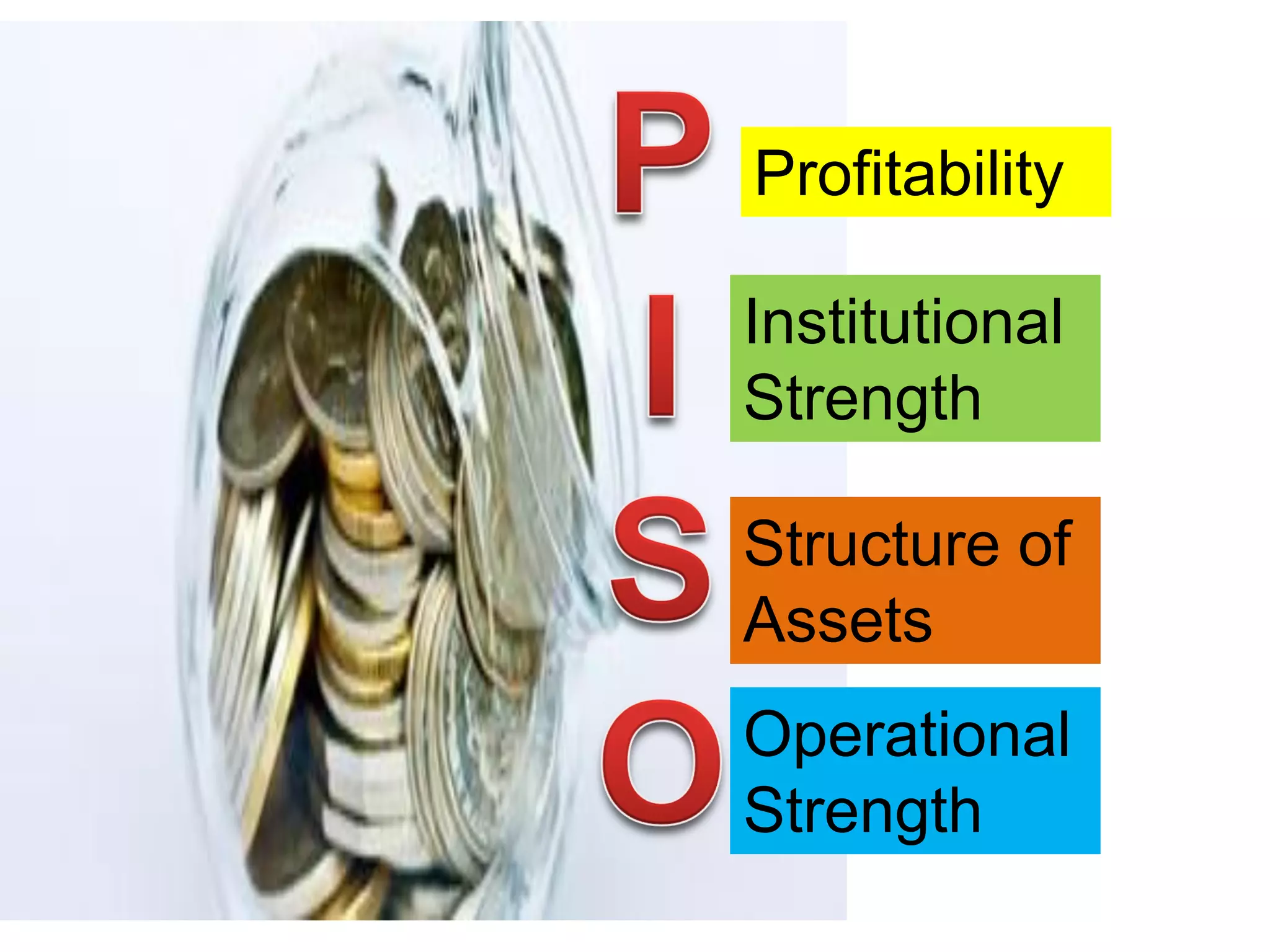

This document outlines various metrics for evaluating the profitability, institutional strength, asset structure, and operational strength of cooperatives. It provides metrics in the following areas:

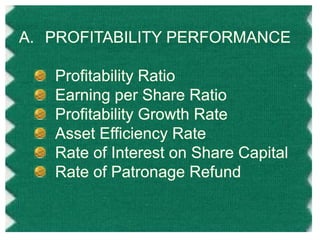

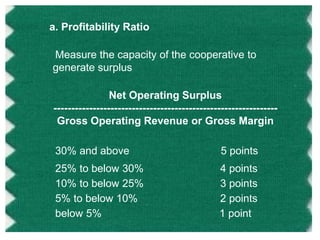

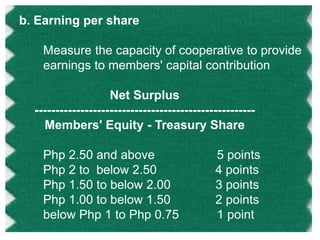

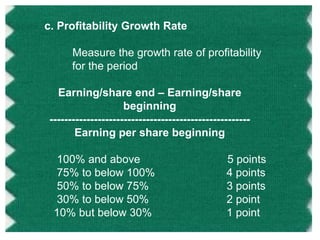

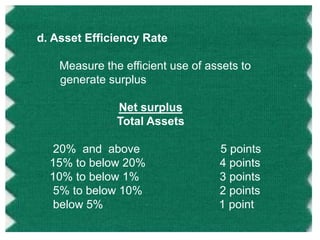

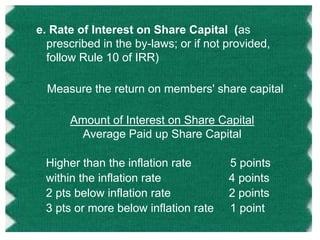

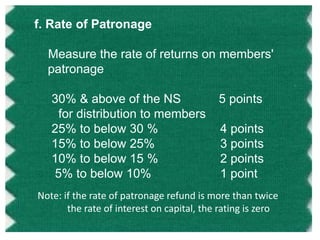

1. Profitability is measured through ratios like profitability, earnings per share, profitability growth rate, and asset efficiency rate. Higher ratios indicate stronger profitability.

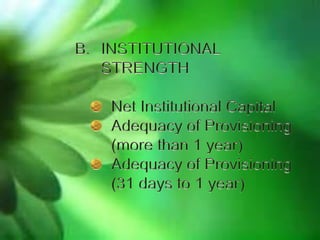

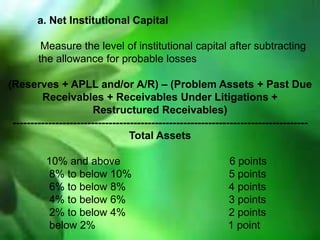

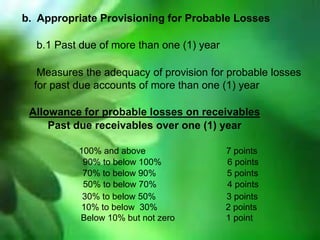

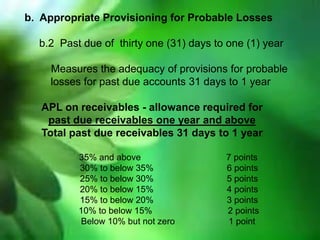

2. Institutional strength is evaluated based on the level of institutional capital, adequacy of provisions for probable losses on past due accounts, and capital participation levels.

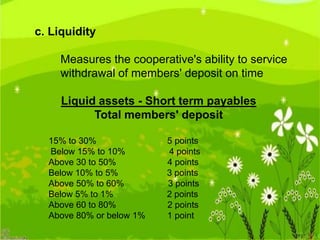

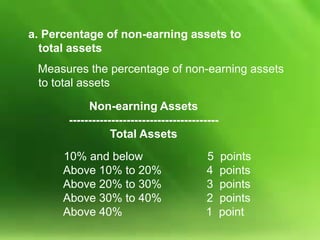

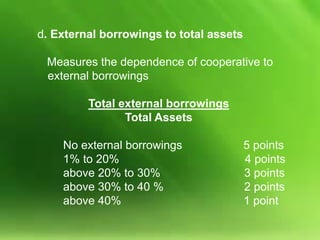

3. Asset structure examines the allocation of assets between earning and non-earning assets, and participation of members' equity, deposits, and external borrowings.

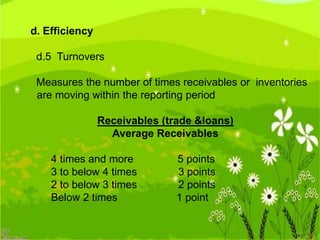

4. Operational strength considers metrics like business volume

![b. Solvency

Measures the degree of protection that the cooperative has

for members savings and share capital in the event of

liquidation of coop's assets and liabilities

(Assets + APL) - [ (Total liabilities - Deposit liabilities)+

(Past due receivables + restructured receivables +

receivables under litigation)]

--------------------------------------------------------------------------------Deposit liabilities + Share capital

10% and above

100% to below 110%

85% to below 100%

75% to below 85%

50% below 75 %

5 points

4 points

3 points

2 points

1 point](https://image.slidesharecdn.com/pisopresentation-131201181601-phpapp01/85/Performance-Standard-for-Philippine-Cooperatives-P-I-S-O-25-320.jpg)