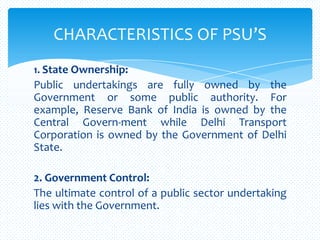

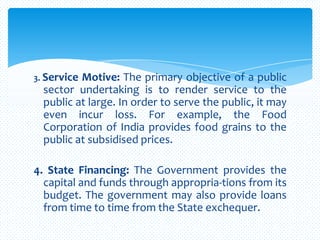

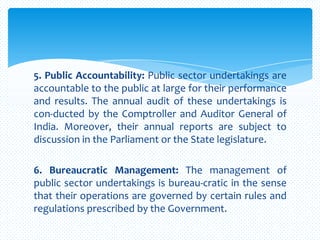

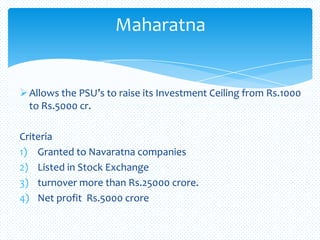

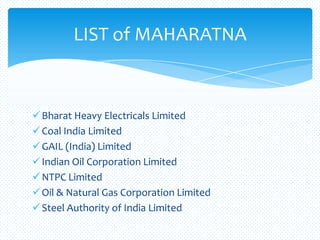

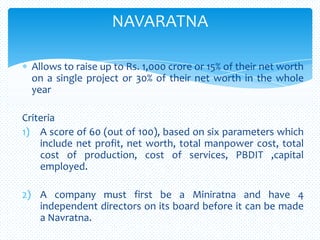

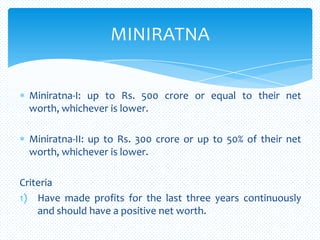

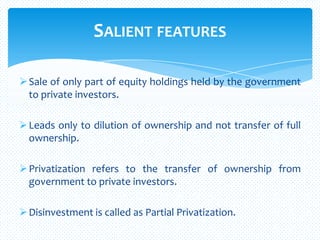

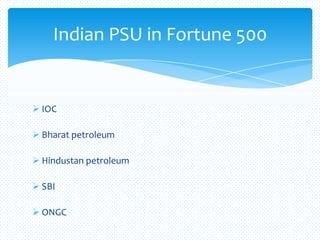

Central and state public sector undertakings (PSUs) play an important role in India's economic development and industrialization. PSUs were established by the government to address socio-economic issues and steer the country towards self-reliant growth. There are currently 249 PSUs in India. PSUs are characterized by state ownership and control, a service motive over profits, state financing, and bureaucratic management. They provide advantages like balanced growth and development but also have limitations like lack of efficiency and flexibility. PSUs are categorized as Maharatna, Navaratna or Miniratna based on their performance and criteria. Disinvestment involves partial privatization of PSUs to raise resources and increase efficiency.