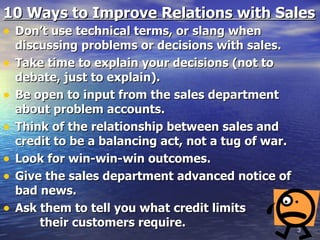

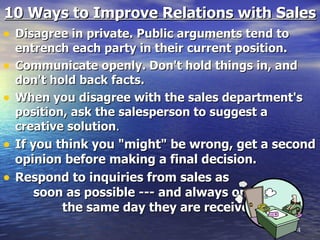

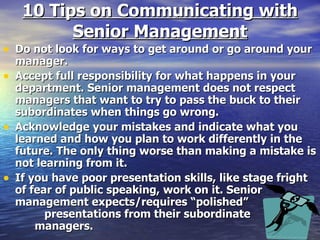

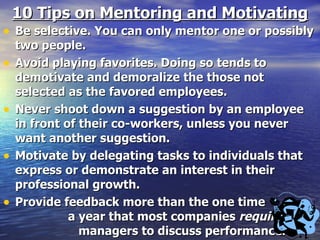

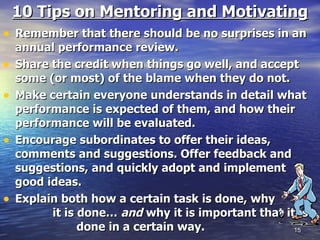

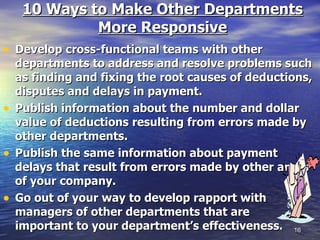

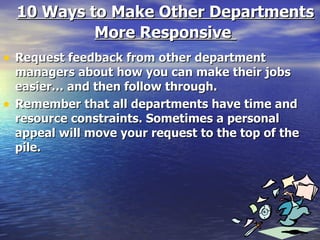

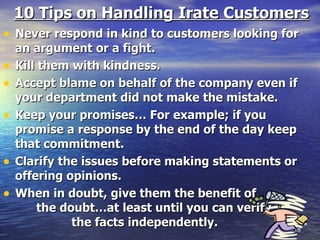

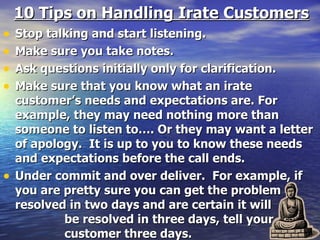

This document provides 100 tips across 10 categories to improve various aspects of credit department performance. The tips include ways to improve relations with sales and other departments, accelerate collections, evaluate financial statements more quickly, avoid bad debt losses, communicate with senior management, mentor and motivate employees, make other departments more responsive, and handle irate customers. The overall recommendations are focused on strengthening relationships, increasing efficiency and productivity, and reducing risks.

![10 Tips for Increasing the Influence of the Credit Department Stop thinking of the credit department as apart from the rest of the company. Consider yourself to be a part of the company. Volunteer for tasks outside of the traditional “boundaries” of the credit department. [Example: If you do not currently forecast cash inflows volunteer to try do these forecasts each month]. Look for ways to help the company achieve its sales goals. Stop thinking of the credit department as sales prevention and stop acting as if you have to control all aspects of credit risk.](https://image.slidesharecdn.com/presentation1-100726150006-phpapp01/85/Presentation-1-20-320.jpg)

![10 Tips for Increasing the Influence of the Credit Department Guard against an attitude that it is us [meaning the credit department] against them [meaning sales and/or customers]. Remember that our adversaries are delinquencies and bad debts, not salespeople and customers. Visit customers. Attend and make presentations at company sales conferences. Develop a reputation as a problem solver, not a problem identifier. Think outside the box. Be creative in helping your company to achieve its overarching goals.](https://image.slidesharecdn.com/presentation1-100726150006-phpapp01/85/Presentation-1-21-320.jpg)