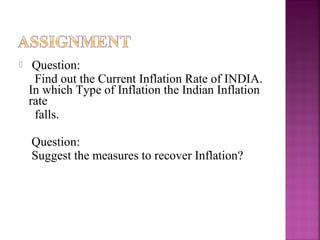

Here are some measures that can help control inflation in India:

1. Monetary policy tightening: The Reserve Bank of India can raise policy interest rates to make borrowing more expensive and reduce money supply growth. This helps contain demand-pull inflation.

2. Fiscal consolidation: The government needs to reduce its fiscal deficit by cutting non-essential spending and increasing tax revenues. Lower fiscal deficit will reduce pressure on money supply.

3. Supply-side measures: The government can take steps to boost agricultural and industrial production through reforms, infrastructure spending, etc. This will increase domestic supply of goods and ease inflationary pressures.

4. Rationalize subsidies: Fuel and food subsidies need to be better targeted to control their