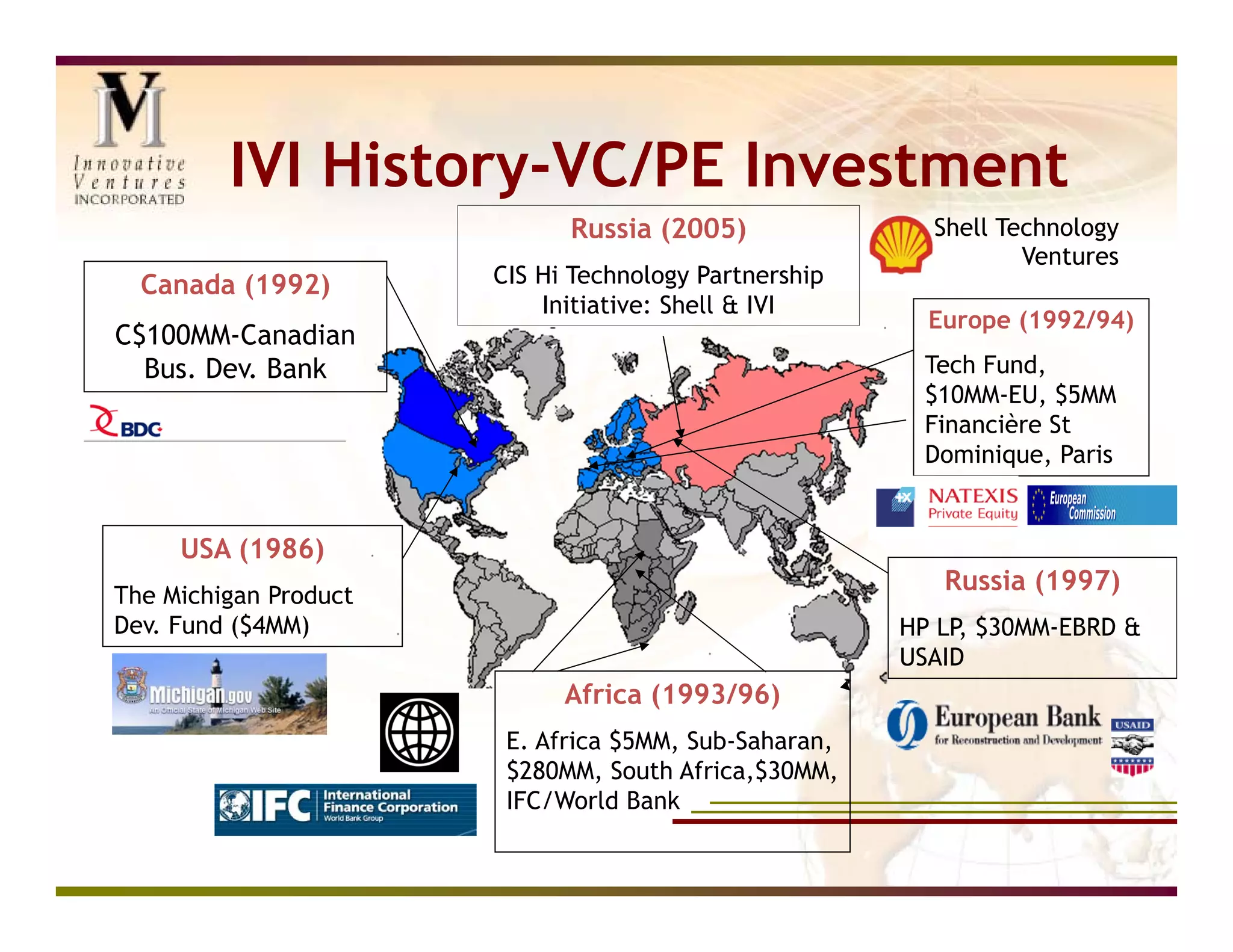

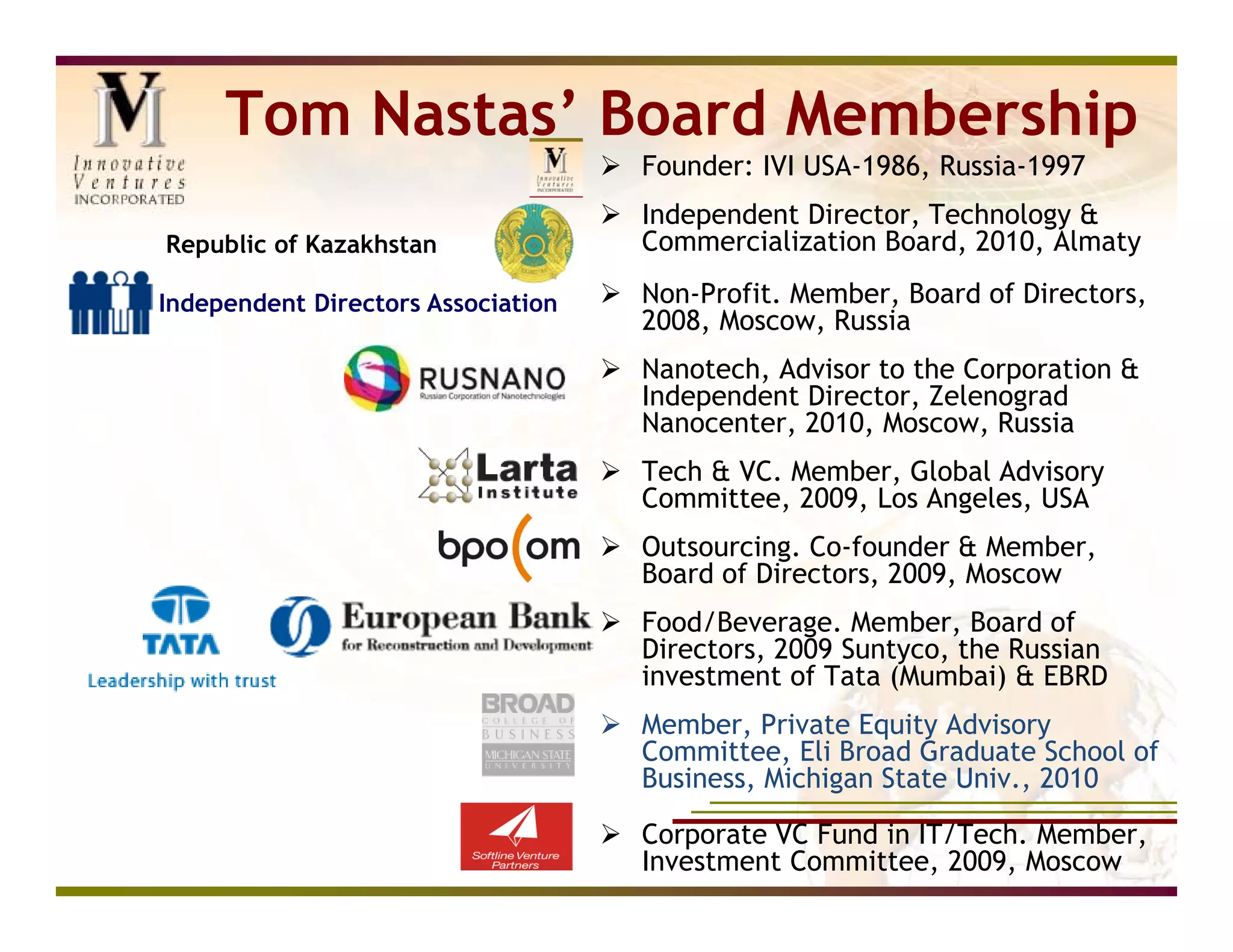

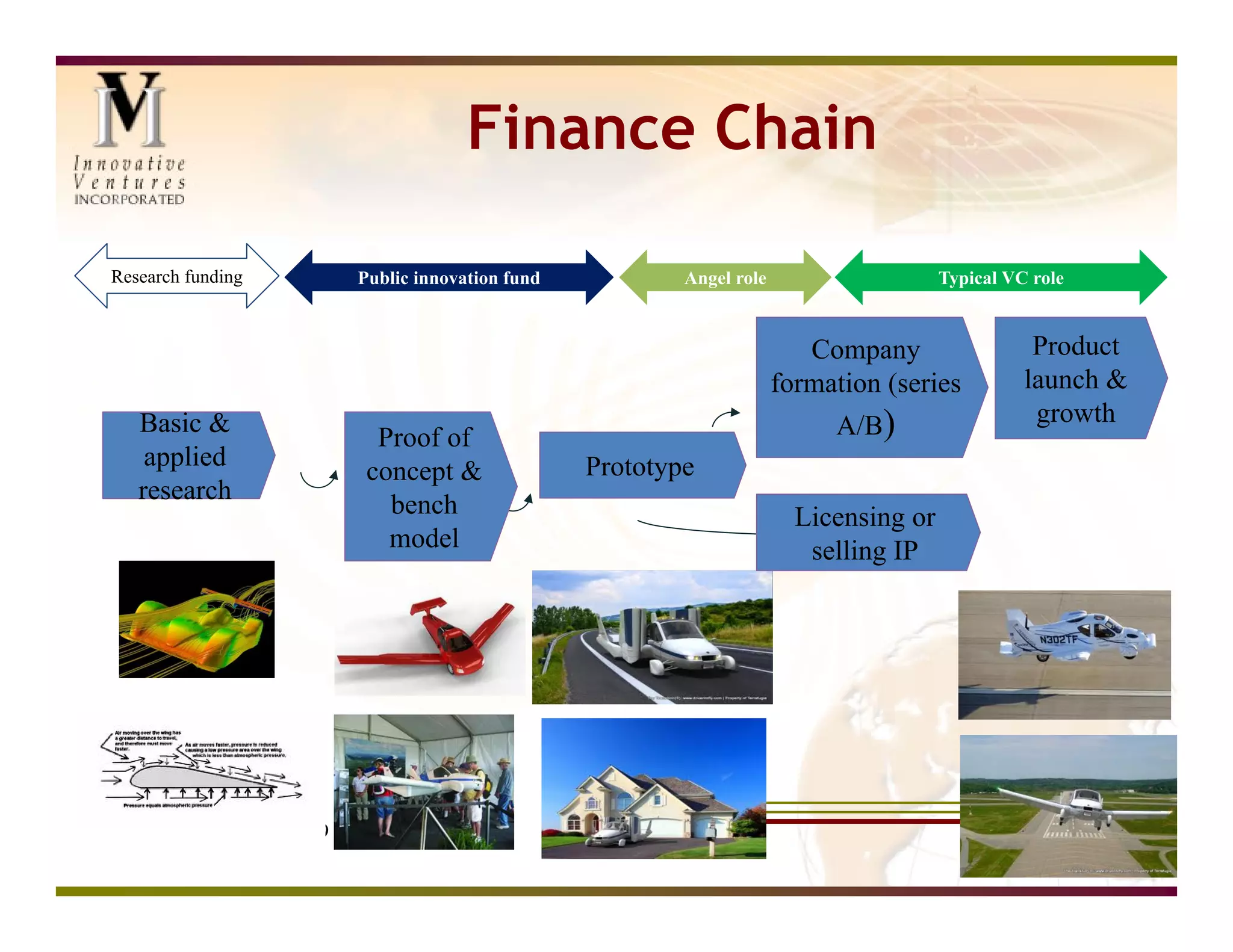

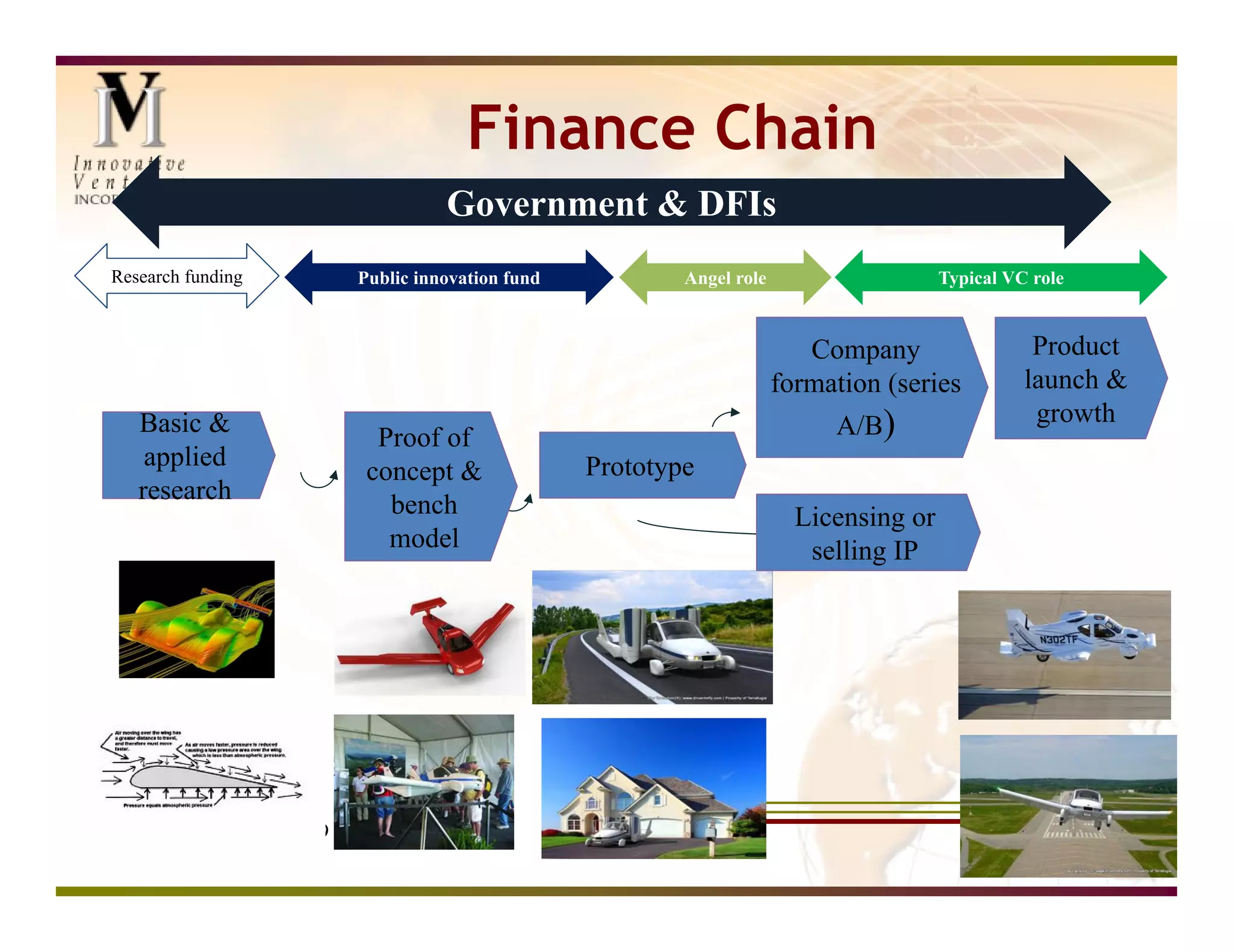

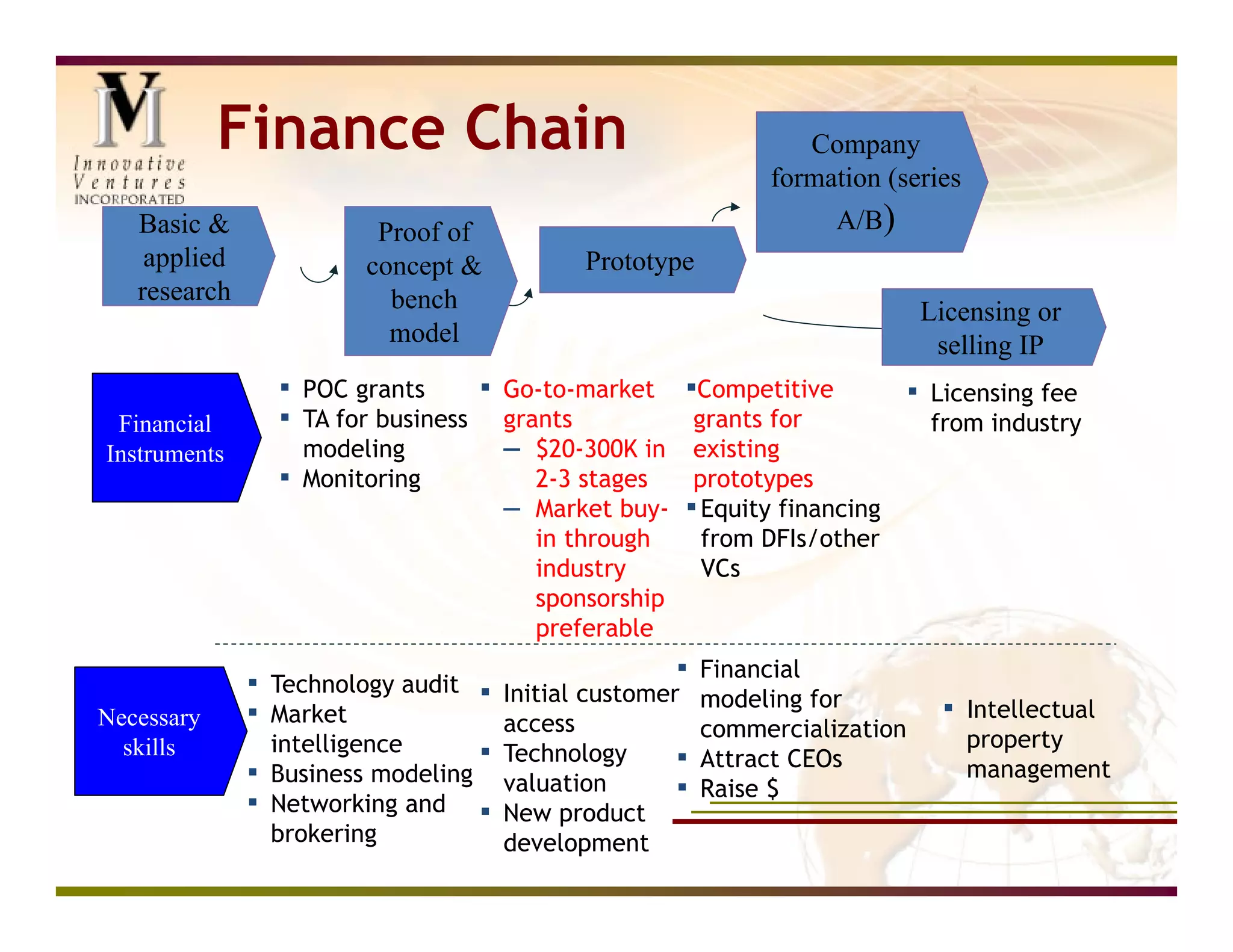

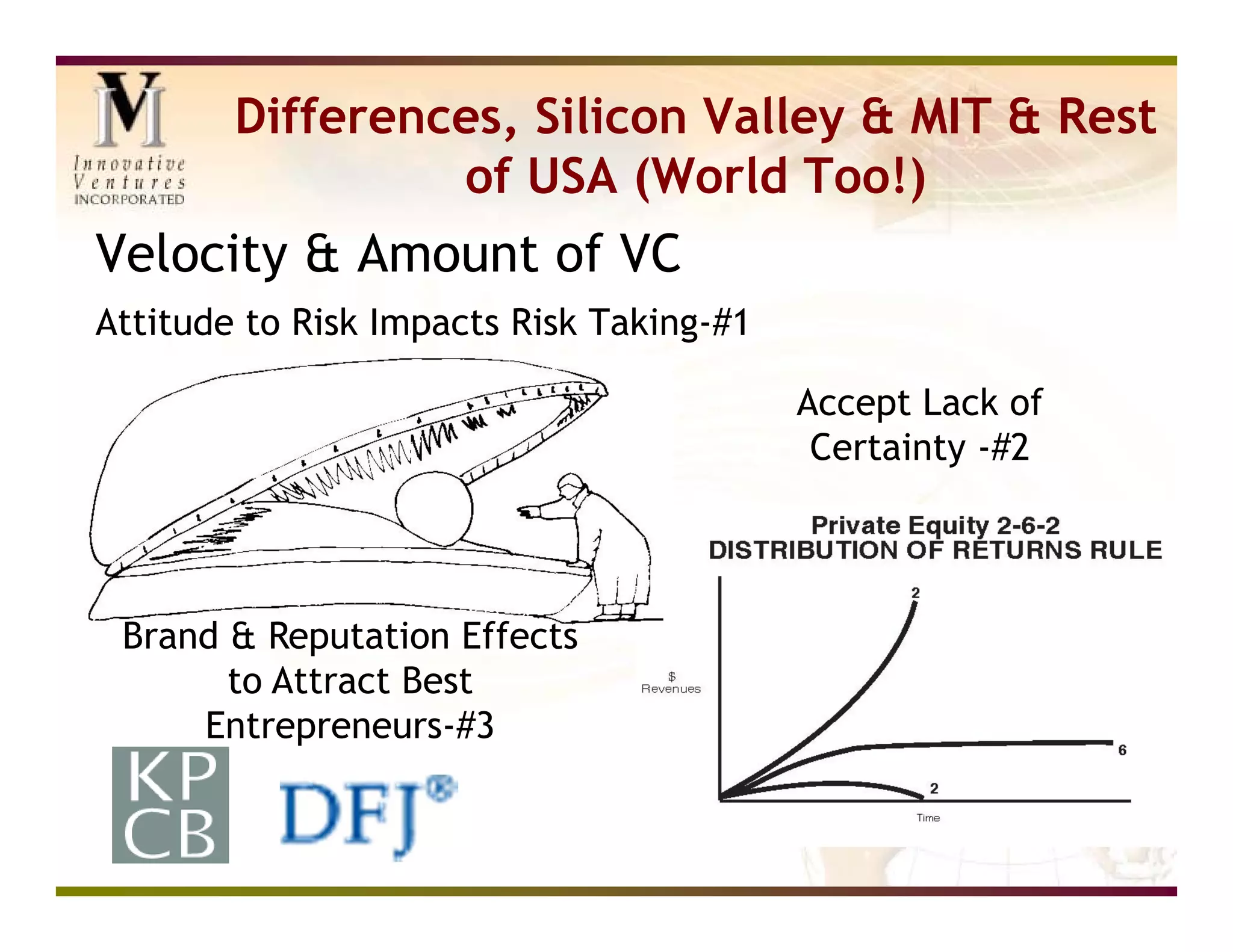

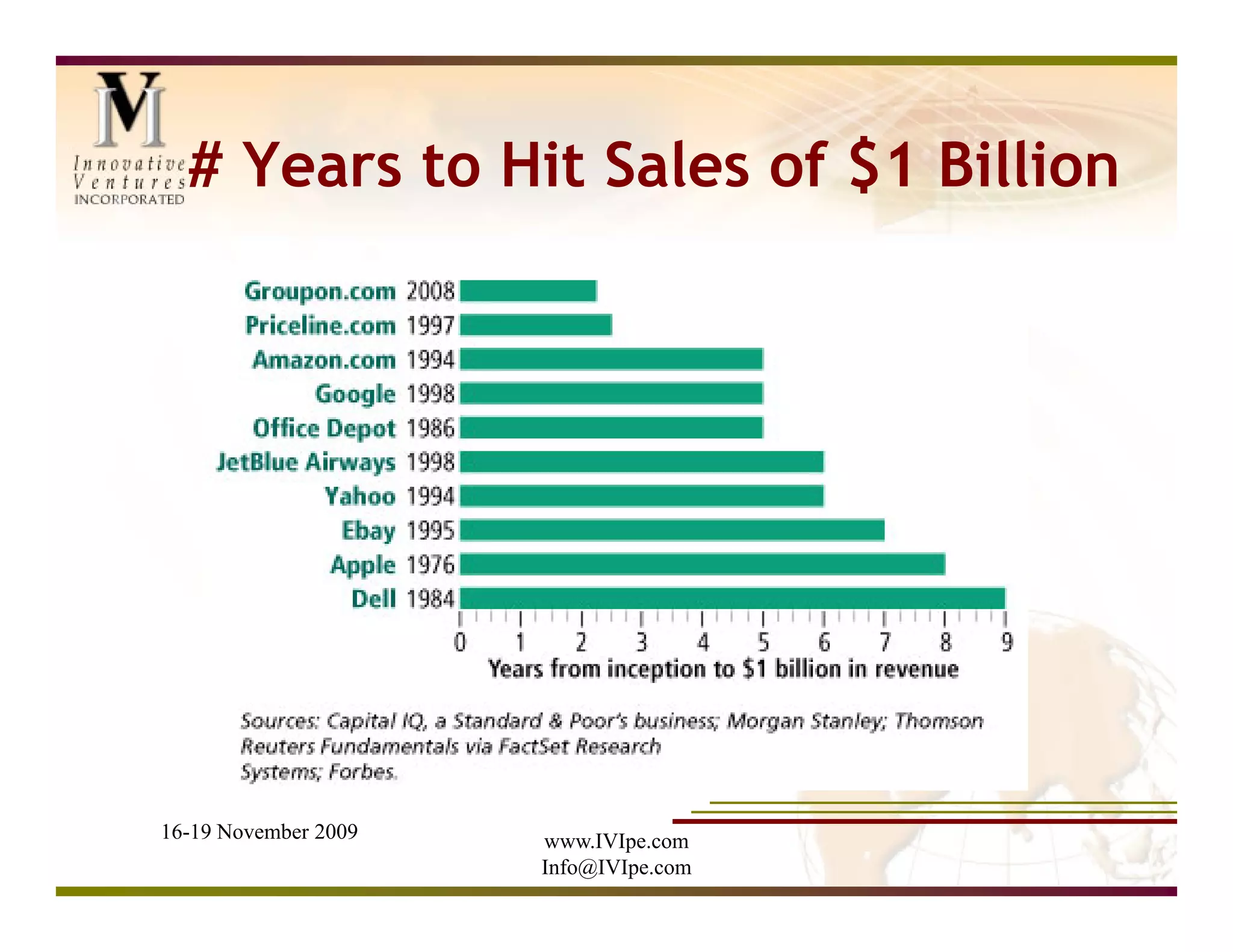

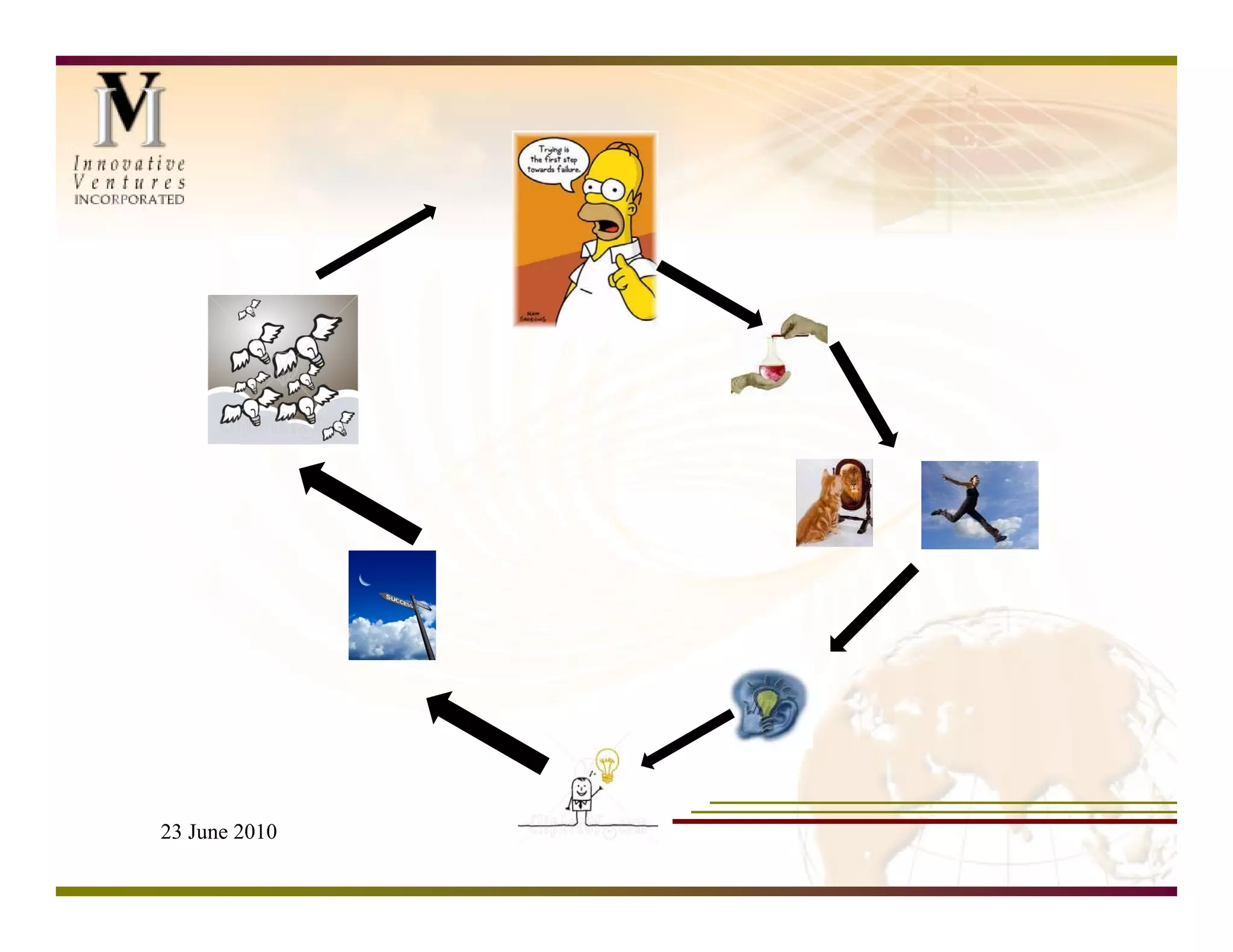

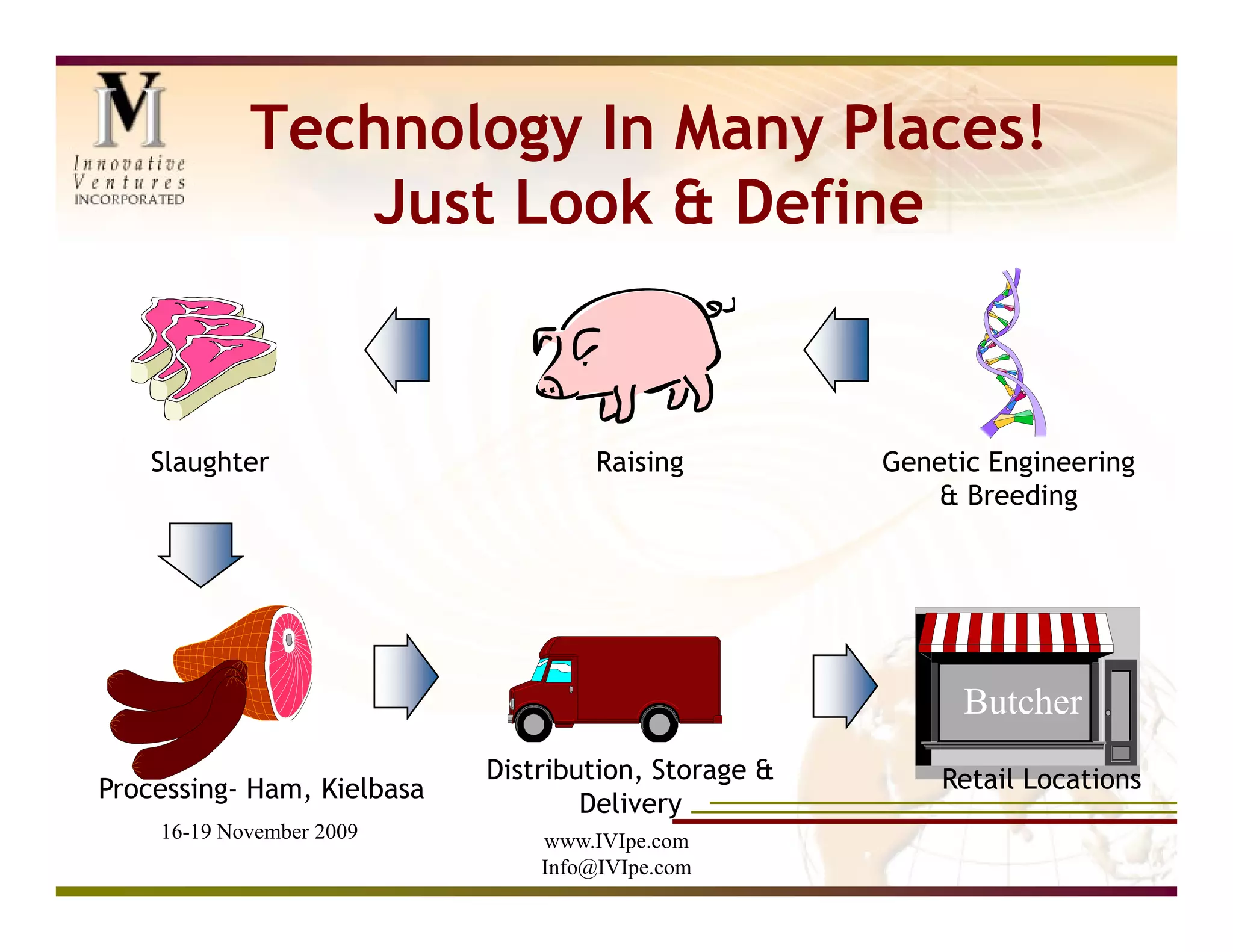

The presentation by Thomas Nastas discusses strategies to overcome barriers in Croatia's innovation and entrepreneurship landscape, focusing on developing seed and early-stage venture capital. It emphasizes the need for investment-ready projects, building experience in risk tolerance, and improving market readiness for technology. The document outlines historical investment efforts and offers insights into fostering a culture of investment rather than capital preservation in Croatia.