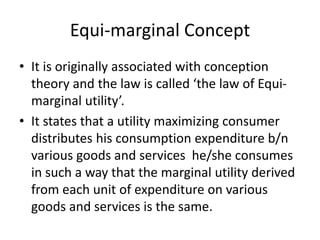

Managerial economics applies microeconomic and macroeconomic theories to business decision-making. It helps managers understand market conditions, competition, and the business environment. Managerial economics provides analytical models, methods, and frameworks to analyze operational issues like pricing, production levels, and new investments from a microeconomic perspective. It also helps analyze macroeconomic factors like economic growth, interest rates, and government policies that shape the business environment. Key economic concepts used in managerial decision-making include incremental costs and revenues, discounting, opportunity costs, and equi-marginal utility.