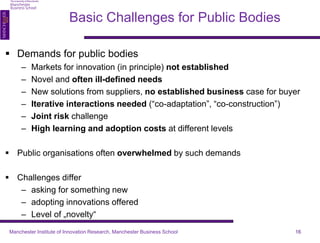

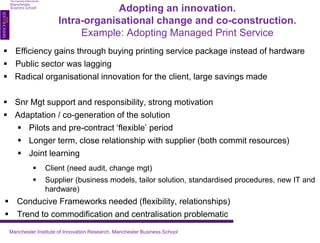

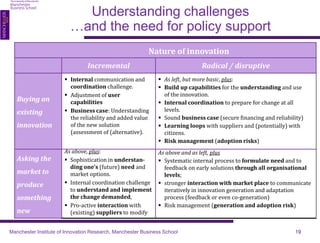

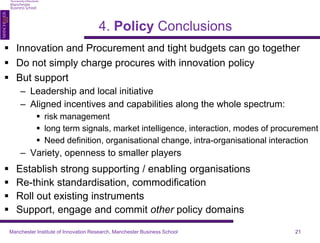

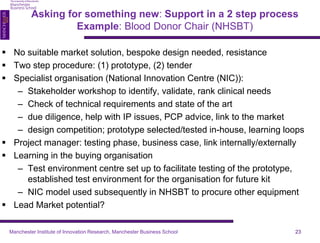

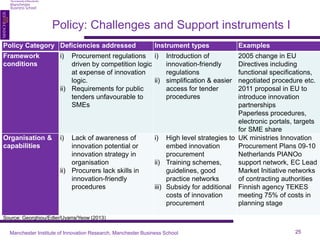

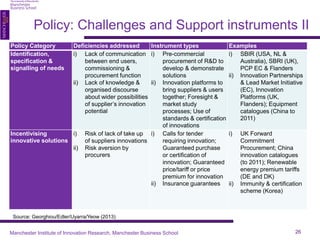

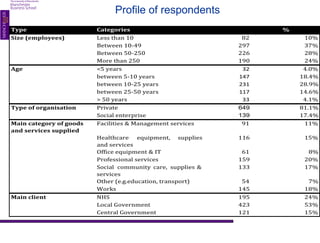

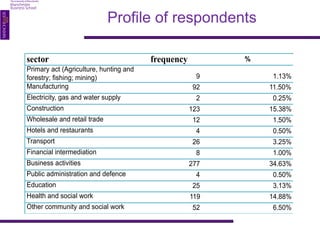

The document discusses the findings of a study on public procurement of innovation, emphasizing the challenges and opportunities faced by suppliers in the UK public sector. It highlights that 94% of surveyed firms innovate, with public procurement significantly impacting their innovation capabilities, especially in larger firms. It also identifies barriers to effective innovation procurement and suggests that policy support is crucial for enhancing innovation outcomes within public sectors.