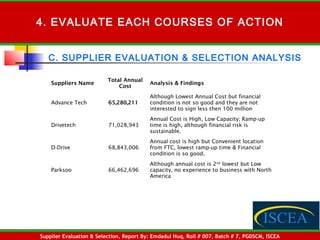

The document is a case study report analyzing the supplier evaluation and selection process for Fastraq Technology Corporation (FTC). FTC is expanding into assembling personal computers and needs to outsource DVD drives. Four potential suppliers were evaluated on price, quality, capacity, financials and total cost. D-Drive Systems was recommended as they had the lowest costs and risks despite a higher quoted price. D-Drive offered the lowest lead times, highest quality and was in close proximity to FTC. Selecting D-Drive would allow FTC to launch their new PC line on schedule and minimize supply chain risks.