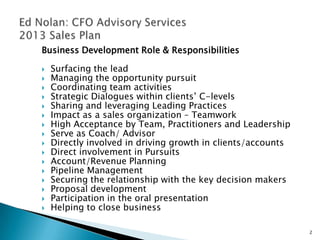

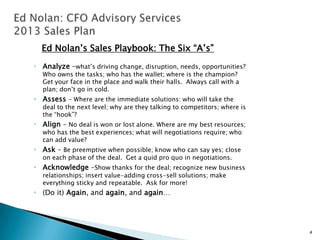

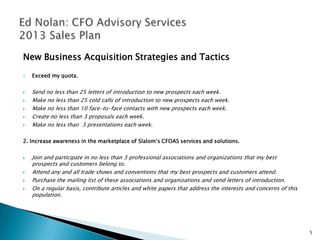

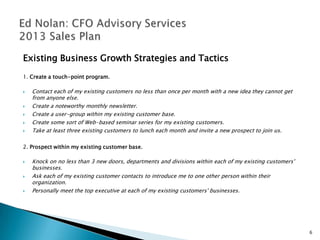

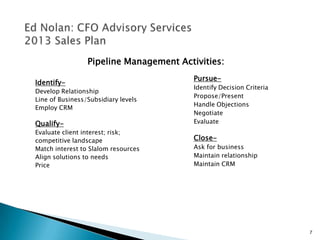

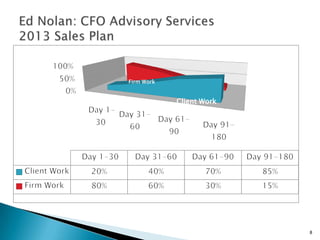

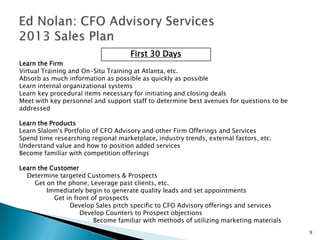

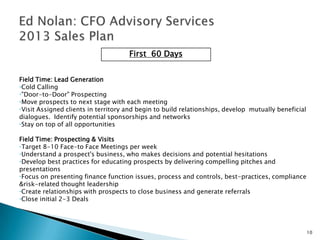

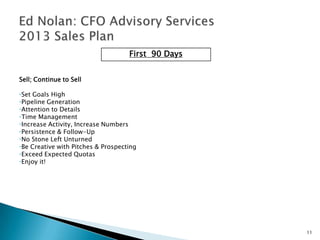

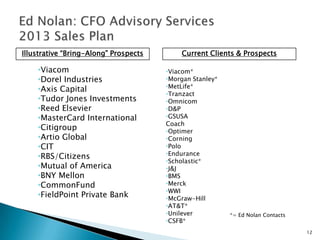

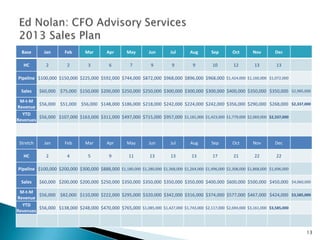

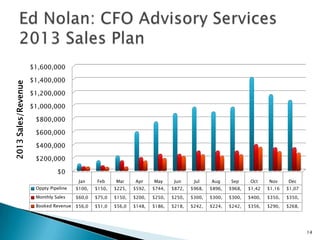

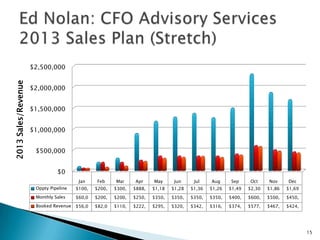

The document outlines Ed Nolan's responsibilities and activities as a business development role, including surfacing leads, managing opportunities, coordinating team activities, and directly pursuing and closing business. It provides strategies and tactics for acquiring new business and growing existing business. Metrics include targets for pipeline growth, sales, and headcount. Annual sales forecasts show projections for hitting quota and stretching goals.