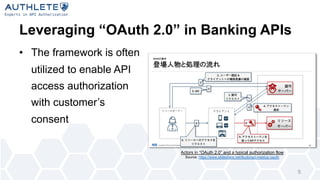

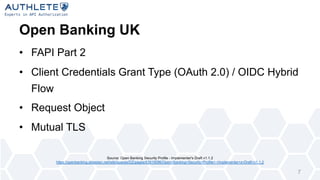

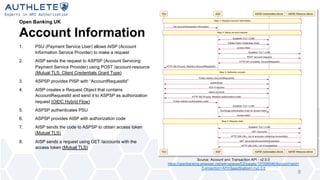

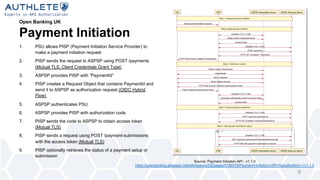

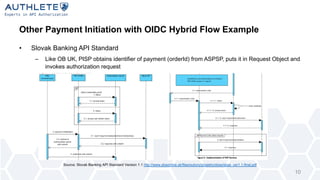

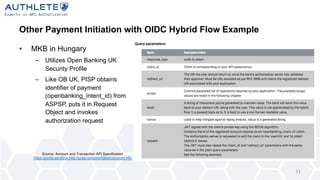

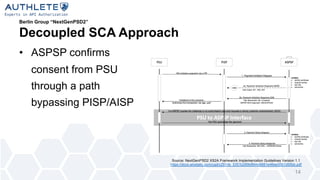

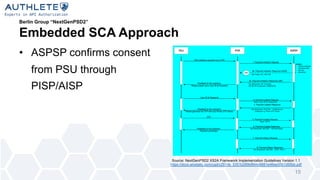

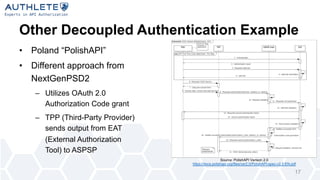

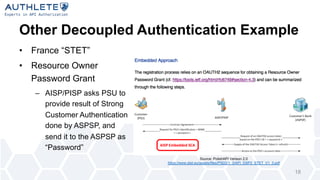

This document summarizes trends in banking APIs. It discusses how standards like Open Banking UK define API access authorization, typically using OAuth 2.0. Open Banking UK specifies the client credentials grant type and OIDC hybrid flow for account information and payment initiation APIs. It involves the TPP obtaining an identifier from the ASPSP, including it in a request object for authorization. Other standards like NextGenPSD2 and PolishAPI also utilize decoupled or OAuth-based authorization flows. Mutual TLS authentication between TPPs and ASPSPs is common across specifications.