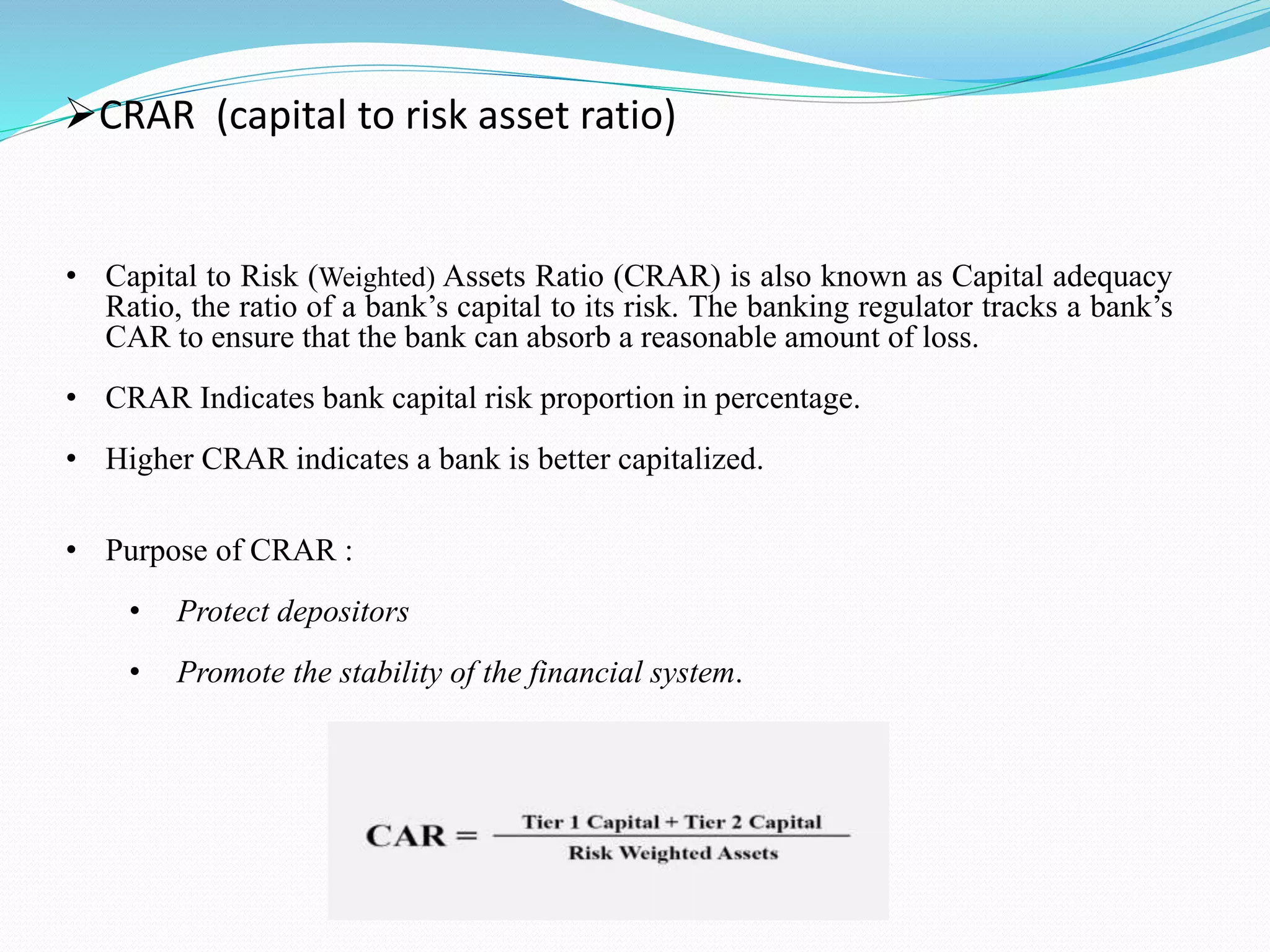

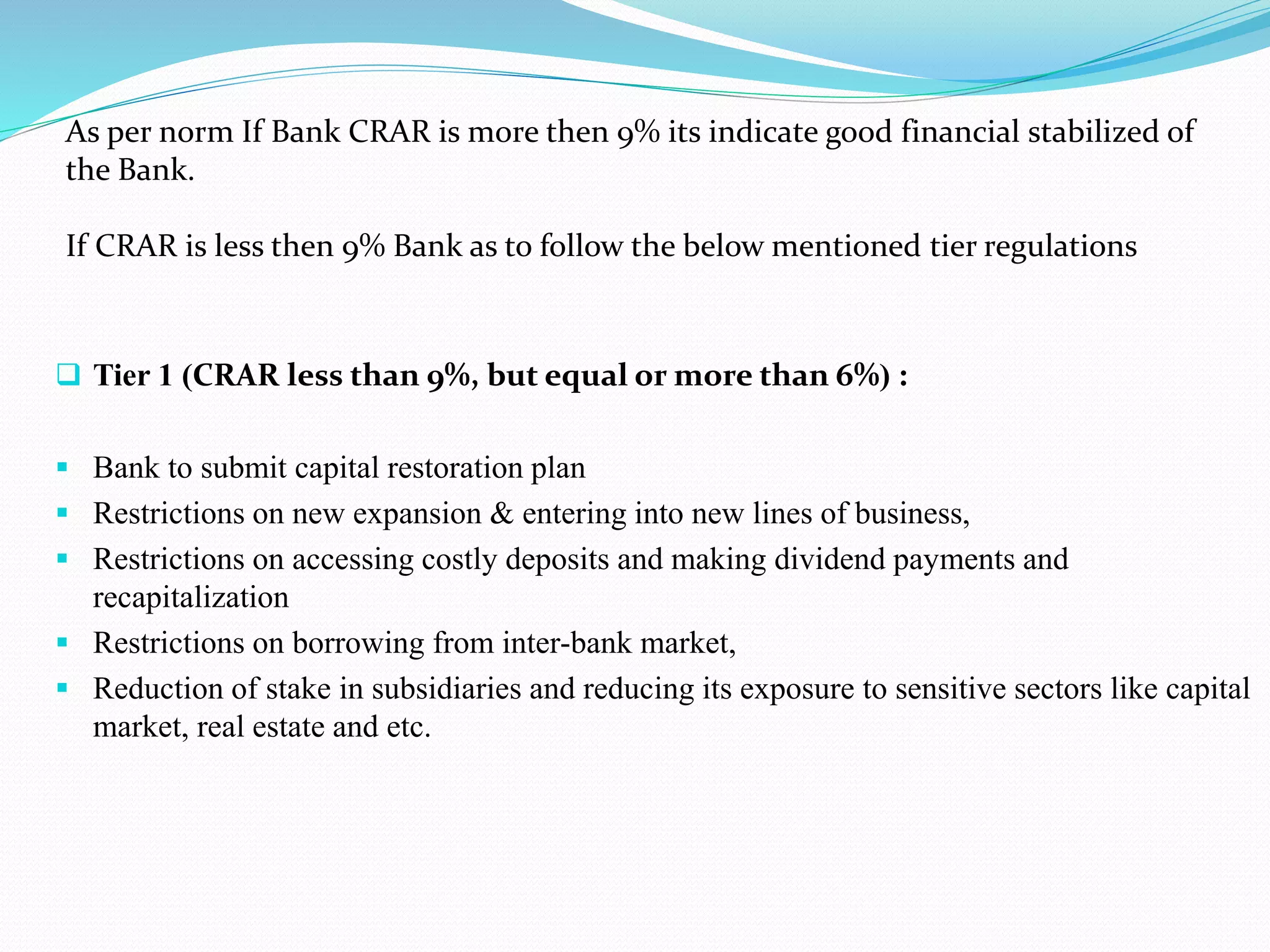

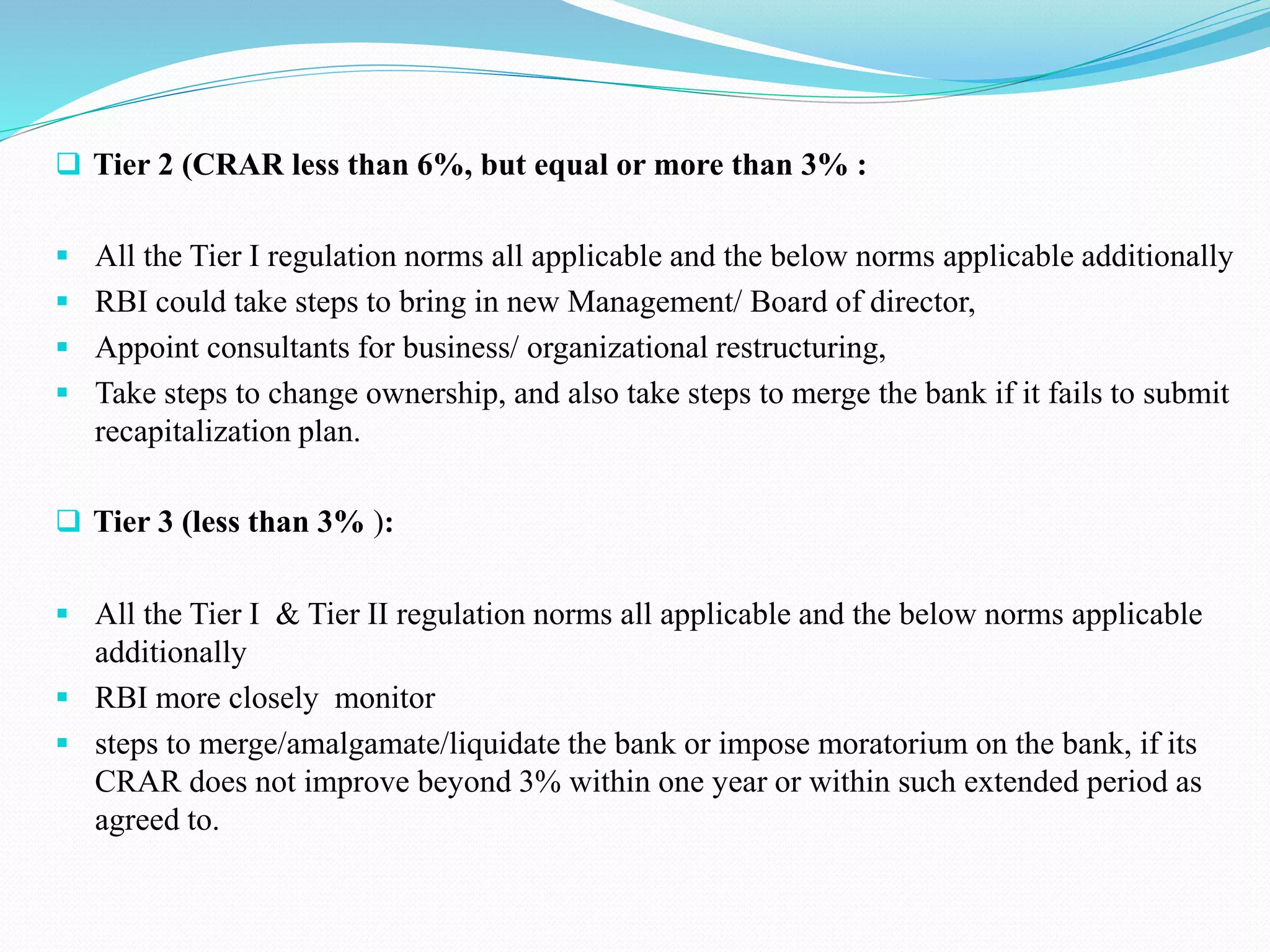

The Reserve Bank of India's Prompt Corrective Action framework provides guidelines for intervention when banks demonstrate weak financial performance based on capital, asset quality, profits, and losses. The framework specifies thresholds for capital ratios, non-performing assets, and returns on assets that trigger increasing restrictive actions by the RBI to restore financial health as a bank's condition deteriorates. As of March 2019, six public sector banks in India remained under PCA framework restrictions, down from a peak of twelve in early 2018, as government capital injections helped other banks improve their financial positions.