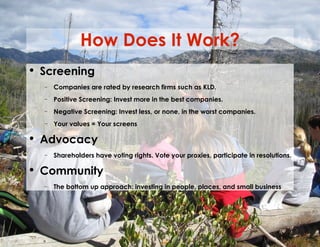

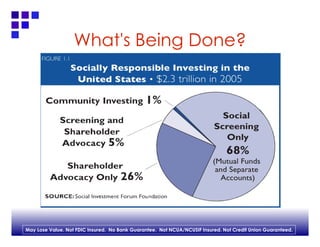

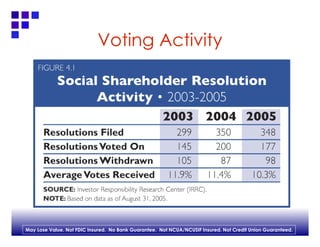

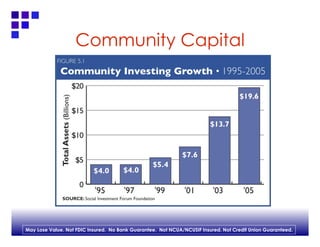

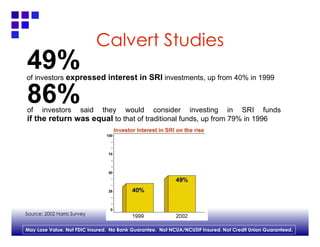

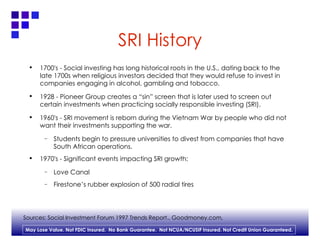

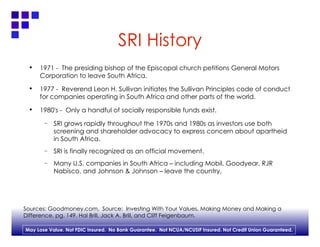

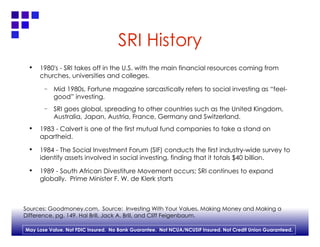

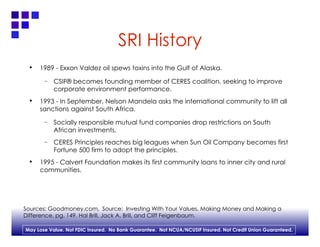

Socially responsible investing (SRI) considers environmental and social factors when investing. SRI uses screening to invest more in companies with positive records and less in those with negatives ones. It also uses shareholder advocacy like proxy voting to encourage companies to improve. SRI has grown significantly over the past few decades and now manages over $2 trillion in assets, influenced by events like apartheid and corporate scandals.