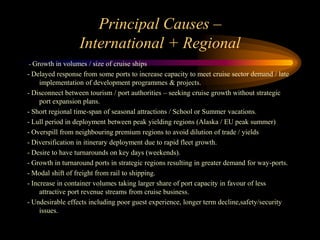

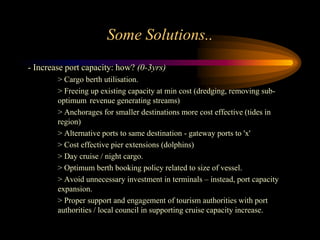

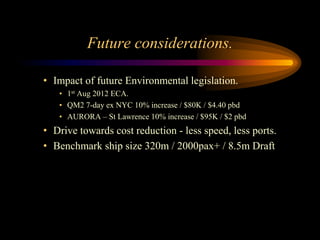

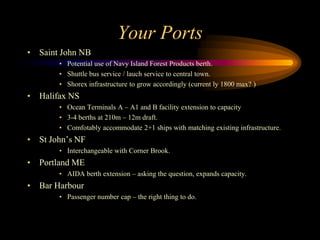

The document discusses port congestion issues facing cruise ports in Canada, New England, and Atlantic Canada. It identifies principal causes as the growth in cruise ship sizes and volumes without matching increases in port capacity. Solutions proposed include expanding the cruise season length, smoothing peak weeks, and increasing port infrastructure capacity over the short and long term. Specific ports mentioned are Saint John NB, Halifax NS, St. John's NF, Portland ME, and Bar Harbour, along with potential capacity expansion projects.