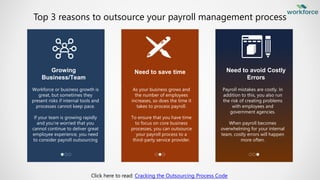

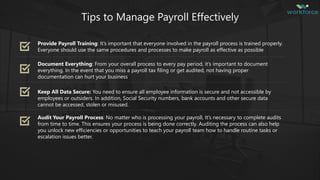

The document outlines the significance of payroll management in ensuring timely employee compensation and legal compliance. It discusses various methods of payroll processing, including manual processing, payroll software, and outsourcing, highlighting their pros and cons. Additionally, it emphasizes the necessity of proper training, documentation, and security measures in payroll management to avoid costly errors and retain employee trust.