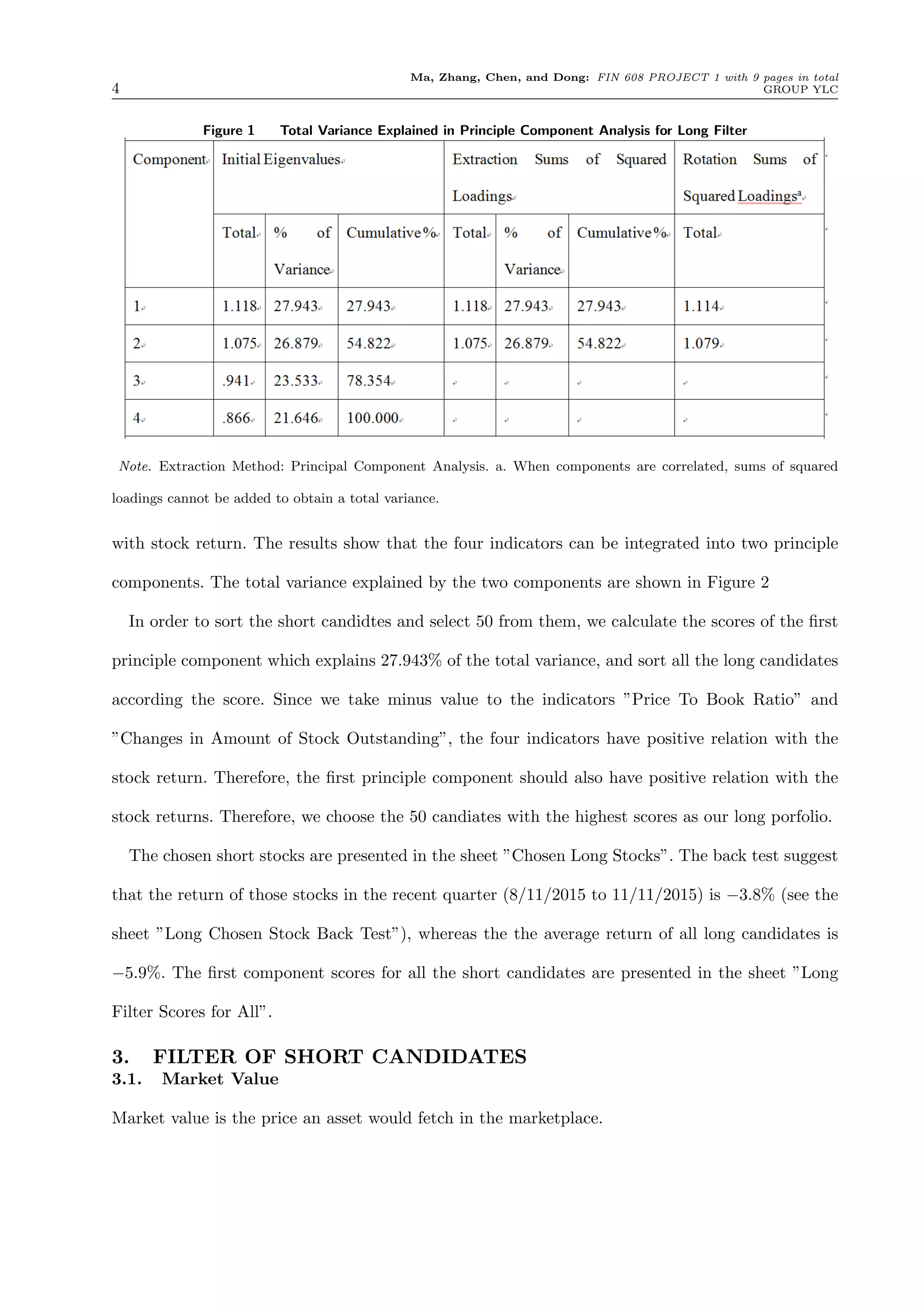

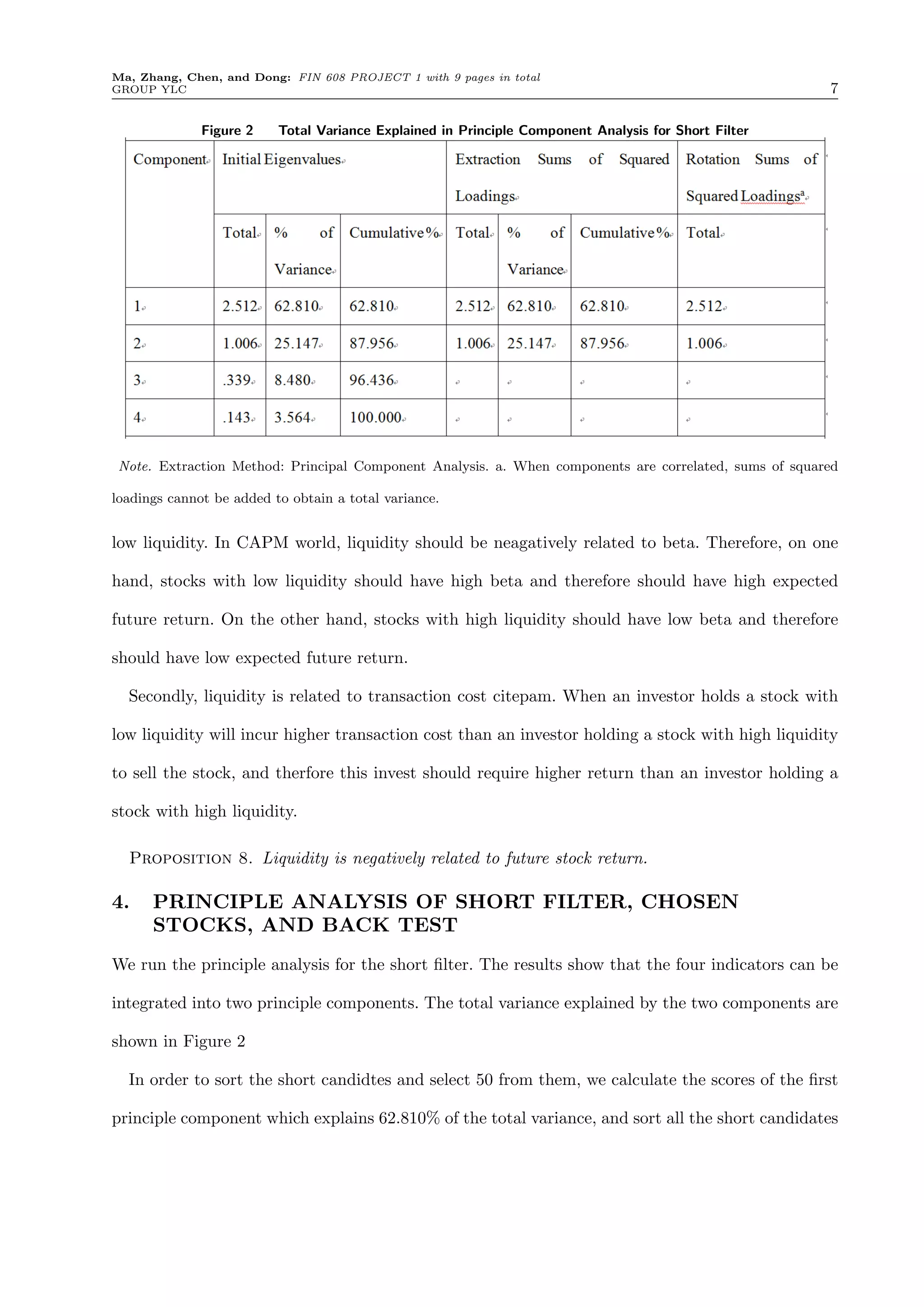

This document presents an analysis of factors to use in filtering stocks for long and short positions in a portfolio. For long positions, the factors of alpha, dividend yield, price-to-book ratio, and changes in stock outstanding are analyzed. For short positions, the factors of market value, price-to-book ratio, capital investment, and liquidity are considered. Principal component analysis is used to analyze the factors and scores are calculated to select 50 stocks for long and short positions that are backtested for returns. The results show the filtered portfolio outperformed the total market.