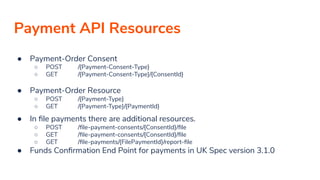

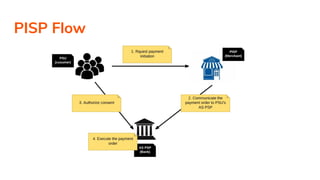

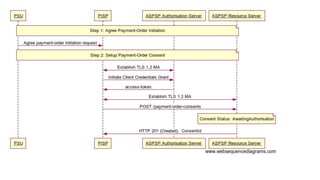

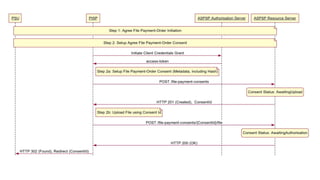

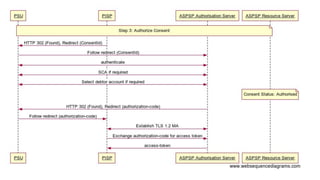

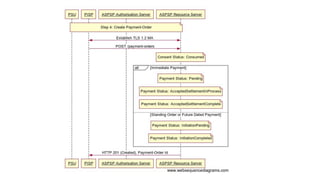

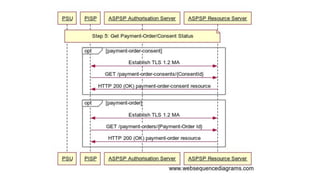

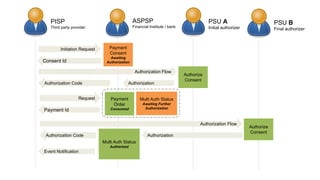

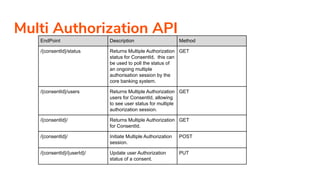

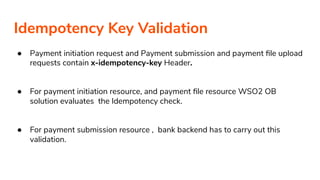

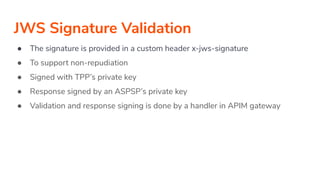

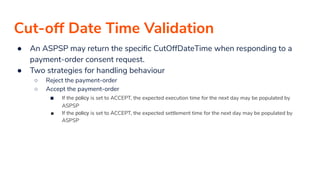

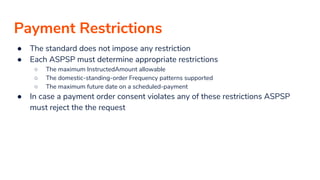

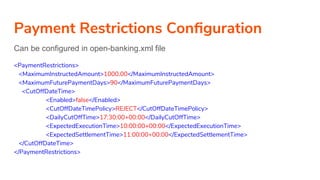

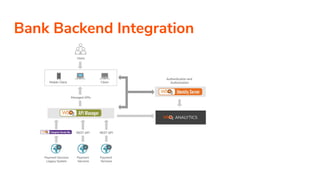

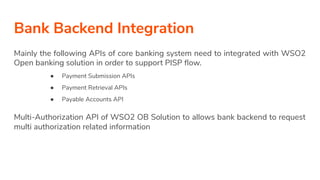

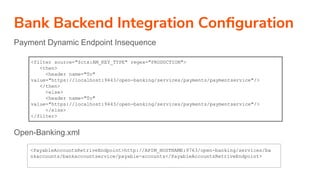

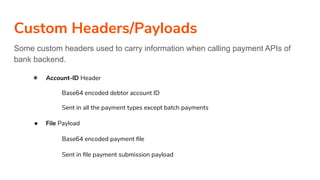

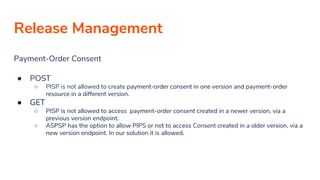

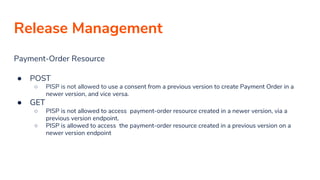

The document outlines the Payment Initiation Service Provider (PISP) journey based on Open Banking in the UK, detailing various payment types and the related API resources needed for integration. It describes the PISP flow, including multi-authorization, idempotency key validation, and JWS signature validation, along with payment restrictions and backend integration requirements. Additionally, it emphasizes the release management protocols for handling payment order consents and resources across different API versions.