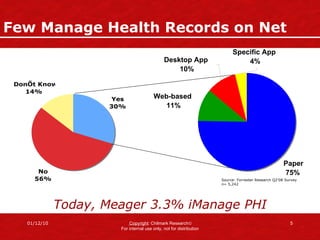

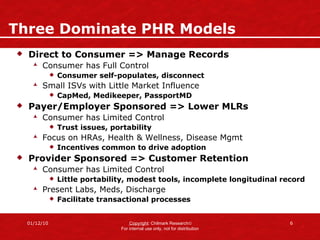

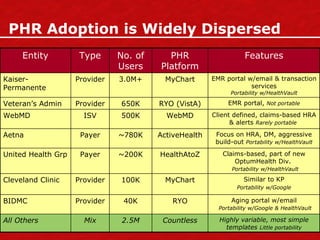

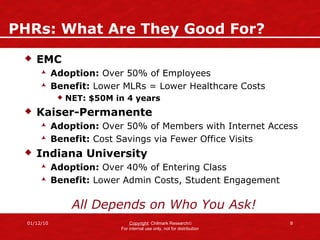

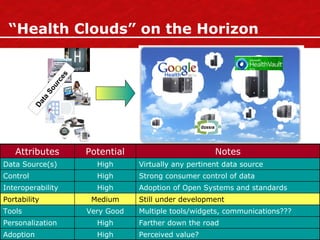

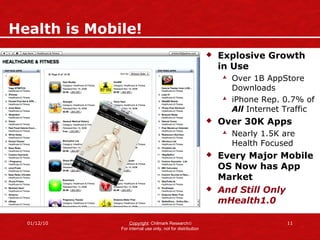

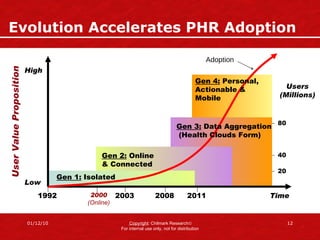

The document discusses the evolution of personal health records (PHRs) and their transition toward online platforms amid growing consumerism in healthcare. It highlights key challenges in data management, privacy, and security, while emphasizing the need for consumer engagement and the incorporation of mobile technologies. The future of healthcare is seen as shifting to Personal Health Platforms (PHPs), which require actionable and personalized data to ensure higher adoption rates.

![PHRs: Where We’ve Been, Where We’re Going By: John Moore, Managing Partner [email_address]](https://image.slidesharecdn.com/mooreahrq09-090915105907-phpapp01/75/PHRs-Where-We-ve-Been-Where-We-re-Going-1-2048.jpg)