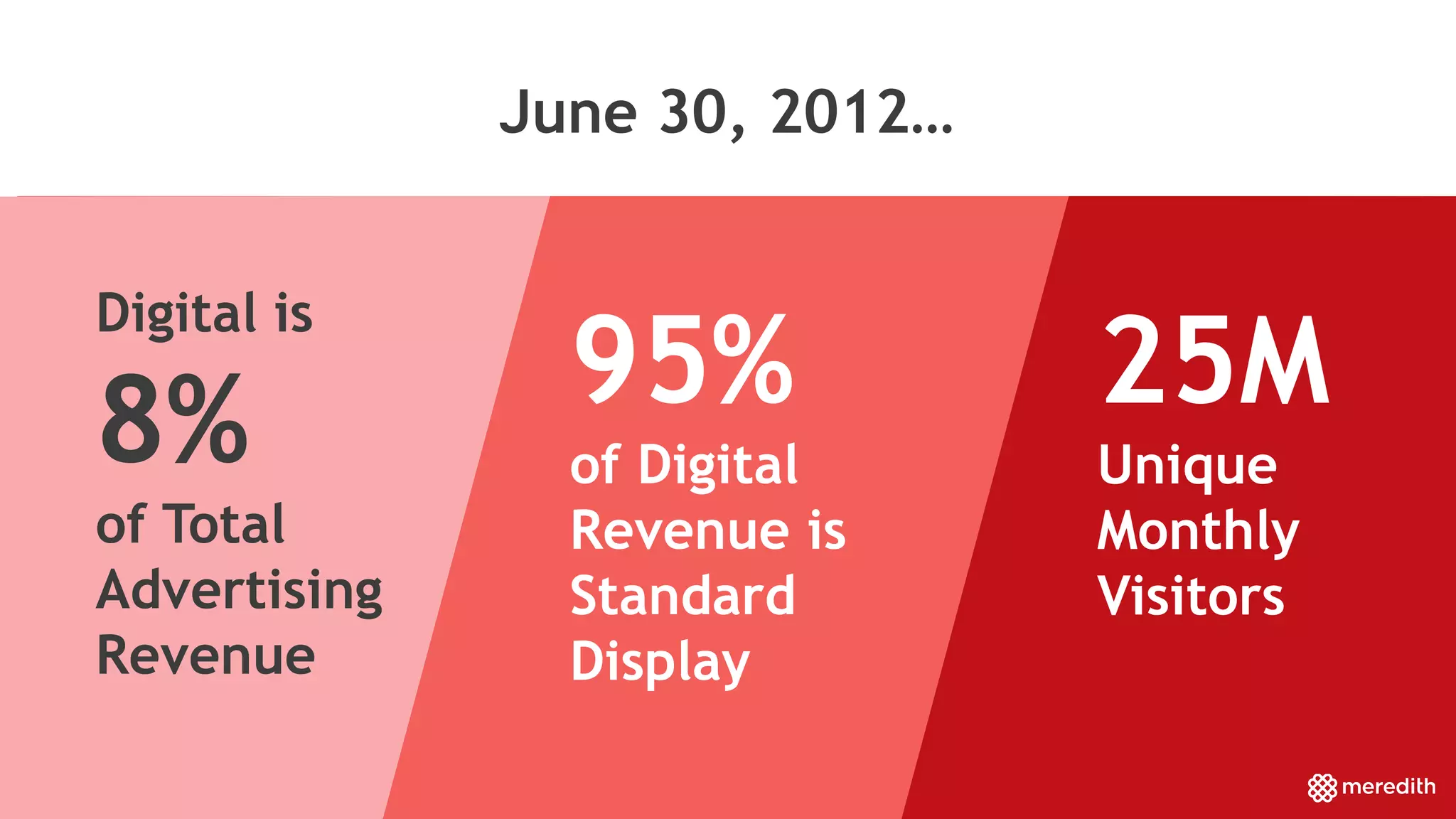

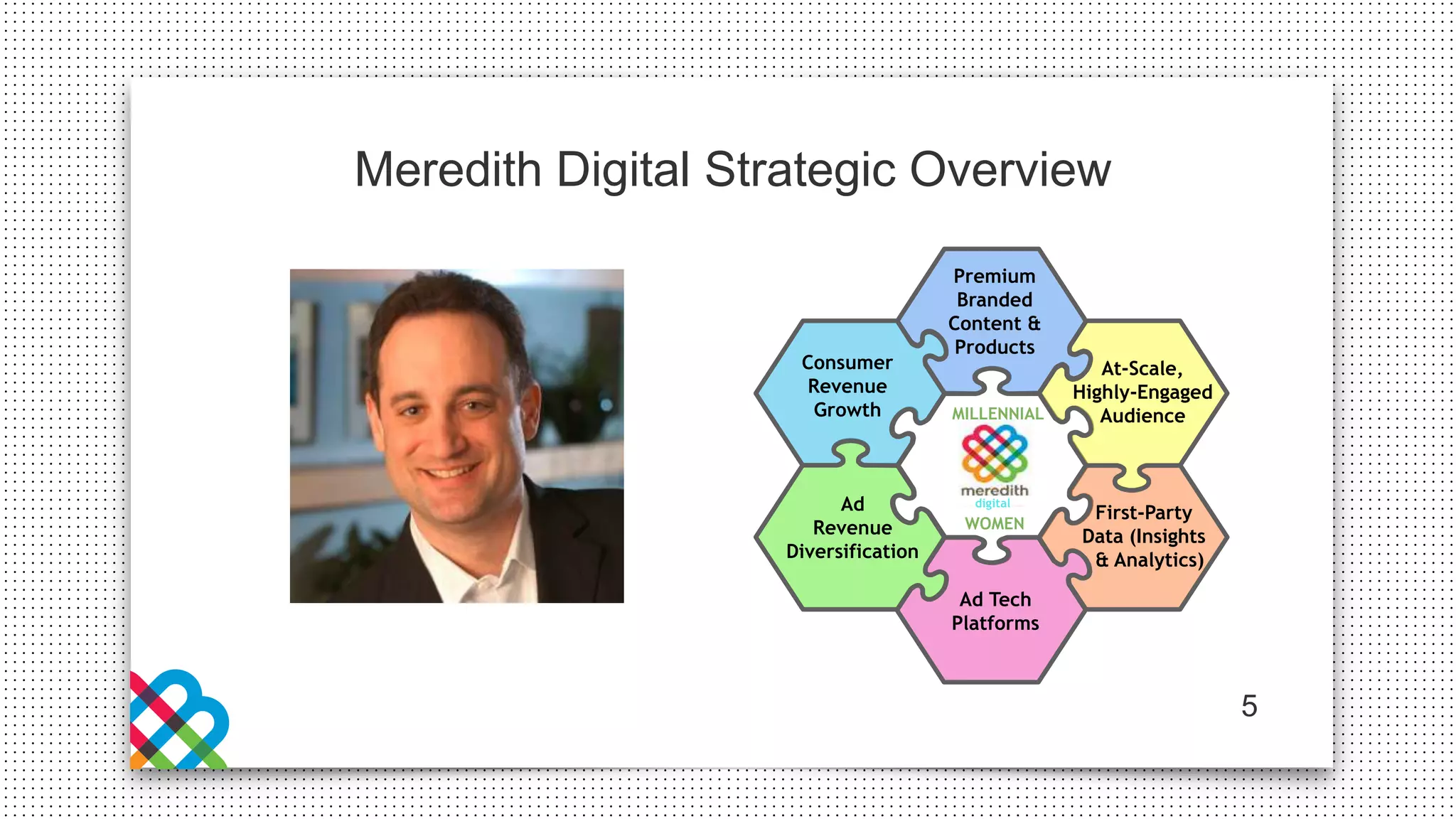

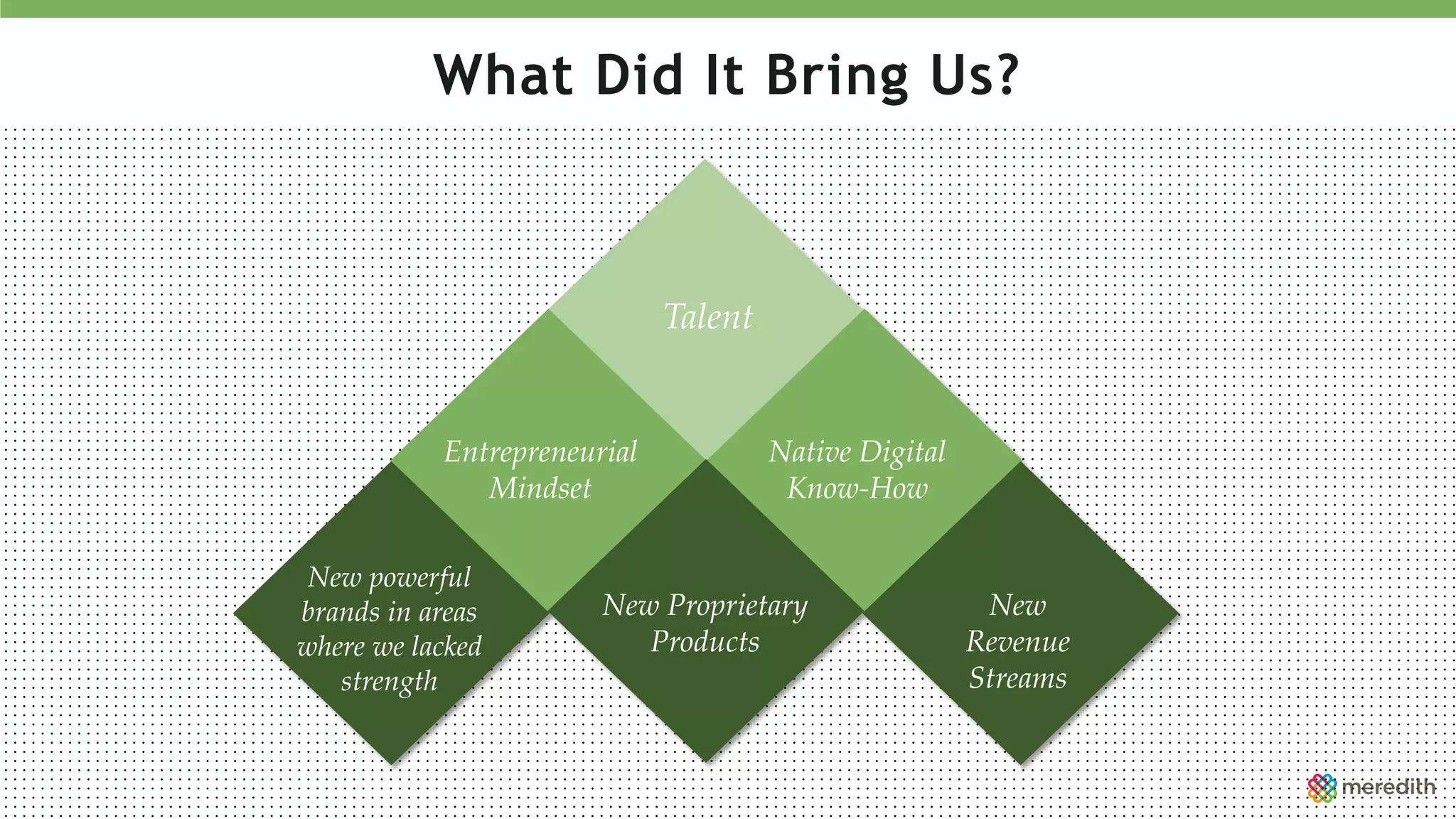

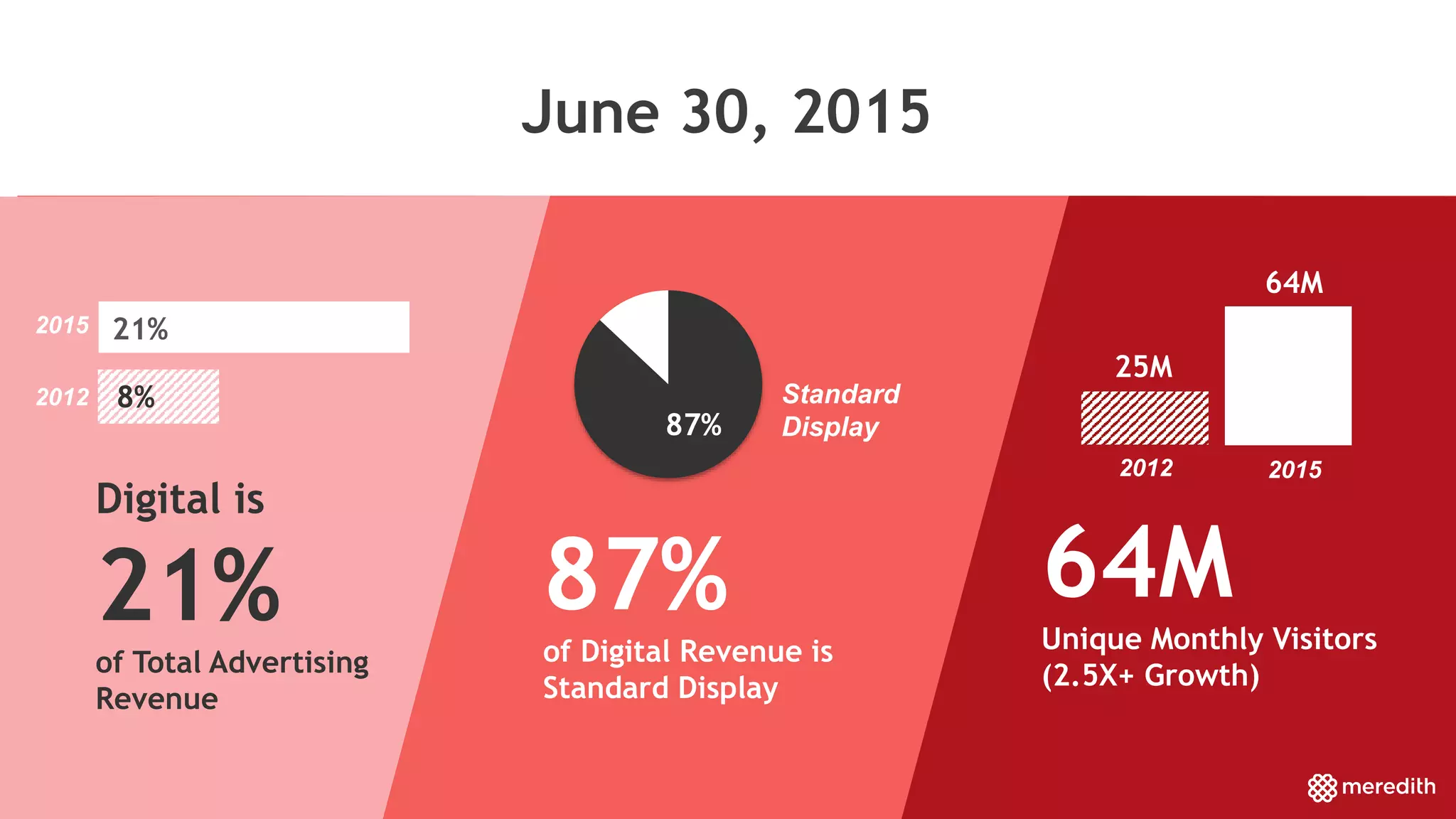

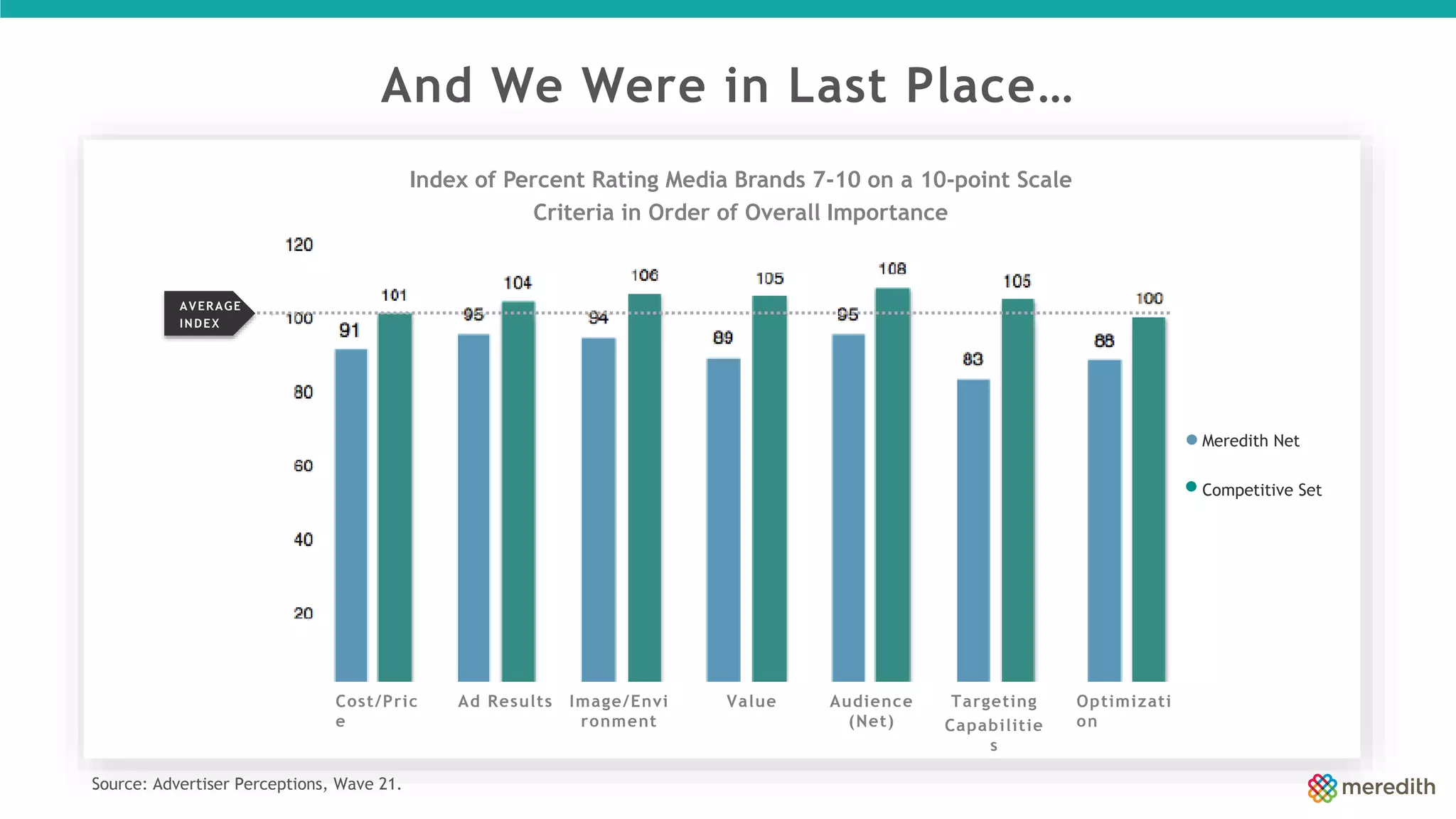

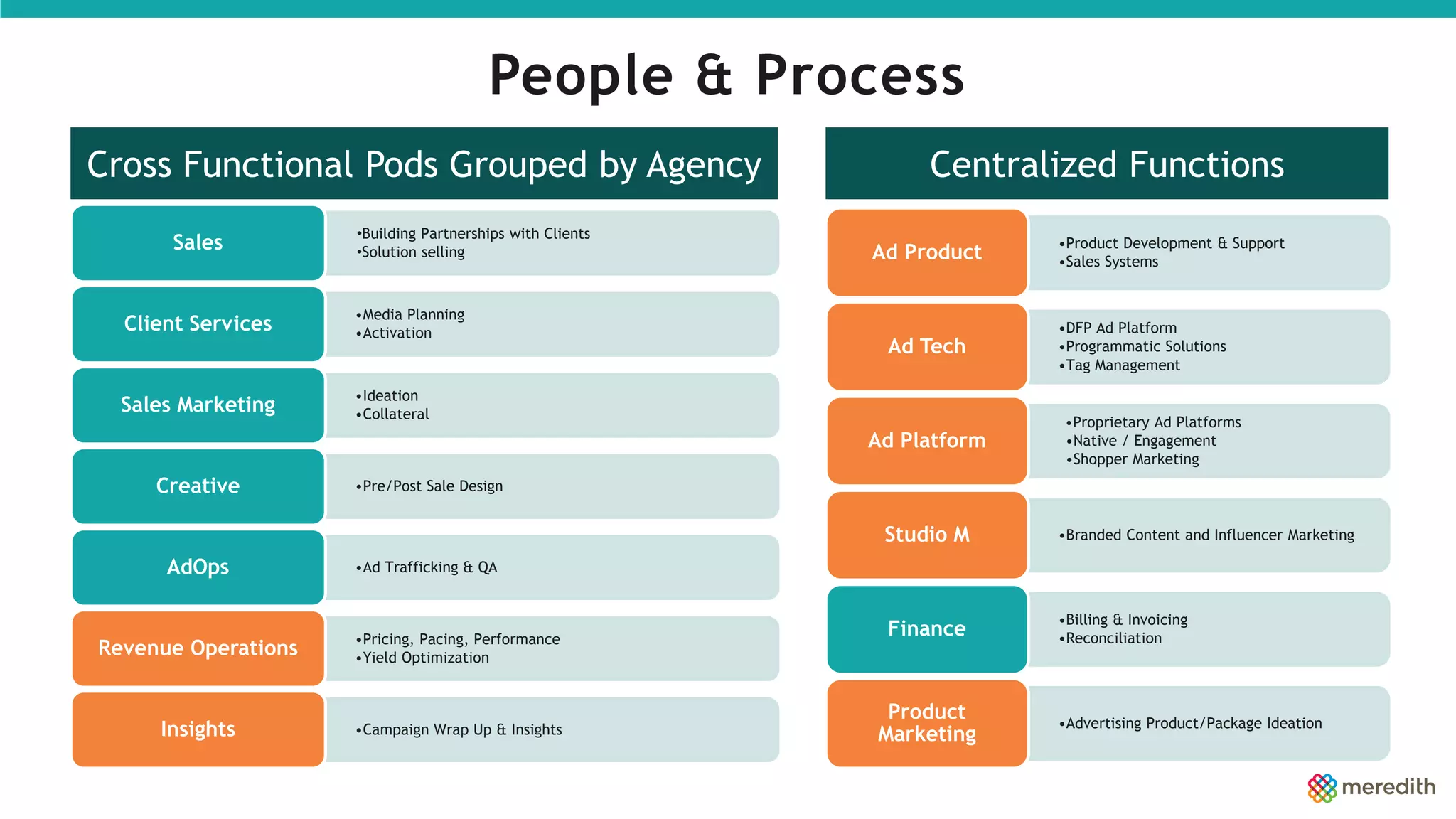

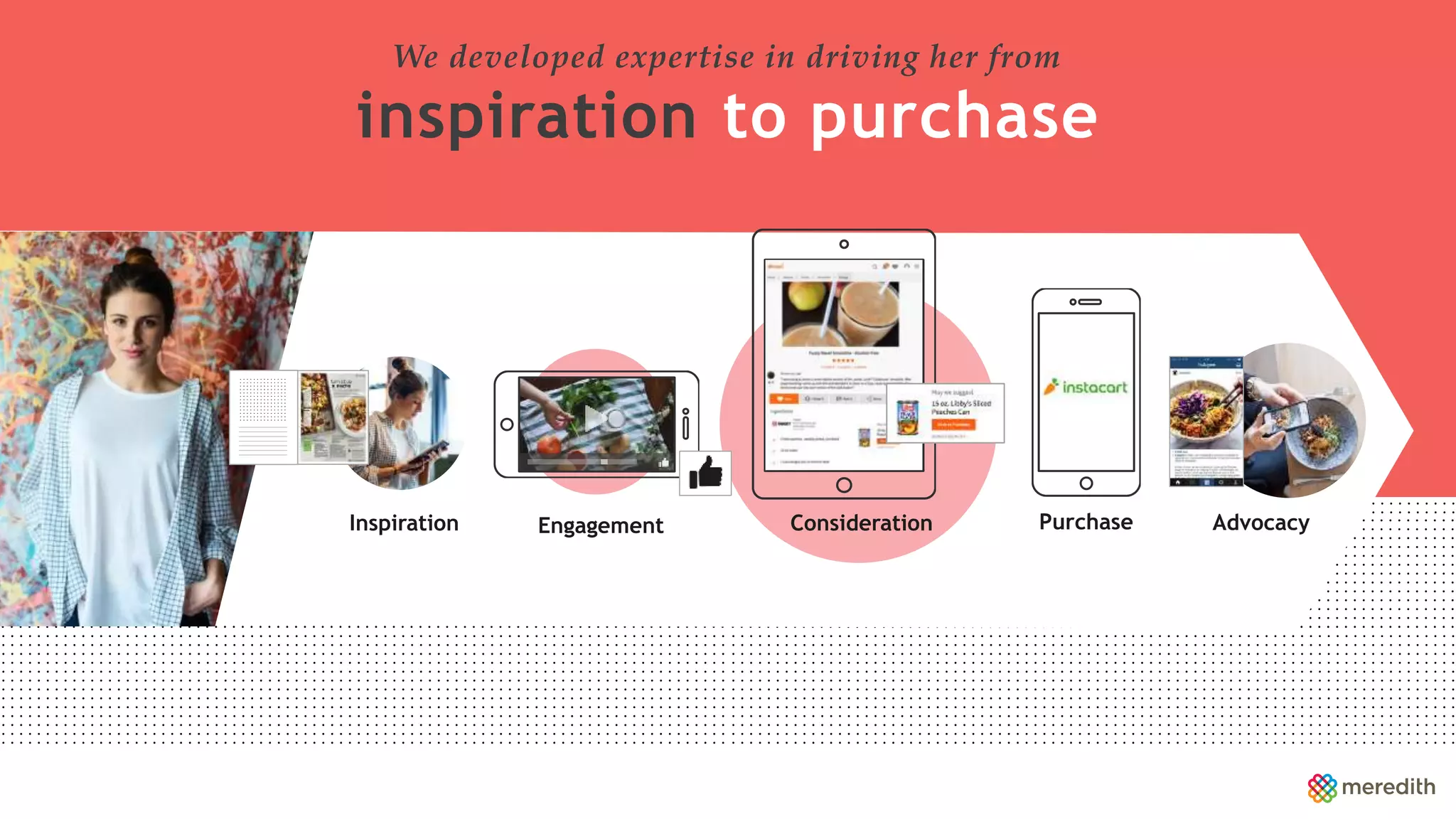

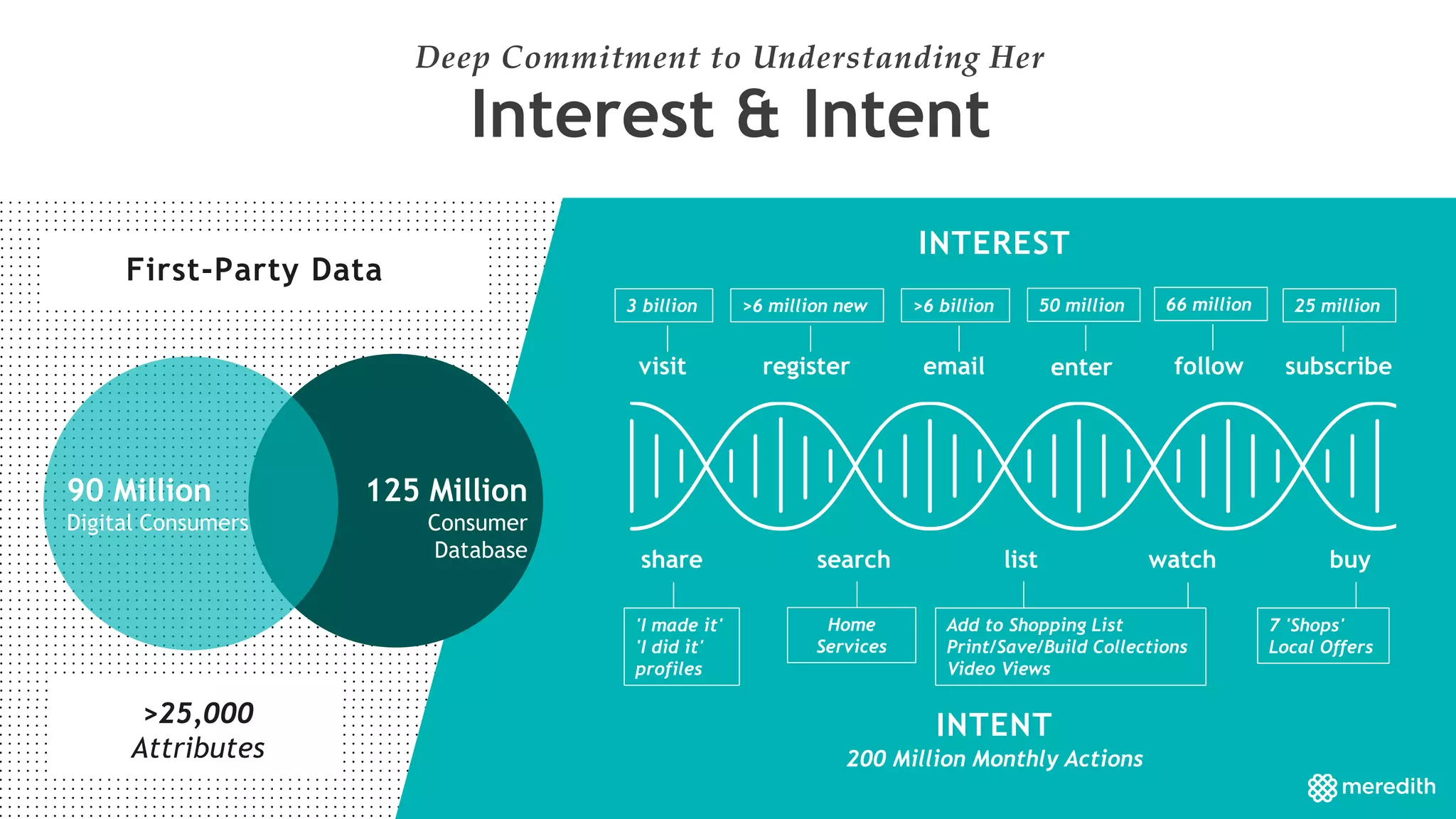

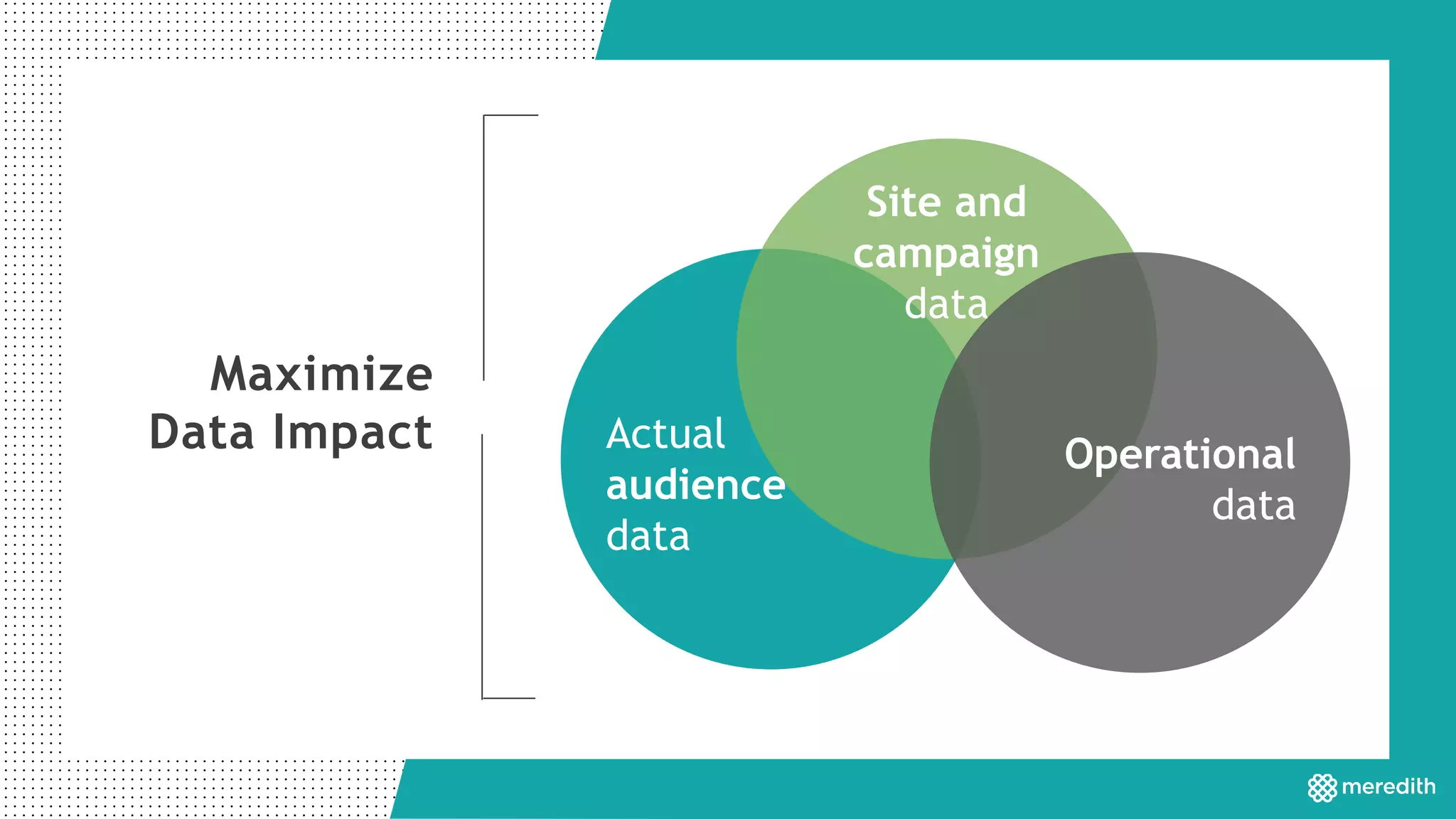

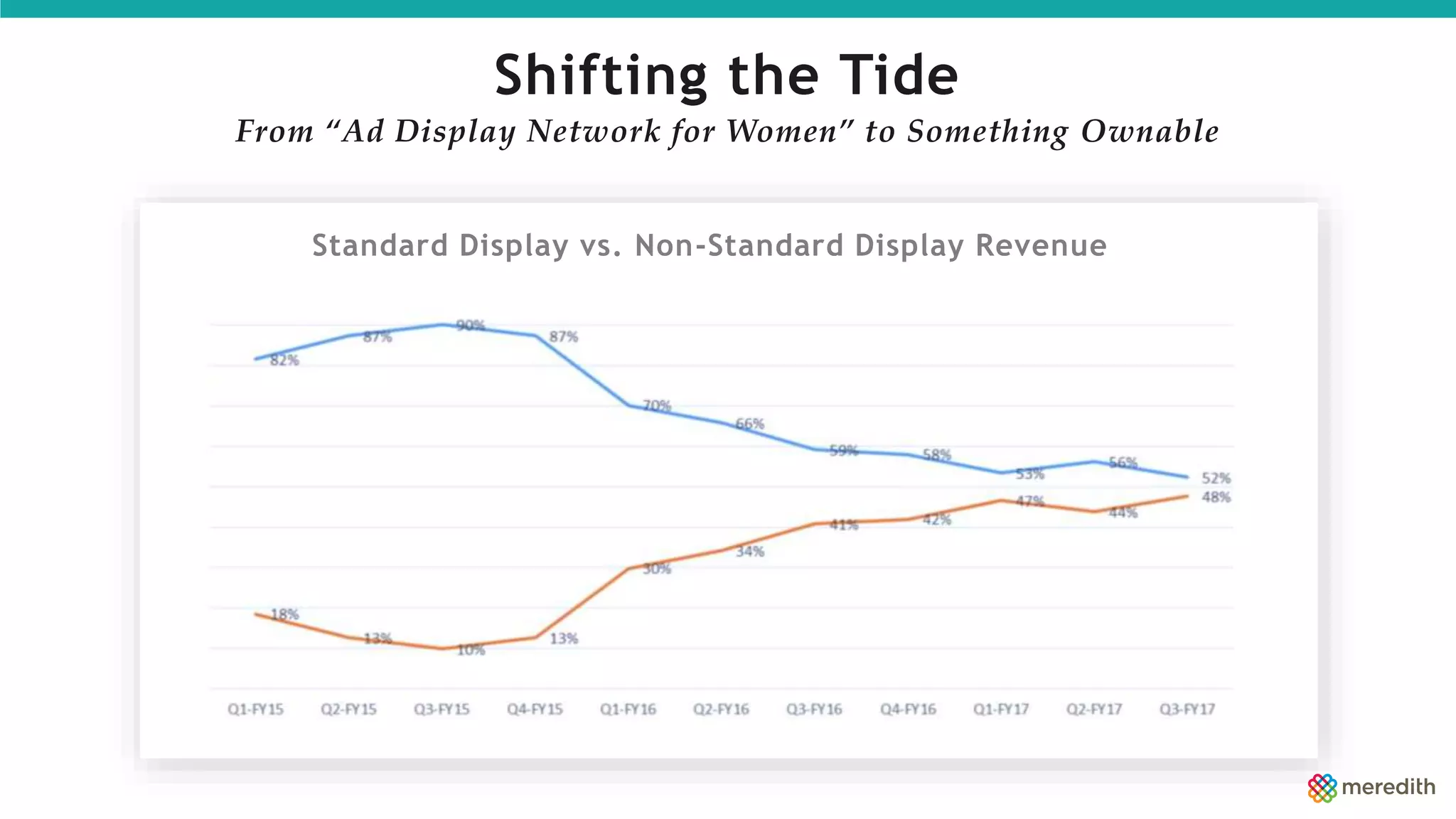

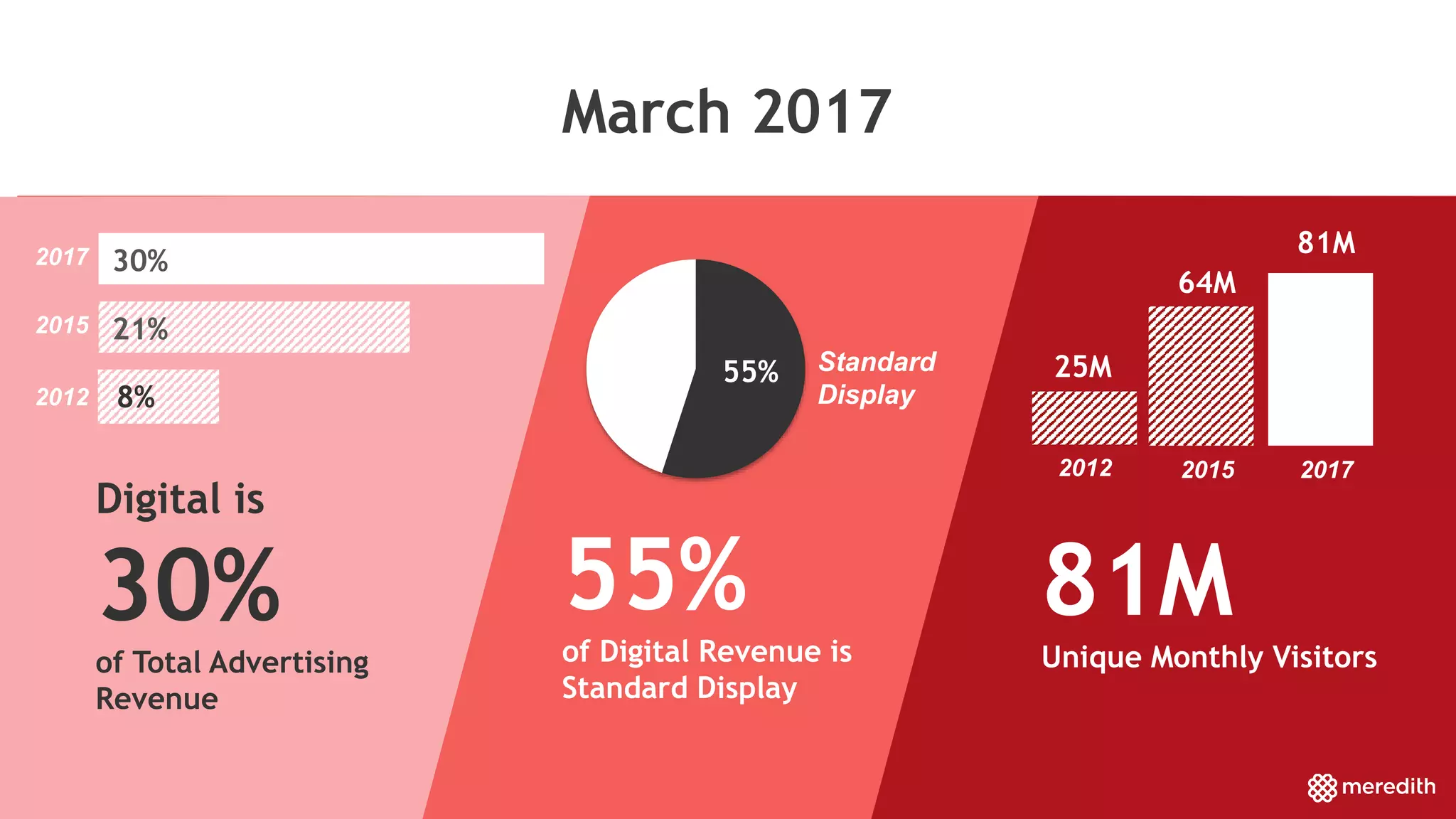

The document outlines Meredith Corp's digital transformation journey and its significant growth in digital advertising revenue, which rose from 8% to 30% between 2012 and 2017. Key strategies included developing proprietary products, enhancing first-party data usage, and fostering partnerships. Despite challenges, the company successfully boosted its unique monthly visitors from 25 million to 81 million and diversified revenue streams effectively.