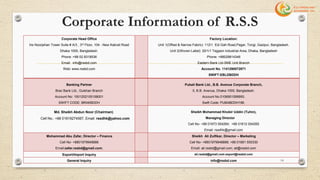

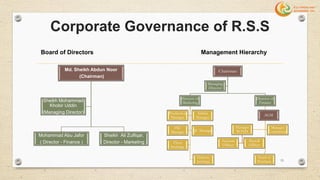

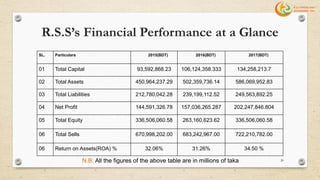

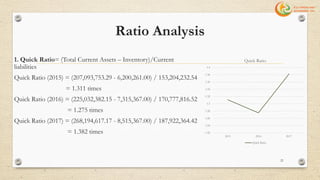

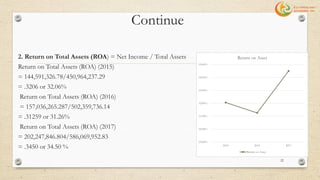

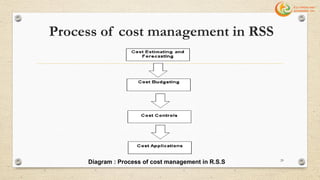

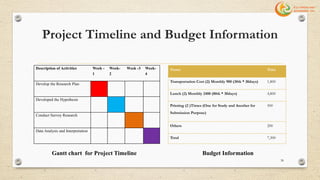

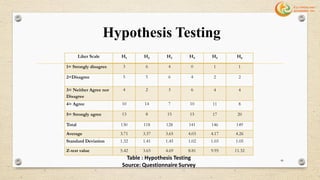

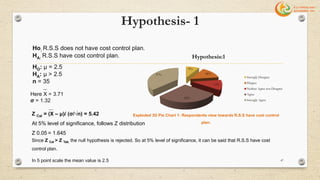

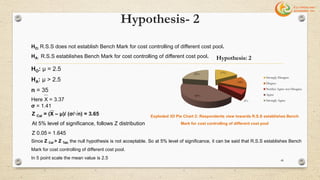

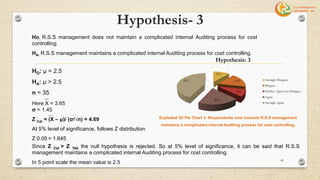

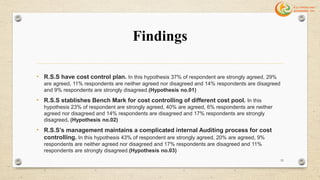

This document provides an overview and analysis of cost management at R.S.S Thread and Accessories Limited. It begins with an introduction to the topic and objectives of analyzing R.S.S.'s cost management. The document then provides organizational details about R.S.S, including its mission, products, financial performance and management structure. A discussion of cost management processes at R.S.S follows. The author describes their internship experience working in the commercial and finance departments. The document concludes with details about the author's research methodology to analyze problems in R.S.S.'s cost management.