Embed presentation

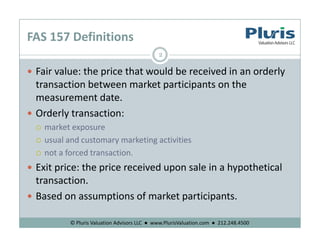

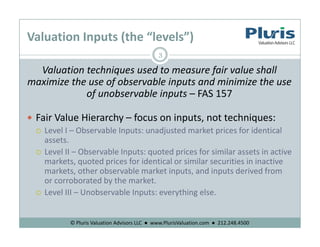

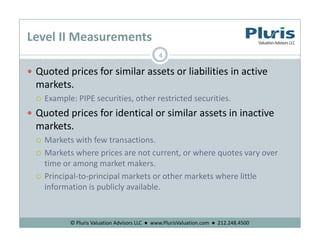

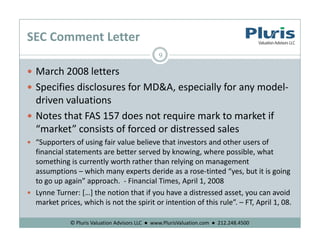

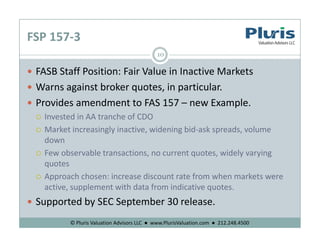

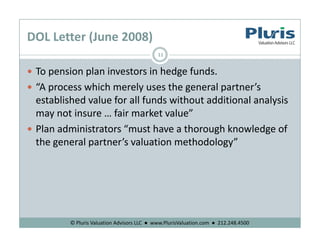

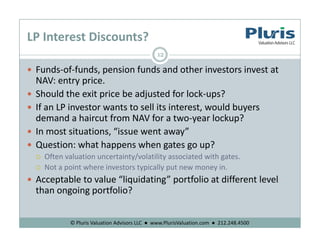

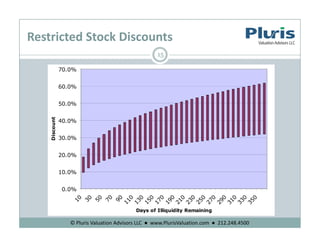

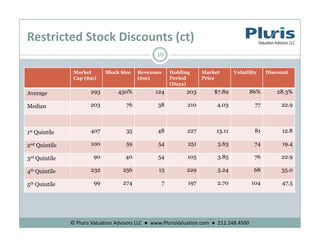

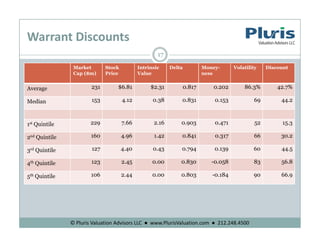

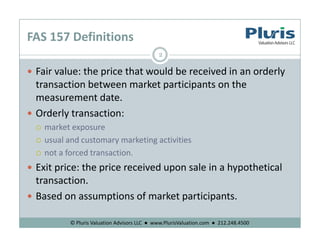

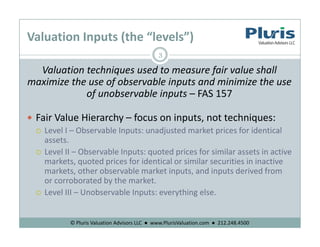

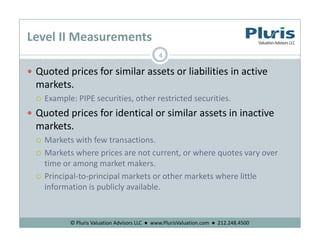

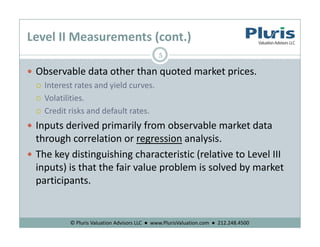

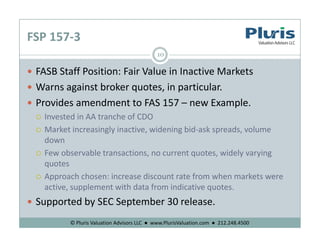

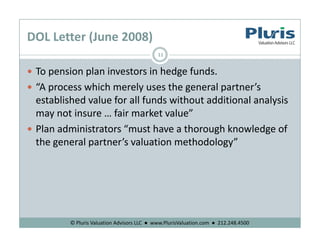

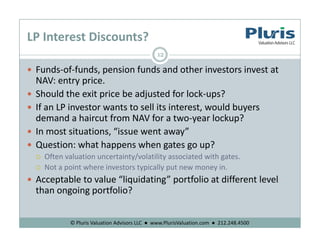

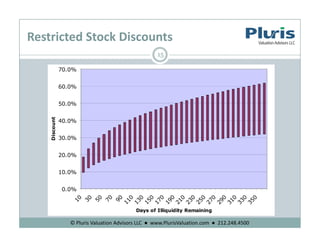

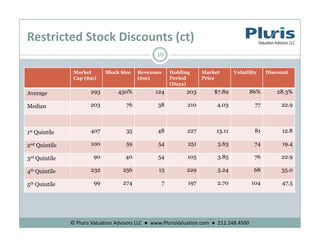

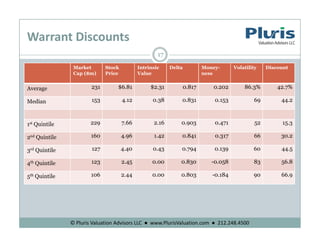

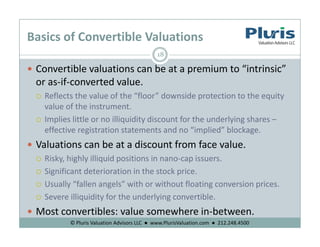

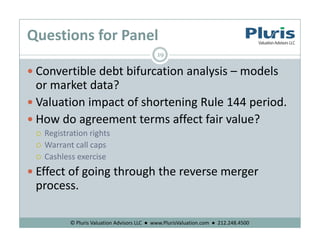

The document discusses fair value measurement guidelines under FAS 157, emphasizing the use of observable inputs to minimize the use of unobservable inputs for asset valuations. It outlines the valuation hierarchy, new guidance for illiquid markets, and the importance of considering market conditions and transaction volume in fair value assessments. Additionally, it addresses various types of discounts that may apply to restricted stock and convertible securities.