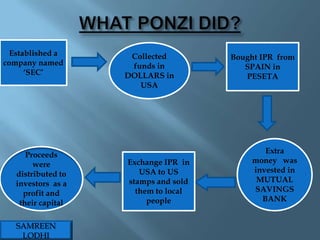

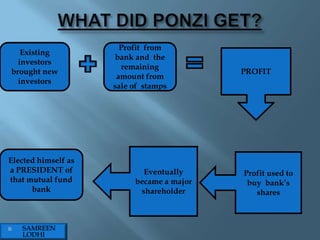

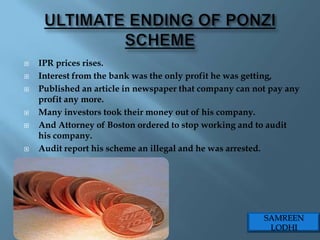

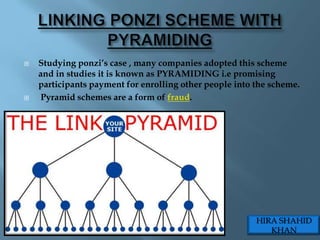

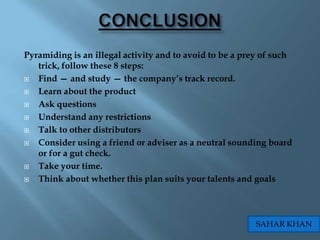

The document discusses pyramiding, a fraudulent financial scheme that increases margins using unrealized returns and resembles Ponzi schemes. It highlights historical examples, such as Charles Ponzi's use of international postal reply coupons, and warns about the nature of pyramid schemes that rely on recruiting new members for profit. Additionally, it provides steps to avoid falling victim to such schemes.