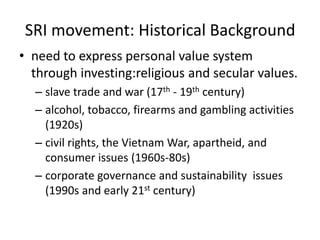

This document provides an overview of Andrea Roofe's dissertation proposal on examining the effect of business cycles on the financial performance of socially responsible investments. The summary includes:

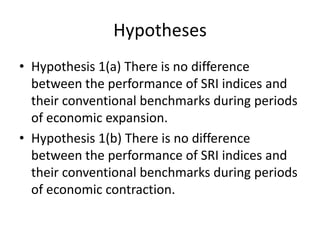

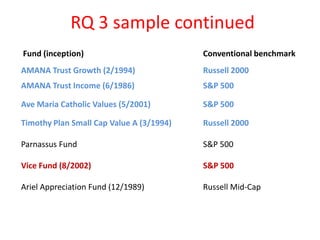

1) The proposal outlines research questions on whether SRI delivers financial value and whether performance varies across economic expansions and contractions.

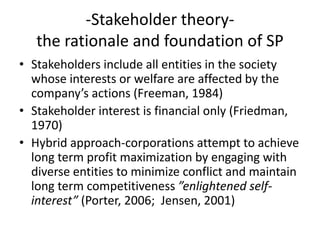

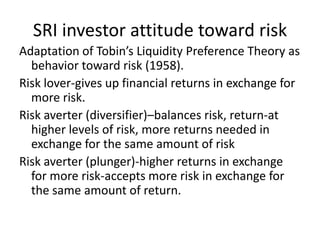

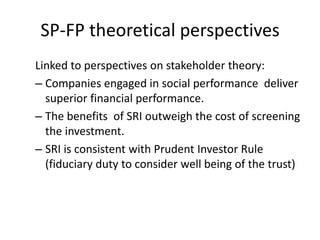

2) The theoretical framework discusses stakeholder theory, social and financial performance links, and how SRI investor attitudes toward risk may impact performance across economic conditions.

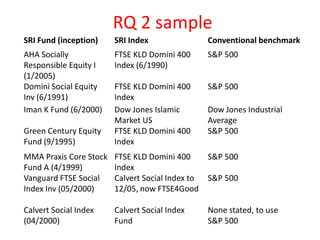

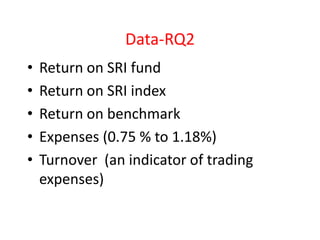

3) The methodology proposes examining SRI index and fund returns against benchmarks in both bull and bear markets using Fama-French and Carhart models with Markov switching regimes.