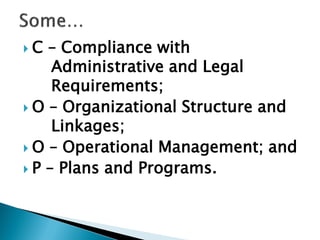

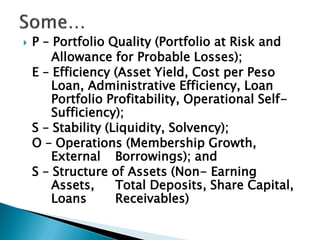

This document outlines various requirements and best practices for cooperatives in the Philippines. It states that cooperatives must allocate allowances for probable loan losses, apply for tax exemption with BIR, and submit yearly reports to CDA to maintain their Certificate of Operation. It also describes the COOP-PESOS rating system used by CDA to evaluate cooperatives' soundness. Additional requirements include proper documentation of loans, regular financial audits, and developing strategic plans.