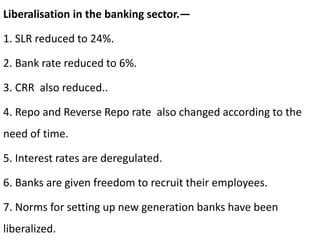

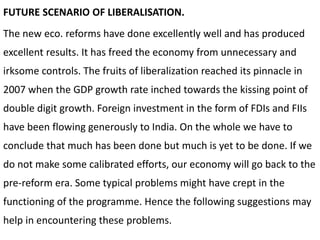

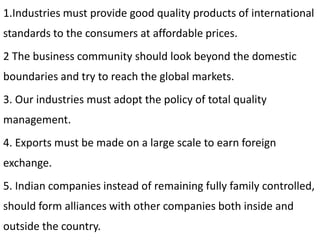

The document discusses protectionism and economic liberalization in India. It provides arguments for and against protectionism, as well as methods of protection like tariffs and quotas. Economic liberalization in India in 1991 abolished licensing for most industries, allowed more foreign investment and imports, and deregulated interest rates and capital markets. Further liberalization could help industries compete globally by improving quality, expanding exports, and forming more partnerships.