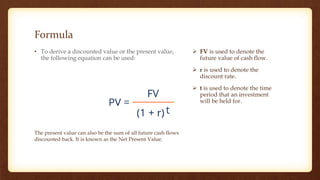

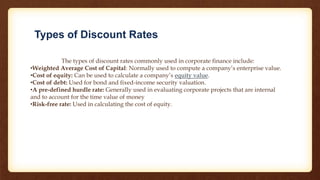

The document discusses the concept of time preference, which is the valuation of receiving goods or cash sooner rather than later, influenced by both neo-classical and Austrian economic theories. It explains temporal discounting, the practice of valuing immediate rewards more highly than future ones, alongside the role of discounting in evaluating present value of future cash flows. Additionally, it outlines different types of discount rates used in corporate finance and the implications of positive, negative, and zero time preferences on investment decisions.