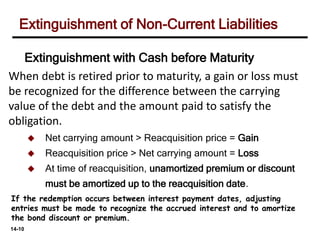

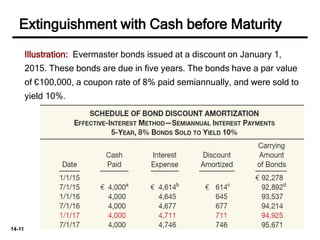

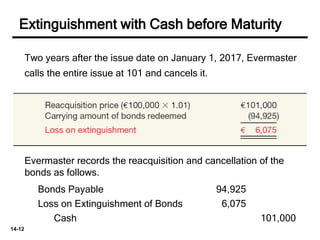

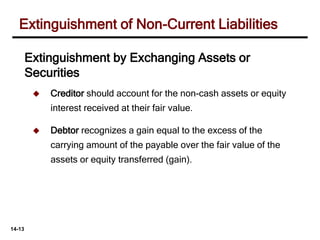

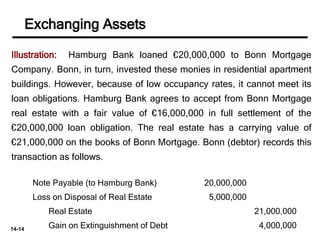

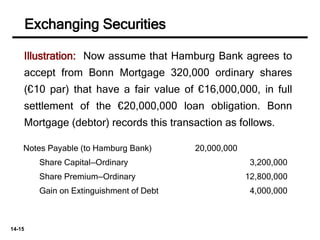

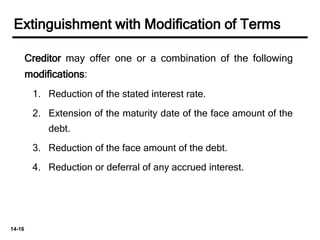

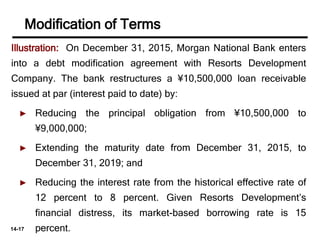

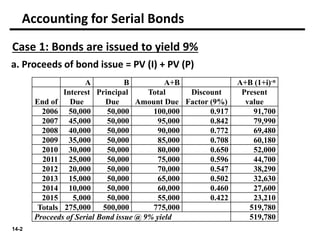

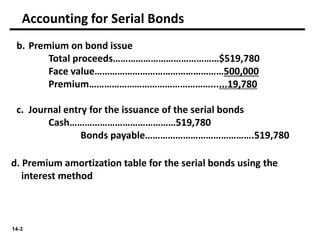

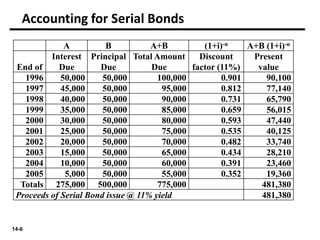

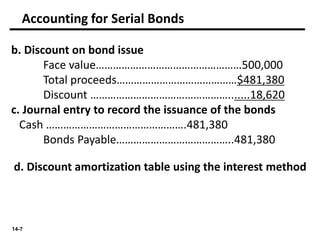

This document provides an example of accounting for serial bonds issued at a 9% yield and 11% yield over 10 years. It includes calculations of present value of interest and principal payments, journal entries to record bond issuances and premium/discount amortization, and examples of early extinguishment before maturity through cash payment, asset exchange, and modification of terms.

![14-8

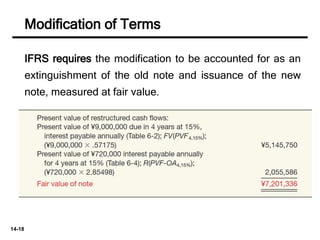

Year Carrying

Amount

Interest

Expense

(11%)

Interest

Payment

(10%)

Discount

Amortization

Bond

Discount

Balance

Cumulative

Principal

Payment

Issue 481,380 - - - 18,620 -

1996 434,332 52,952 50,000 2,952 15,668 50,000

1997 387,109 47,777 45,000 2,777 12,891 100,000

1998 339,691 42,582 40,000 2,582 10,309 150,000

1999 292,057 37,366 35,000 2,366 7,943 200,000

2000 244,183 32,126 25,000 2,126 5,817 250,000

2001 196,043 26,860 20,000 1,860 3,957 300,000

2002 147,608 21,565 15,000 1,565 2,392 350,000

2003 98,845 16,237 10,000 1,237 1,155 400,000

2004 49,718 10,873 5,000 873 282* 450,000

2005 - 5,469 496* - 500,000

*Rounding up difference

Accounting for Serial Bonds

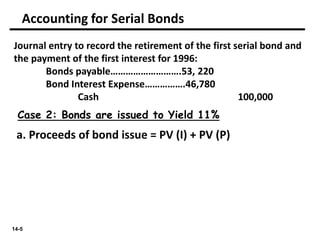

e. Journal entry to record the retirement of the first serial bond and

the payment of the first interest for 1996:

Bonds payable [50000-2952]……47048

Bond Interest Expense…………..52,952

Cash………………………………… 100,000](https://image.slidesharecdn.com/faii-chapter23partii-240404200256-86adf9b8/85/FA-II-Chapter-2-3-Part-II-pptx-best-presentation-8-320.jpg)