This document provides a report on a portfolio optimization project. It summarizes the construction, weekly performance, and rebalancing of a portfolio formed using Markowitz's modern portfolio theory. Over the course of a month, the portfolio was initially constructed using 20 stocks and was rebalanced weekly based on updated stock prices. The portfolio achieved a return of 4.58%, outperforming the S&P 500 benchmark. A risk analysis of the portfolio returns was also conducted using measures like the Sharpe ratio, Treynor ratio, and Sortino ratio.

![6

(1) Sharpe Ratio:

p f

p

RS

(2) Treynor Ratio:

p f

p

RT

, 2

PM

p

M

(3) Information Ratio

p f

Rp RM

RI

(4) Sortino Ratio:

Definition:The dispersion of X from a given value a is

2 2

( ) ( )a x a f x dx

.

In finance, we are concerned about downside dispersion from some value a i.e. X taking

values in ( , ]a define the semi variance of X about a is

2 2

( ) ( )a x a f x dx

.

Given sample R1, R2, R3…Rn of returns with some distribution f(x), Define

,

,

i

i

i i

a R a

y

R R a

,

then the downside sample semi variance is

2 2 2

1 1

1 1

( ) [min(0, )]n n

a i i i iS y a R a

n n

So, we use

f

p f

S

to estimate the Sortiono Ratio

0

0p

r

r

.

Outcomes:

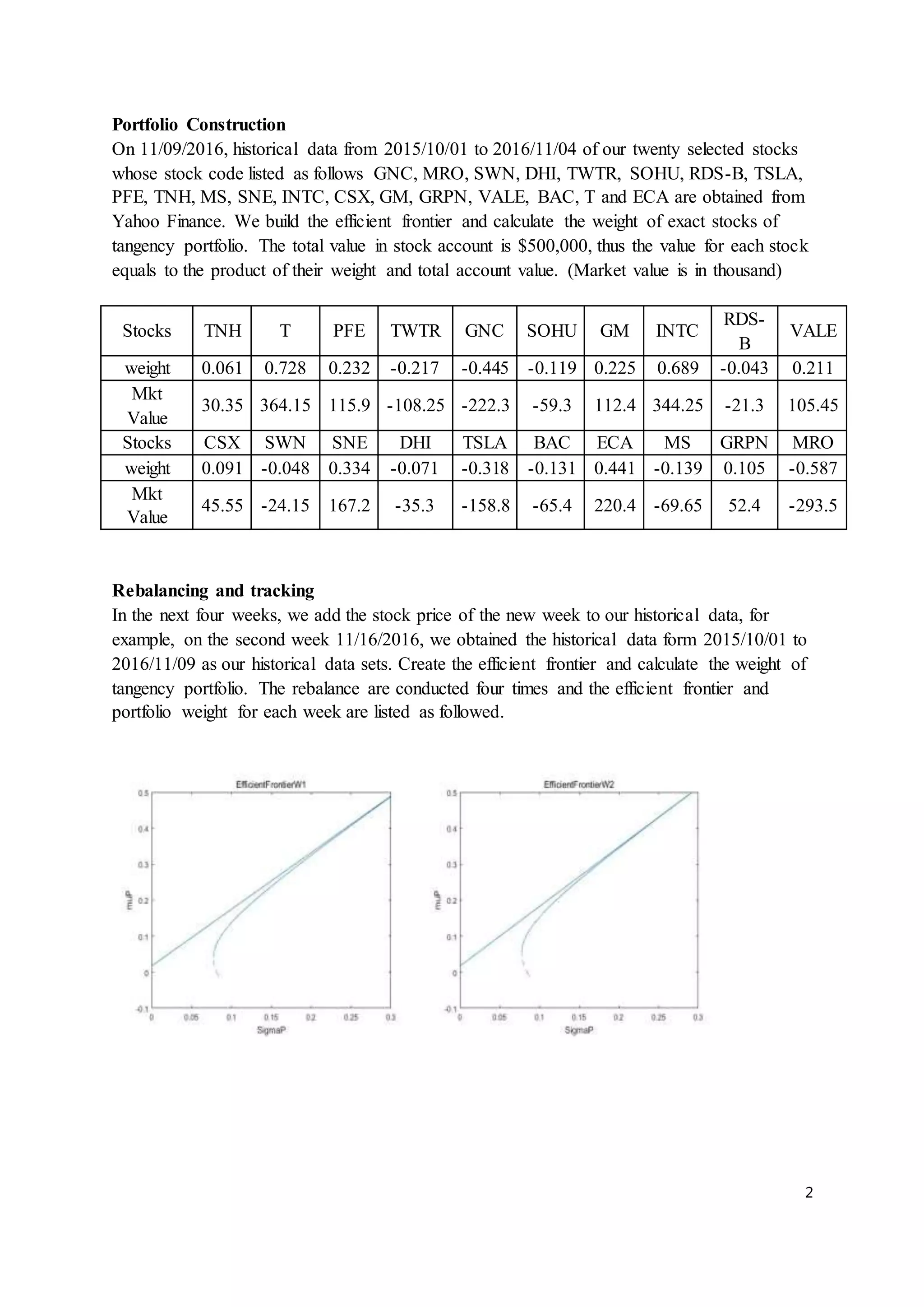

Sharp Ratio Treynor Ratio Information Ratio Sortino Ratio

0.06390022971 0.001292279398 0.008901856247 0.09195970697

The Sortino Ratio is a modification of the Sharpe Ratio but penalizes only those returns falling

below our expected return, while the Sharpe ratio penalizes both upside and downside volatility

equally. The difference between the Sharpe ratio and the Information Ratio is that the

Information Ratio aims to measure the risk-adjusted return in relation to a benchmark. A

variation of the Sharpe ratio is the Sortino ratio, which removes the effects of upward price

movements on standard deviation to measure only return against downward price volatility and

uses the semi variance in the denominator. The Treynor ratio uses systematic risk, or beta (β)

instead of standard deviation as the risk measure in the denominator.](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-6-2048.jpg)

![7

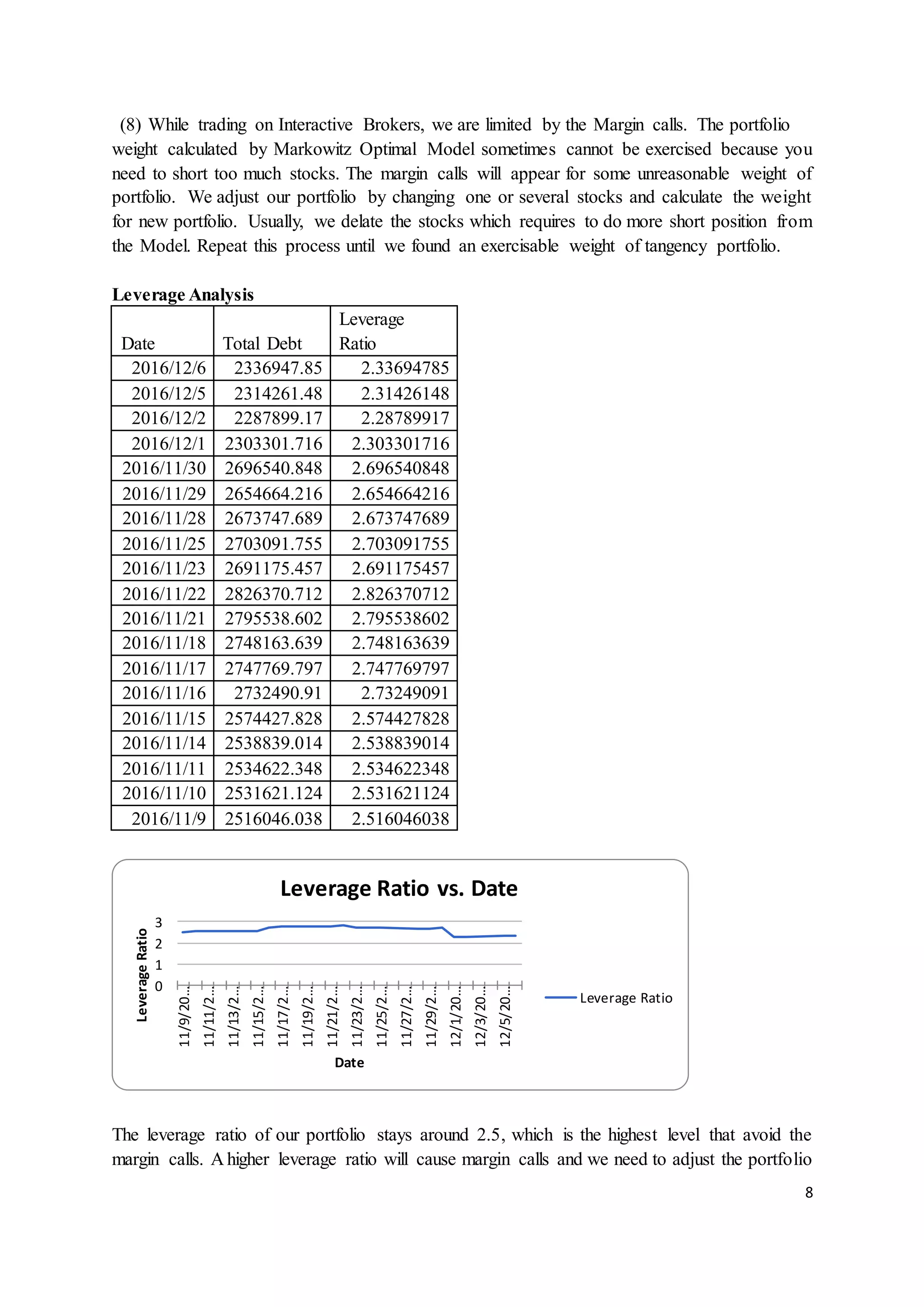

Comparing through these ratios, it shows that all the ratios are all positive indicating that our

portfolio perform well. However, these values of ratios are not very high, Treynor Ratio and

Information Ratio are even around zero. We could conclude that although our portfolio could

make money, we still take additional risks.

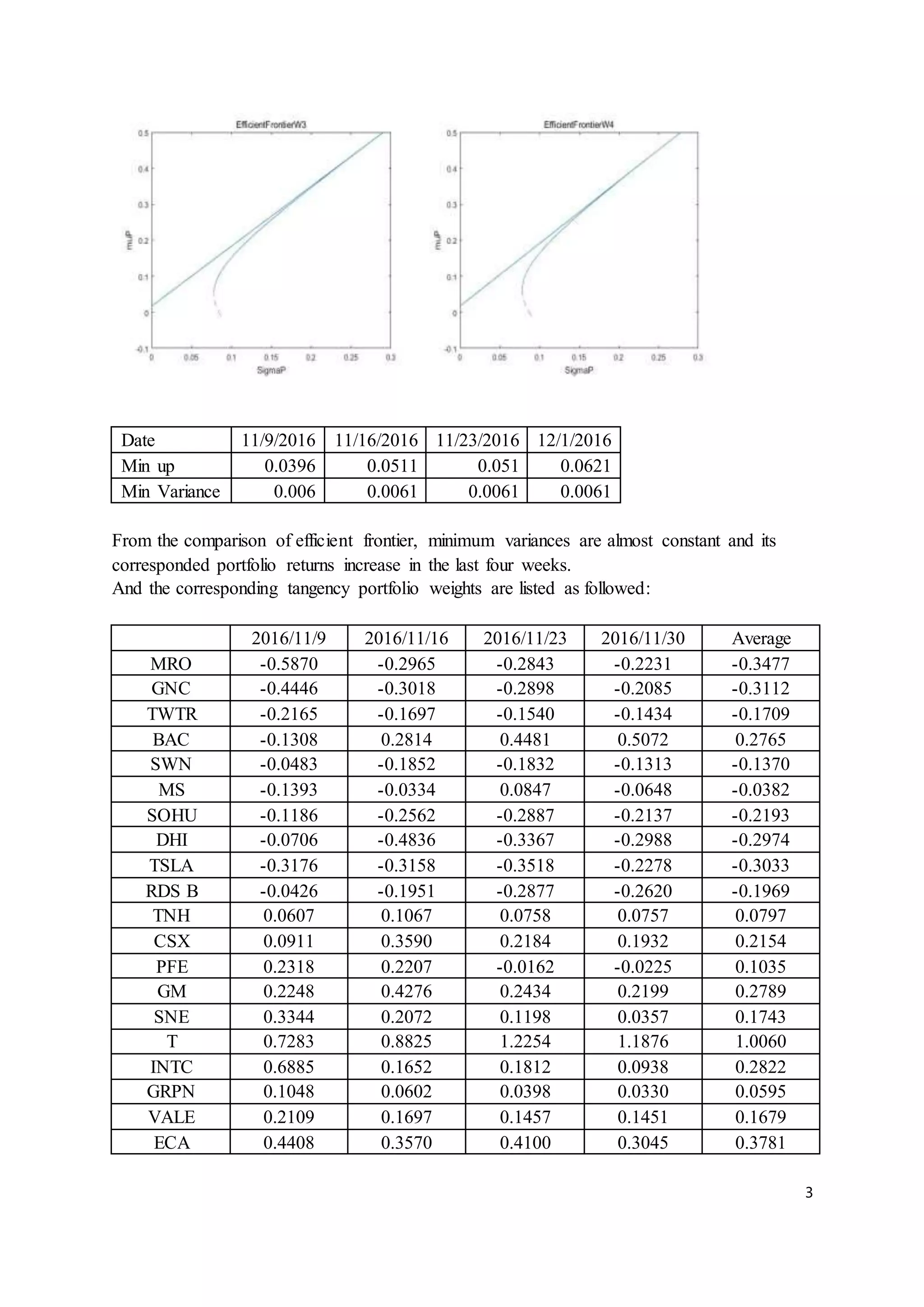

(5) Maximum drawdown:

The maximum drawdown (MDD) up to time T is,

(0, ) (0, )

( ) max[max ( ) ( )]

T t

MDD T X t X

Peak value valley value Maximum drawdown Maximum drawdown/Peak Value

992236 925201 67035 6.76%

During this period, huge loss was suffered in our portfolio with a maximum drawdown of 6.76%

within four trading days.

(6) Portfolio alpha and beta

It is based on Jensen performance measure,

( )p p f p m f

Portfolio Beta 0.03333847659

Portfolio Alpha 0.0001460887197

With a positive Alpha 0.0001460887197, it means although our portfolio performs better than

the benchmark, its value is around 0 which means our portfolio’s performance is very close

to the market performance. And the Beta is 0.03, indicating that our portfolio return has

potential risk in some way.

(7) Comparison of our portfolio performance to industry benchmarks

As far as we are concerned, by comparing to the benchmarks, the overall performance of our

portfolio is very close to the benchmarks’. But we take additional risks comparing to the market.

850000

900000

950000

1000000

1050000

1100000

11/10/2016

11/11/2016

11/12/2016

11/13/2016

11/14/2016

11/15/2016

11/16/2016

11/17/2016

11/18/2016

11/19/2016

11/20/2016

11/21/2016

11/22/2016

11/23/2016

11/24/2016

11/25/2016

11/26/2016

11/27/2016

11/28/2016

11/29/2016

11/30/2016

12/1/2016

12/2/2016

12/3/2016

12/4/2016

12/5/2016

12/6/2016

Market value](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-7-2048.jpg)

![9

composition by changing several stocks.

Capstone Part

Basic risk Measure

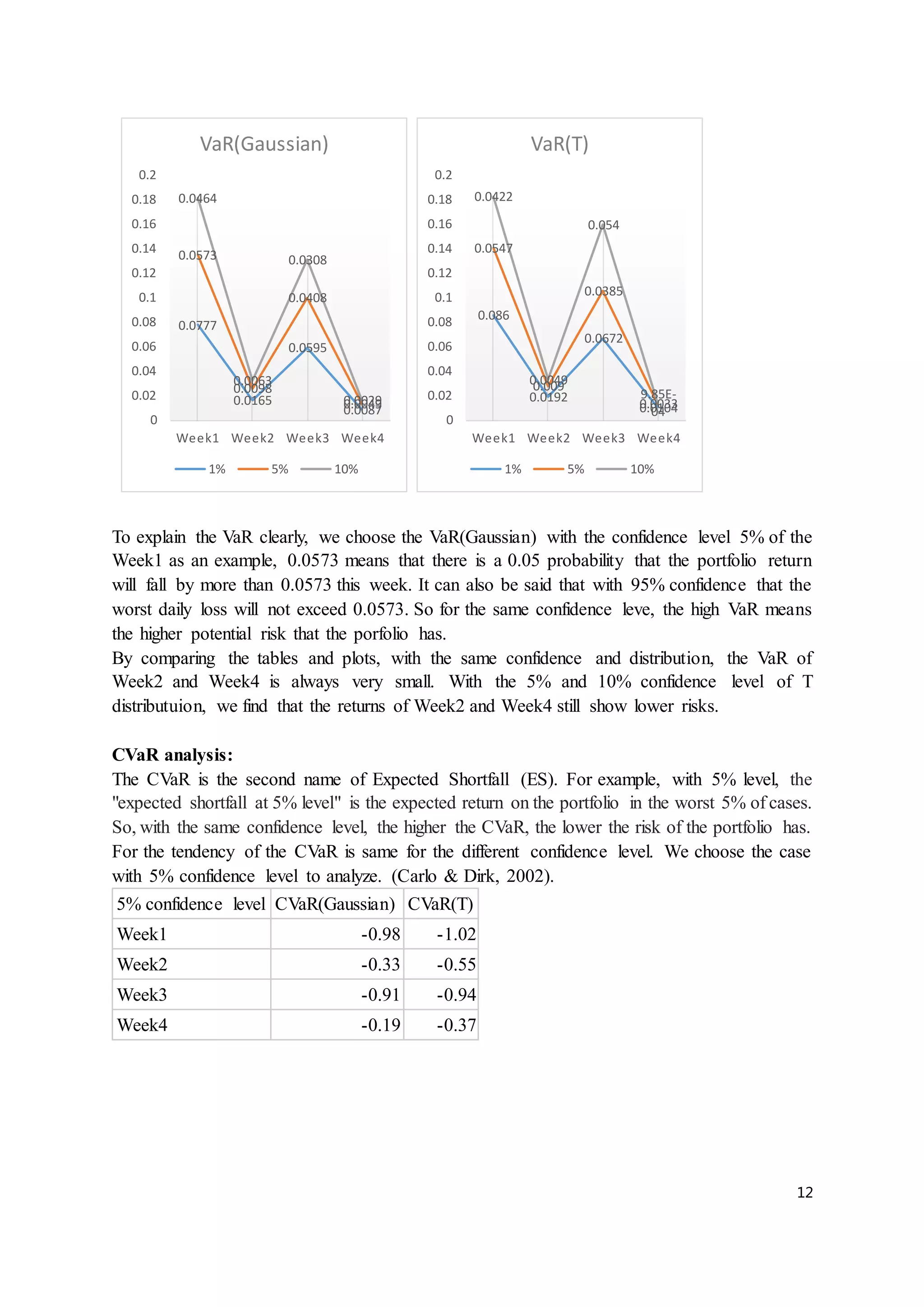

In this part, we use volatility of returns, Value-at-risk (VaR) and Conditional value-at-risk

(CVaR) as the weekly risk measures of our portfolio. For VaR and CVaR, we use the parametric

method to estimate them with both a normal and a student-t returns distribution and three

different confidence level (1%, 5%, 10%).

Method introduction:

Gaussian VaR and CVaR

Let

2

-x /21

2

e

(x)= denote the PDF of the standard normal distribution, and let (x)

denote the corresponding CDF with '

. The Gaussian quantile function ( )Q is the

function satisfying the condition

( ( ))Q

for all :0 1 .

In the case of a Gaussian distribution with mean and variance 2

, the quantile function

of that distribution is then ( )Q and the corresponding “Value at Risk”, or VaR, is just

the negative of the quantile, which is

( ) ( )VaR Q

The CVaR is a related entity, giving the average in a tail bounded by the corresponding VaR

level. In general, for a density function ( )f x linked to a random variable X, we would need to

know

( )1

[ | ( )] ( )

Q

E X X Q xf x dx

In the case, because '

x , so that for a standard normal distribution

1

[ | ( )] ( ( ))E X X Q Q

and applying a scaling and translation to get the general case gives us, for the loss

( ) ( ( ))CVaR Q

In the case of a Gaussian system, there is no substantive difference between the VaR and CVaR](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-9-2048.jpg)

![10

measures: both take the form

( ) ( )Risk

where ( ) ( )Q in the case of VaR and

1

( ) ( ( ))Q

u

in the case of CVaR.

Student’s T VaR and CVaR

The pdf of the Student’s T distribution is

2 ( 1)/2

1 [( 1) / 2] 1

( , )

[ / 2] (1 / ) v

v

h t v

v t vv

It is like the pdf function in Gaussian case. Define the quantile function ( , )TQ n for a standard

univariate T distribution (n is the degree of freedom). If we wish to parametrize the problem

again by mean and standard deviation, the VaR will be given by

2

( ) ( , )T

n

VaR Q n

n

The relevant function for this case is not the (negative of the) standard T quantile but the

negative of the scaled unit variance T quantile

2

( ) ( , ) ( , )T

n

Q n Q n

n

:

The VaR measure of risk is now in standard form ( ) .

For the CVaR, we need to find the integral of ( , )nh n and we can find the function

1

/2 2 2 2

1

( )( )

2( , )

2 ( )

2

v v

v v t

k t v

v

Then the CVaR with mean and variance 2

is now

2 1

( ) ( , )T

n

CVaR k Q n

n

( ),

and now the

2 1

( ) ( , )T

n

k Q n

n

( ),

By calculation by MATLAB, we get the four weeks’ VaR and CVaR. (William, 2011)](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-10-2048.jpg)

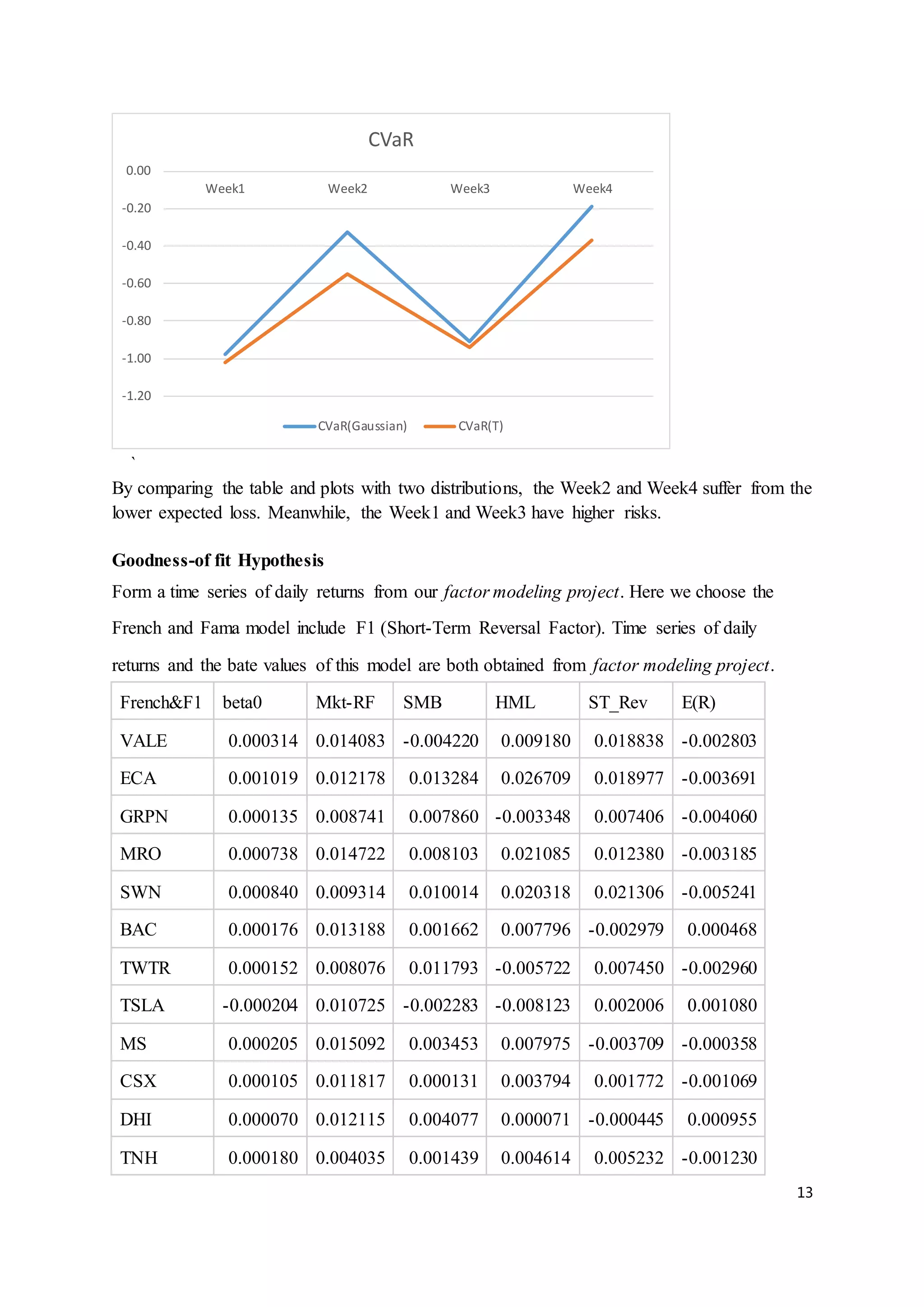

![17

Appendix:

m-files

1.

(1).

function [ optimalWeights ] = optimalPortfolio( expReturns, CovMatrix, expPortfolioReturn)

mu = expReturns ;

Omega = CovMatrix;

N=length(mu);

muP=expPortfolioReturn;

One = ones(length(mu),1) ;

invOmega = inv(Omega) ;

A = One'*invOmega*mu ;

B = mu'*invOmega*mu ;

C = One'*invOmega*One ;

D = B*C - A^2 ;

h=invOmega*(C*mu/D-A*One/D);

g=invOmega*(B*One/D-A*mu/D);

optimalWeights =h*muP+g;

end

(2).

N=length(expPortfolioReturn);

for i=1:N

[ optimalWeights] = optimalPortfolio( expReturns, CovMatrix, expPortfolioReturn(i));

SigmaStar(i)=sqrt(optimalWeights'*CovMatrix*optimalWeights);

end

plot(SigmaStar,expPortfolioReturn)

title('efficientFrontier')

xlabel('SigmaP')

ylabel('muP')

(3). function [ TangencyWeights ] = TangencyPortfolio( expReturns, CovMatrix,muf)

mu = expReturns ;

Omega = CovMatrix;

N=length(mu);

One = ones(length(mu),1) ;

invOmega = inv(Omega) ;

A = One'*invOmega*mu ;

B = mu'*invOmega*mu ;

C = One'*invOmega*One ;

D = B*C - A^2 ;

h=invOmega*(C*mu/D-A*One/D);

g=invOmega*(B*One/D-A*mu/D);](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-17-2048.jpg)

![18

w=invOmega*(mu-muf*One);

TangencyWeights=w/(One'*w);

end

2.

function [ Sharp,Treynor,Sortino,Alpha,Beta ] = Ratios( Rp, Rm,uf)

n=length(Rp);

uRp=mean(Rp);

StDRp=std(Rp);

uRm=mean(Rm);

StDRm=std(Rm);

ExcessRpm=Rp-Rm;

uExcessRpm=mean(ExcessRpm);

StDexcess=std(ExcessRpm);

Sharp=(uRp-uf)/StDRp;

A=cov(Rp,Rm);

B=A(1,2)/var(Rm);

for i=1:n

Rpf(i)=Rp(i)-uf;

end

meanRpf=mean(Rpf);

Treynor =meanRpf/B;

Information=ExcessRpm/StDexcess;

Beta=A(1,2)/var(ExcessRpm);

Alpha=uExcessRpm-uf+Beta*(uRm-uf);

for i=1:n

if (Rp(i)-uf)<0

negative(i)=Rp(i)-uf;

end

end

Downside=(sumsqr(negative)/n)^0.5;

Sortino=meanRpf/Downside;

end

2.

function [VaRnormal,CVaRnormal,VaRt,CVaRt,CVaRTt] = ValueAtRisk(returns,alpha,v)

n=length(returns);

m=mean(returns);

sigma=std(returns);

S=sqrt(sigma^2*n/(n-1));

x=norminv([alpha 1-alpha],0,1);](https://image.slidesharecdn.com/245ba409-66f6-403a-b4b2-4e43ac5287cc-170208170415/75/Portfolio-Optimization-Project-Report-18-2048.jpg)