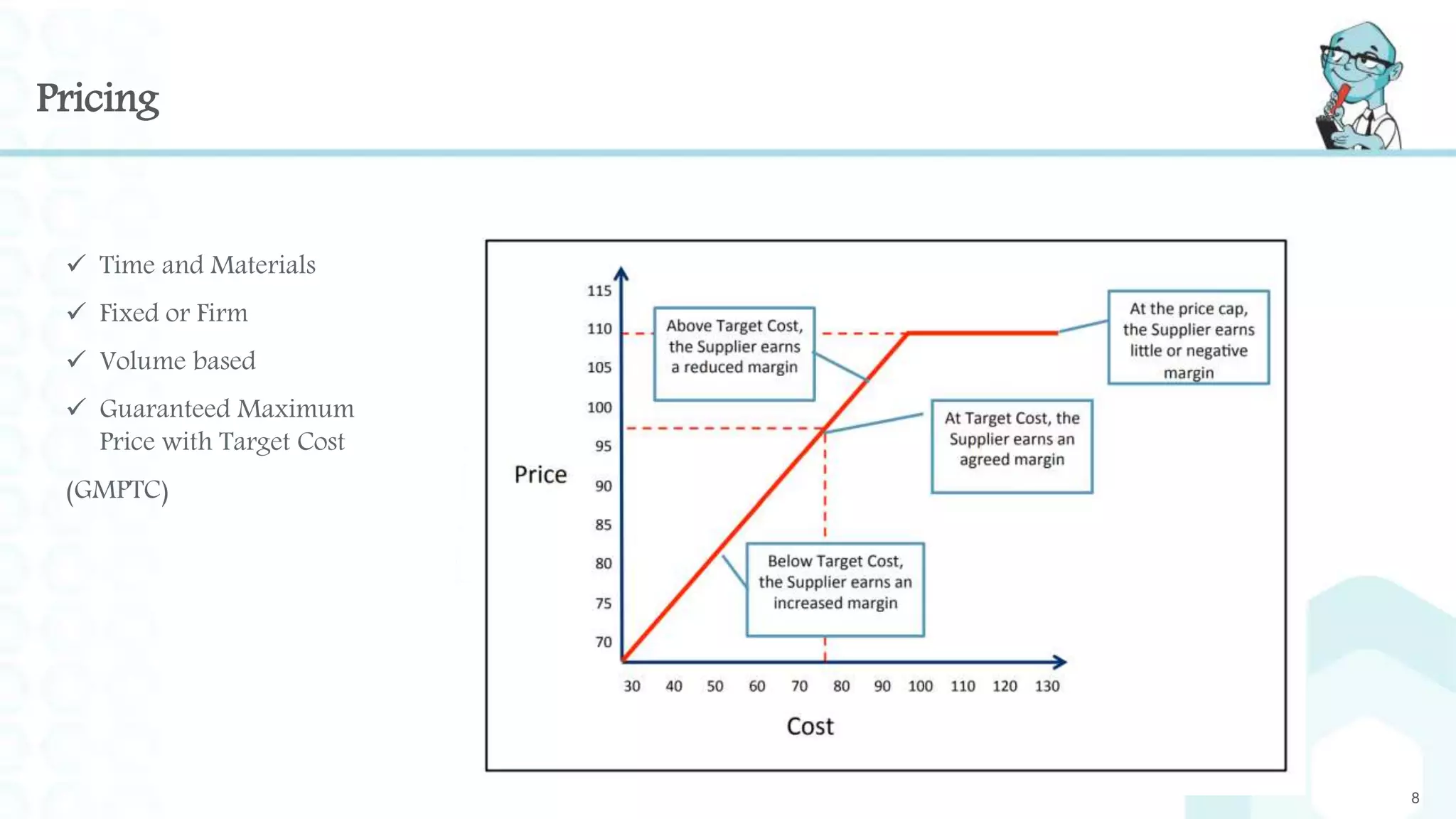

This document provides an overview of pricing principles and strategies for estimating costs. It discusses factors to consider when setting prices like customer value and profitability. Various pricing models are outlined, including fixed pricing, subscriptions, and cost-plus pricing. The document also covers pricing strategies, constructing cost models, analyzing project risks, and reviewing estimates. The key aspects of pricing covered are customer value, profitability, cost analysis, and risk assessment.