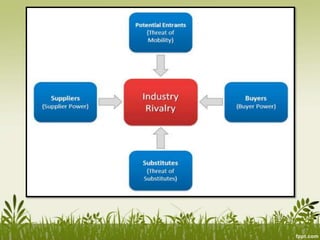

Porter's Five Forces model is used to analyze the agricultural sector. The key forces are: intense industry rivalry due to many competitors and ease of entry; moderate bargaining power of suppliers and buyers; and potential threats from substitute goods and new entrants. To be competitive, agricultural producers need scale efficiencies through consolidation or collaboration, and adoption of new technologies to continuously improve productivity from limited land resources under competitive market conditions.