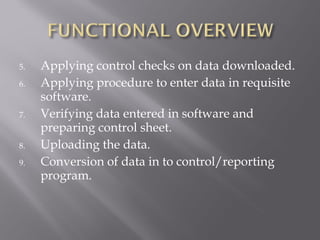

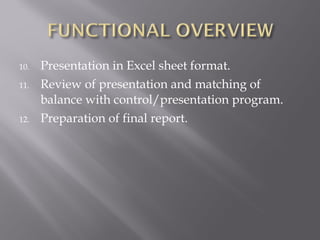

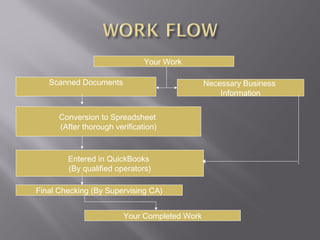

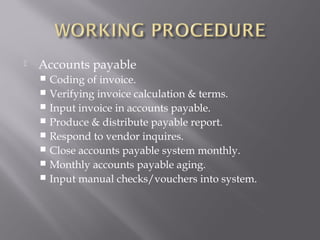

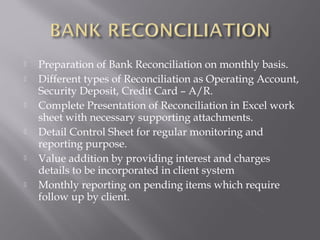

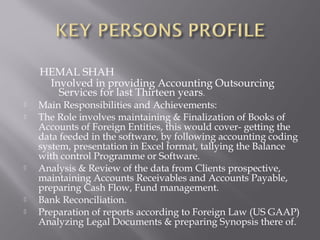

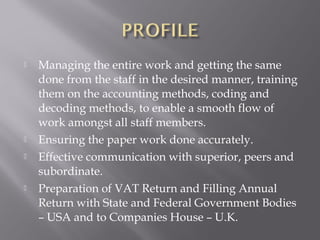

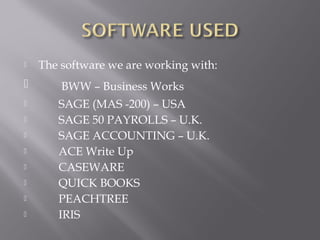

This document provides an overview of bookkeeping and financial business process outsourcing services. It details the key benefits such as focusing on core business functions, leveraging skilled labor at affordable prices, and gaining access to world-class technology. It then lists the specific services offered, including bookkeeping, tax preparation and planning, payroll, and financial reporting. The document concludes with biographies of key staff and details of the software and facilities used.