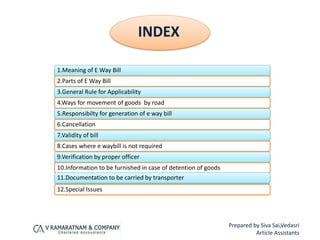

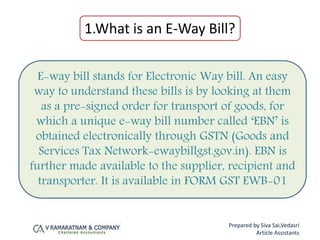

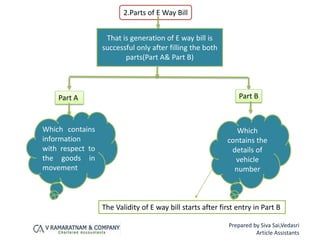

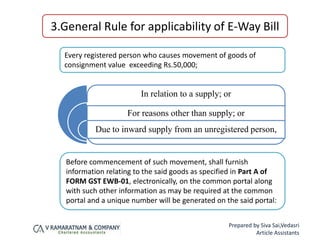

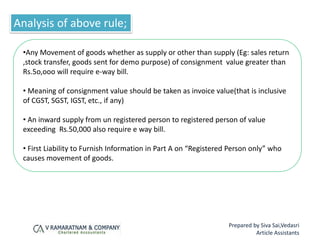

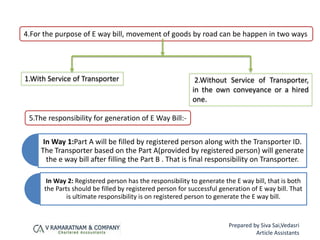

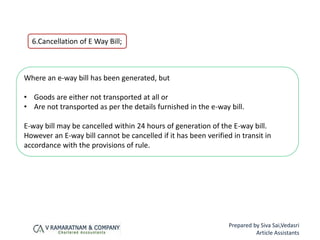

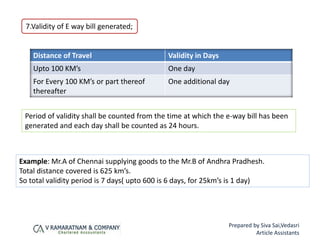

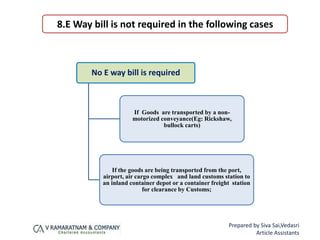

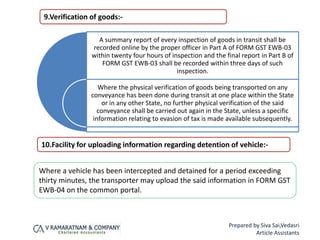

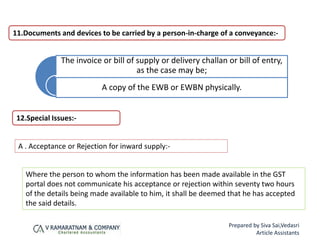

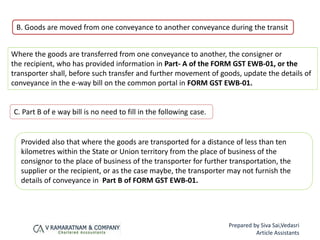

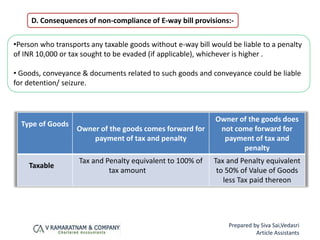

The document provides a detailed presentation on the e-way bill system under GST, explaining its meaning, parts, applicability rules, and responsibilities for generation and verification. It outlines critical guidelines such as the validity period based on distance, cancellation procedures, and exemptions from e-way bill requirements. Additionally, it discusses consequences for non-compliance, including penalties and procedures for handling detained goods.