The document discusses the merger between American Airlines and US Airways which was announced in February 2013 and completed in December 2013. It provides background on both airlines, the rationale for the merger which was to create the world's largest airline, and the legal challenges in obtaining regulatory approval. The merger combined the two airlines under the American Airlines name and brand, with US Airways management taking over operations from American's headquarters in Fort Worth, Texas. However, full integration was delayed as labor unions like the IAM had not yet reached new contracts with the combined airline.

![Slogan- The new American is arriving.

Commenced

operations

1934

Hubs

Dallas/Fort Worth

International Airport

John F. Kennedy

International Airport(New

York)

Los Angeles International

Airport

Miami International

Airport

O'Hare International

Airport (Chicago)

Focus cities LaGuardia Airport (New

York)

Frequent-flyer

program

AAdvantage

Airport lounge Admirals Club

Alliance Oneworld

Fleet size 631

Destinations 273 (excluding US Airways

exclusive destinations) excl.

code-shares[1]

Company

slogan

The new American is

arriving.

Parent

company

American Airlines Group](https://image.slidesharecdn.com/finalreport-140822000650-phpapp02/85/Project-Report-on-Merger-of-American-airlines-and-US-airlines-6-320.jpg)

![Headquarters Fort Worth, Texas, USA

Key people Doug Parker (CEO)

Scott Kirby (President)

Tom Horton (Chairman)

Website www.aa.com

American Airlines, Inc. (AA) is a major U.S. airline headquartered in Fort Worth, Texas.

It operates an extensive international and domestic network, with scheduled flights

throughout North America, the Caribbean, South America, Europe, and Asia. Its route

network centers around five "cornerstone" hubs in Dallas/Fort Worth, New York, Los

Angeles, Miami, and Chicago. Its primary maintenance base is located at Tulsa

International Airport (TUL).

American Airlines is part of the One world airline alliance, and coordinates fares,

services, and scheduling with British Airways, Finn air, and Iberia in the transatlantic

market and with Japan Airlines and Qantas in the transpacific market. Envoy Air,

SkyWest, Inc., SkyWest Airlines, and ExpressJet Airlines operate regional flights for

American Airlines under the American Eagle brand. Chautauqua Airlines fed the

American Airlines network under the American Connection brand; it will then [when?]

operate flights for the American Eagle brand due to the discontinuation of the American

Connection brand.

The former parent company of American Airlines, AMR Corporation, filed for Chapter 11

bankruptcy protection in November 2011, and in February 2013 announced plans to

merge with US Airways Group, creating the largest airline in the world. AMR and US

Airways Group completed the merger on December 9, 2013, with the new holding

company American Airlines Group, Inc. being listed on NASDAQ that day, although the

actual integration of the airlines under a single air operator's certificate will not be

completed until a much later date. The combined airline will carry the American Airlines

name and branding, and will maintain the existing US Airways hubs in

Charlotte, Philadelphia, Phoenix, and Washington D.C. for a period of at least five years

under the terms of a settlement with the US Department of Justice and several state

attorneys-general.](https://image.slidesharecdn.com/finalreport-140822000650-phpapp02/85/Project-Report-on-Merger-of-American-airlines-and-US-airlines-7-320.jpg)

![Founded 1937 (as All American

Aviation)

Hubs

Charlotte/Douglas

International Airport

Philadelphia International

Airport

Phoenix Sky Harbor

International Airport

Ronald Reagan

Washington National

Airport[1]

Frequent-flyer

program

Dividend Miles

Airport lounge US Airways Club

Alliance Oneworld (affiliate)[2]

Subsidiaries Piedmont Airlines

PSA Airlines

Fleet size 349 (Mainline), 278

(Express)[3]

Destinations 193[3]

Company

slogan

Fly with US

Parent

company

American Airlines Group

Headquarters Tempe, Arizona, USA[4]

Key people Robert Isom (CEO)[5]

Website usairways.com](https://image.slidesharecdn.com/finalreport-140822000650-phpapp02/85/Project-Report-on-Merger-of-American-airlines-and-US-airlines-9-320.jpg)

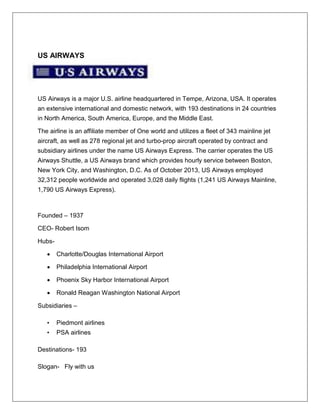

![Combined fleet

American Airlines + US Airways fleet[24]

Aircraft Airline In

Service

Orders Passengers Notes

F J W Y Total

Airbus A319-

100

US

AA

93

16

—

50

— 12

8

112

102

124

110

Airbus A320-

200

US 68 — — 12 138 150

Airbus A321-

200

Transcontinental

AA 12 76[25] 10 20 36 36 102

Airbus A321-

200

US 94 TBA

Airbus A321neo AA — 130[26] TBA Ordered by

American.

Deliveries

begin 2017.

Airbus A330-

200

US 15 20 — 238 258

Airbus A330-

300

US 9 — 28 — 263 291

Airbus A350-

900

AA — 22[27] 36 — 294 330 Ordered by

US Airways.

Deliveries

begin 2017.

Boeing 737-400 US 10 — — 12 132 144 All to be

retired in

2014.

Boeing 737-800 AA 280 76 16 — — 132 148

16 — — 148 160](https://image.slidesharecdn.com/finalreport-140822000650-phpapp02/85/Project-Report-on-Merger-of-American-airlines-and-US-airlines-21-320.jpg)

![Boeing 737

MAX 8

AA — 100[28] TBA

Boeing 757-200

Domestic

US

AA

84 — 22 — — 166 188

Boeing 757-200

International

US

AA

33 — 16 — — 166 182

Boeing 767-

200ER

US

AA

10

6

— 18

10

0

20

— 186

128

204

268

Last Flight

AA : 7 May

2014. Last

Flight US :

Dec 2014.

Boeing 767-

300ER

AA 58 — — 30 — 195 225 Half being

retired. Other

half being

retrofitted.

Boeing 777-

200ER

AA 47 — 8 52 30 157 247

Boeing 777-

300ER

AA 11 10[29] 8 52 30 220 310

Boeing 787-8 AA — 12[28] TBA Deliveries

begin

2014.[30]

Boeing 787-9 AA — 30[28] TBA Deliveries

begin

2014.[30]

McDonnell

Douglas MD-82

AA 89 — 16 — — 124 140 To be

phased out

by 2018.

McDonnell

Douglas MD-83

AA 74 — 16 — — 124 140 To be

phased out

by 2018.

Embraer 190 US 20 — 11 — 88 99

Total 1023 506](https://image.slidesharecdn.com/finalreport-140822000650-phpapp02/85/Project-Report-on-Merger-of-American-airlines-and-US-airlines-22-320.jpg)