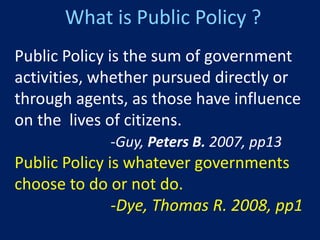

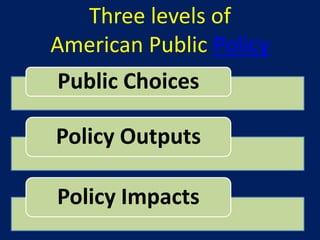

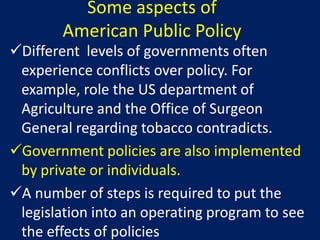

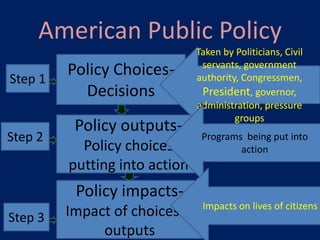

The document discusses key aspects of American public policy, including defining public policy, the instruments used to implement policy, and the environment in which policy operates. It outlines three levels of policy - choices, outputs, and impacts. Instruments include laws, government services, spending money, taxation, and persuasion. Policy is influenced by American values like conservatism, participation, pragmatism, wealth, diversity, and world leadership role.