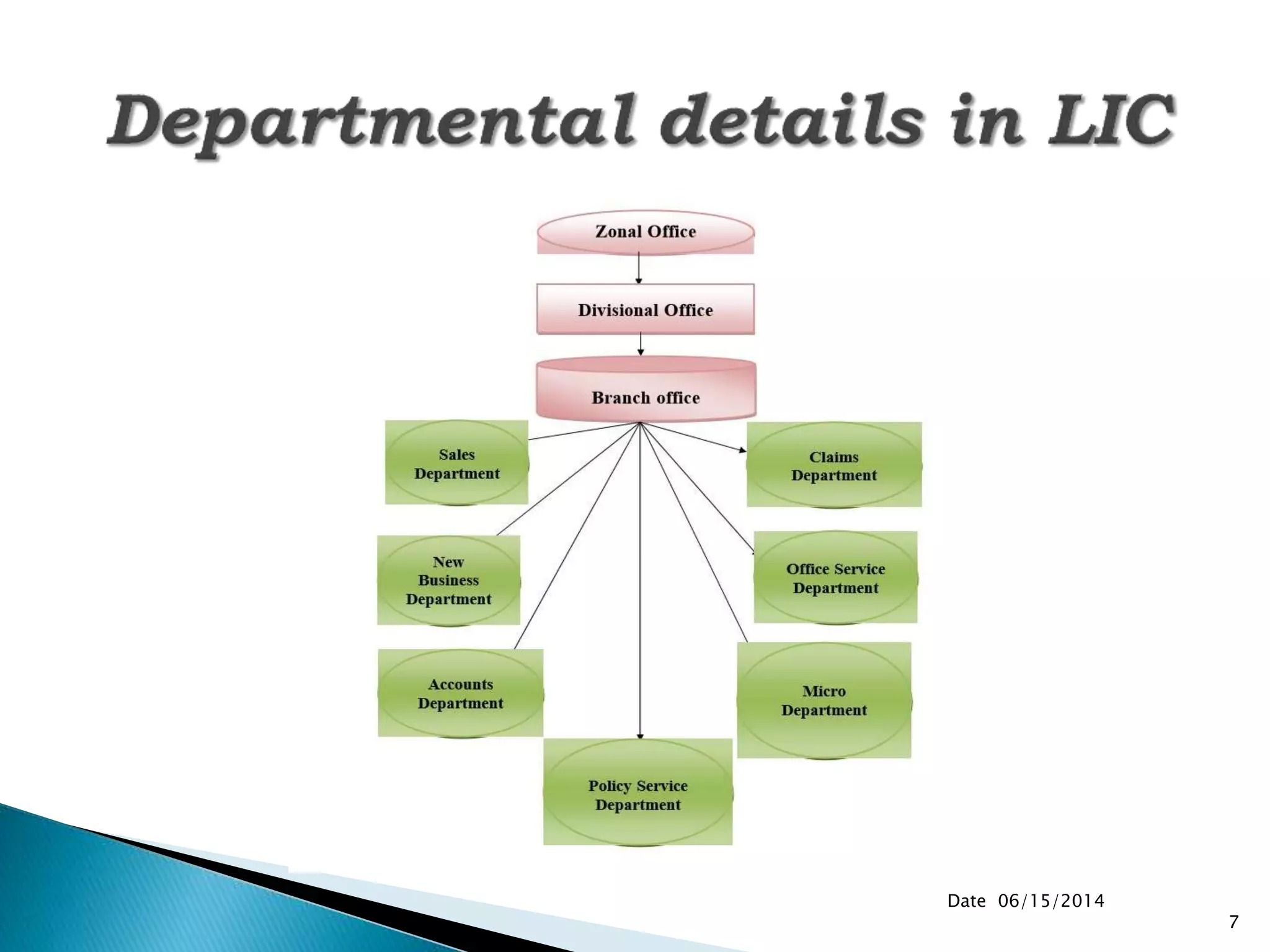

The Life Insurance Corporation of India (LIC) was established in 1956 and is fully owned by the Government of India. It is the largest life insurer in India with over 2,000 branch offices. LIC offers various insurance products including term insurance, whole life insurance, endowment policies, money back policies, and annuities. It has a large network of sales, new business, and claims processing departments to administer its policies. While LIC dominates the Indian life insurance market, growing private competitors and an increasingly discerning customer base present both opportunities and threats to its business model.