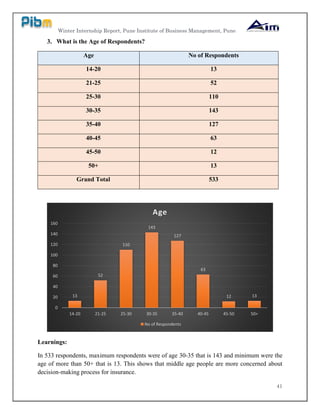

This winter internship report by Anand Singh Tomar analyzes the customer decision-making process in insurance services at AIM India Pvt. Ltd. over a four-week period. It includes sections on the insurance sector, company overview, project methodology, findings, and suggestions for improvement. The report provides insights into the growth and challenges of the Indian insurance industry, along with key statistics and trends.