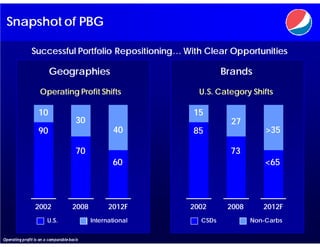

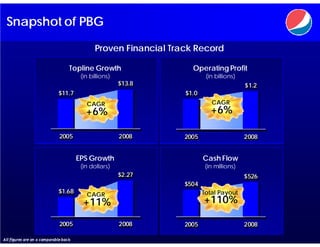

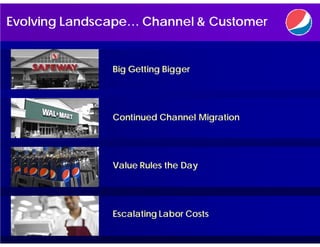

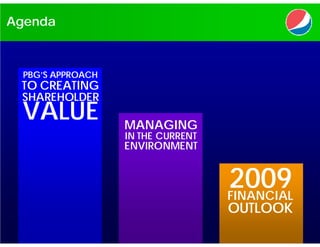

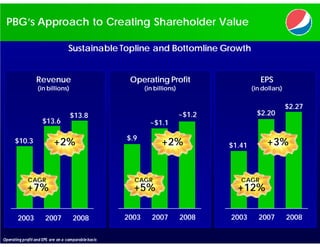

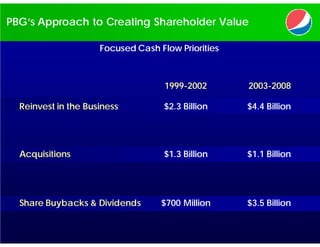

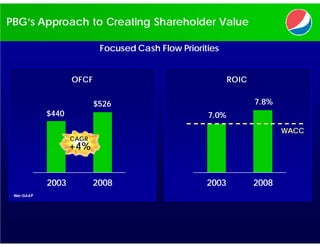

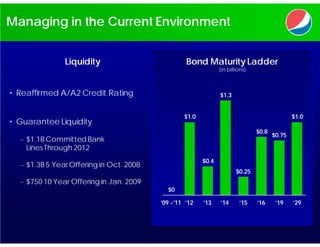

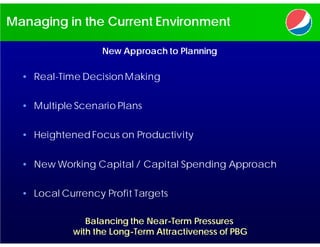

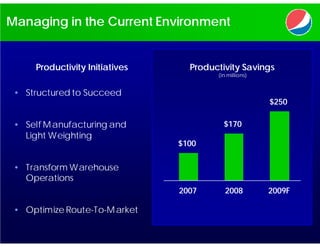

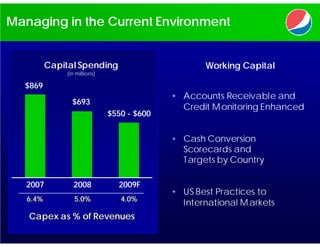

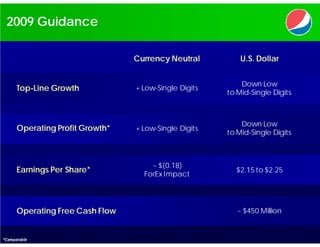

The presentation discusses PBG's strategic priorities to drive shareholder value through refreshing its global brand portfolio, rethinking its operating model to improve performance and efficiency, and redefining its geographic focus. It also outlines PBG's approach to managing challenges in the current economic environment through initiatives to enhance liquidity, productivity, and working capital management. Financial guidance for 2009 indicates currency-neutral growth despite US dollar declines and a continued focus on operating cash flow.