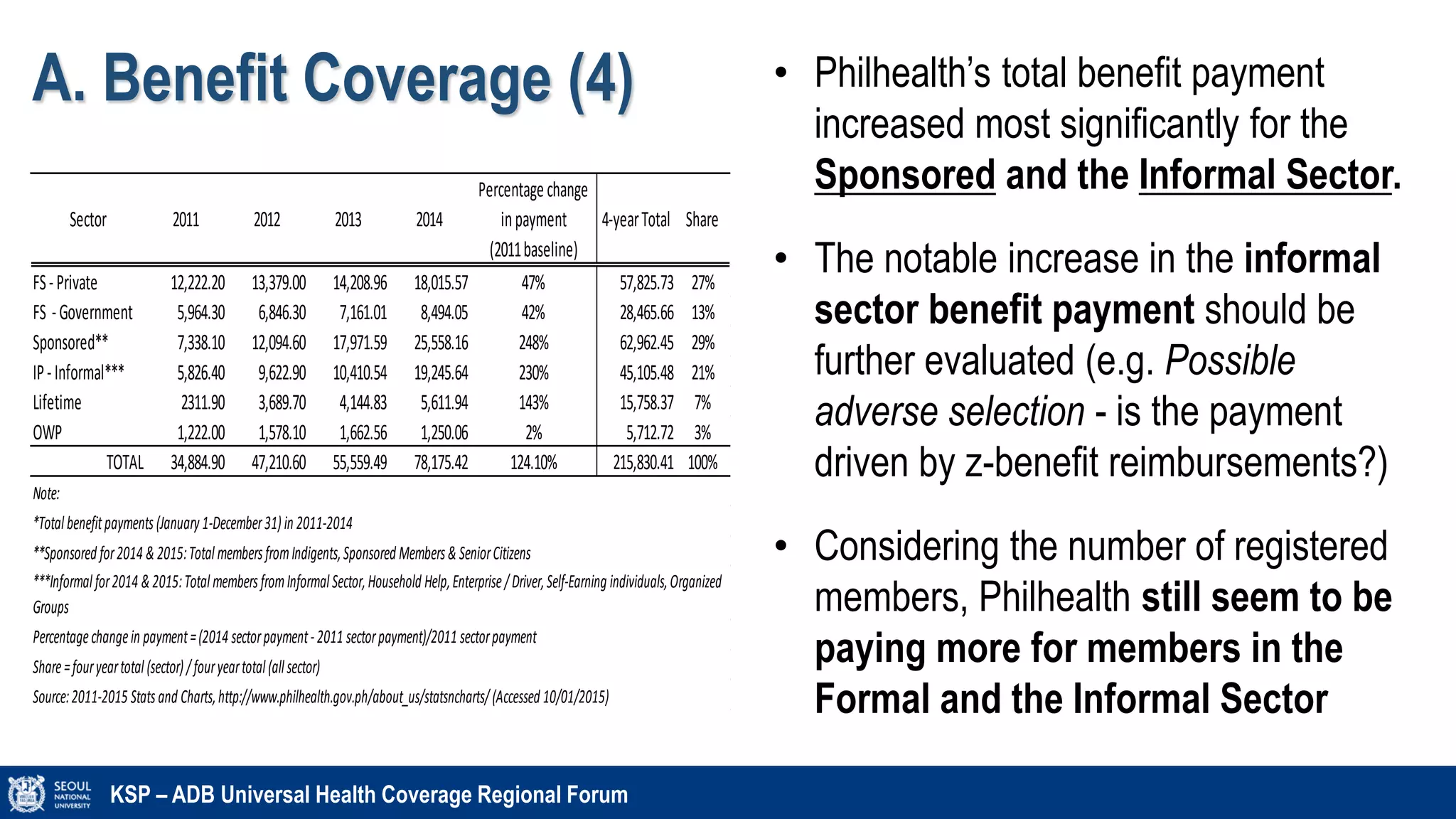

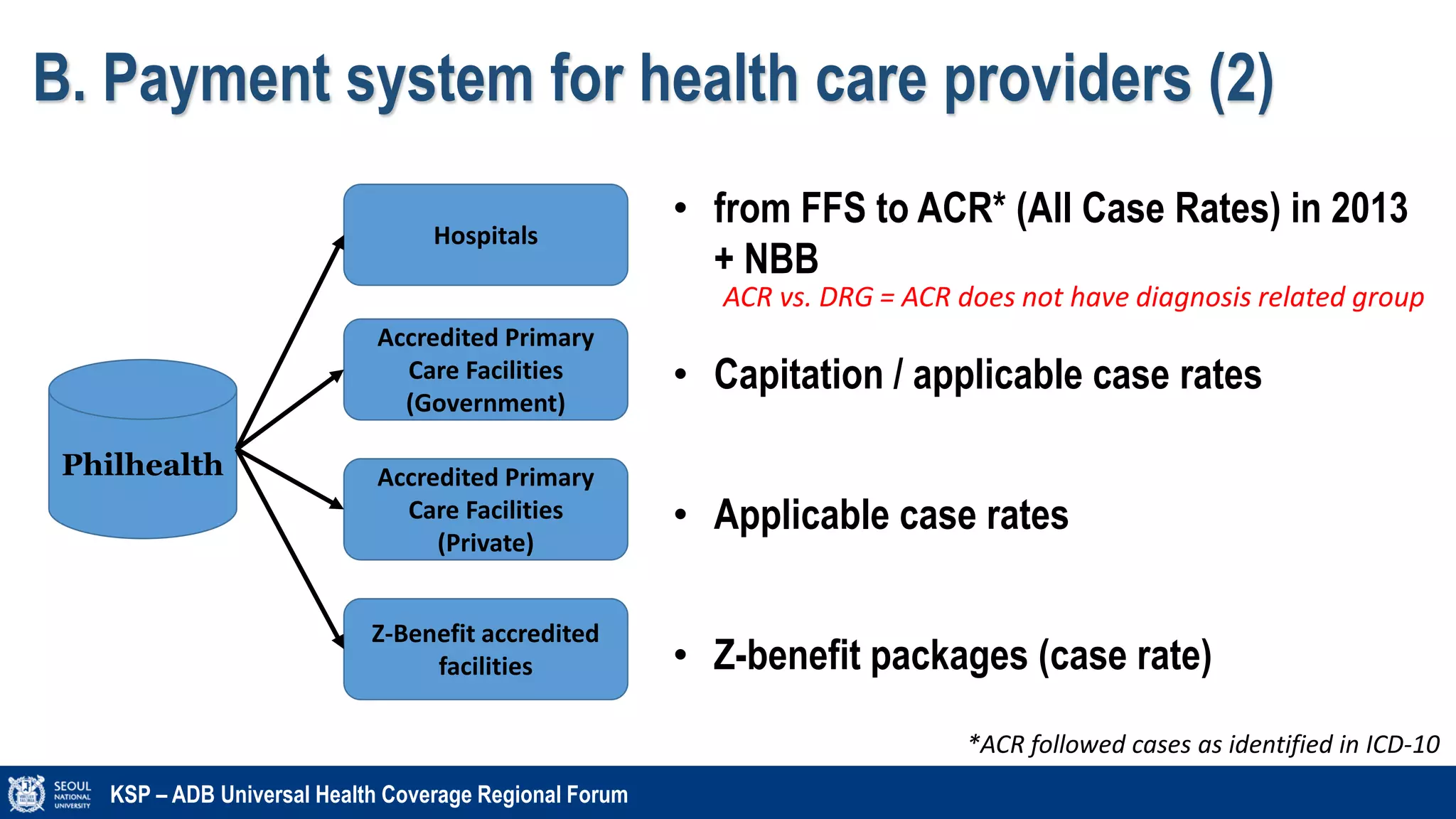

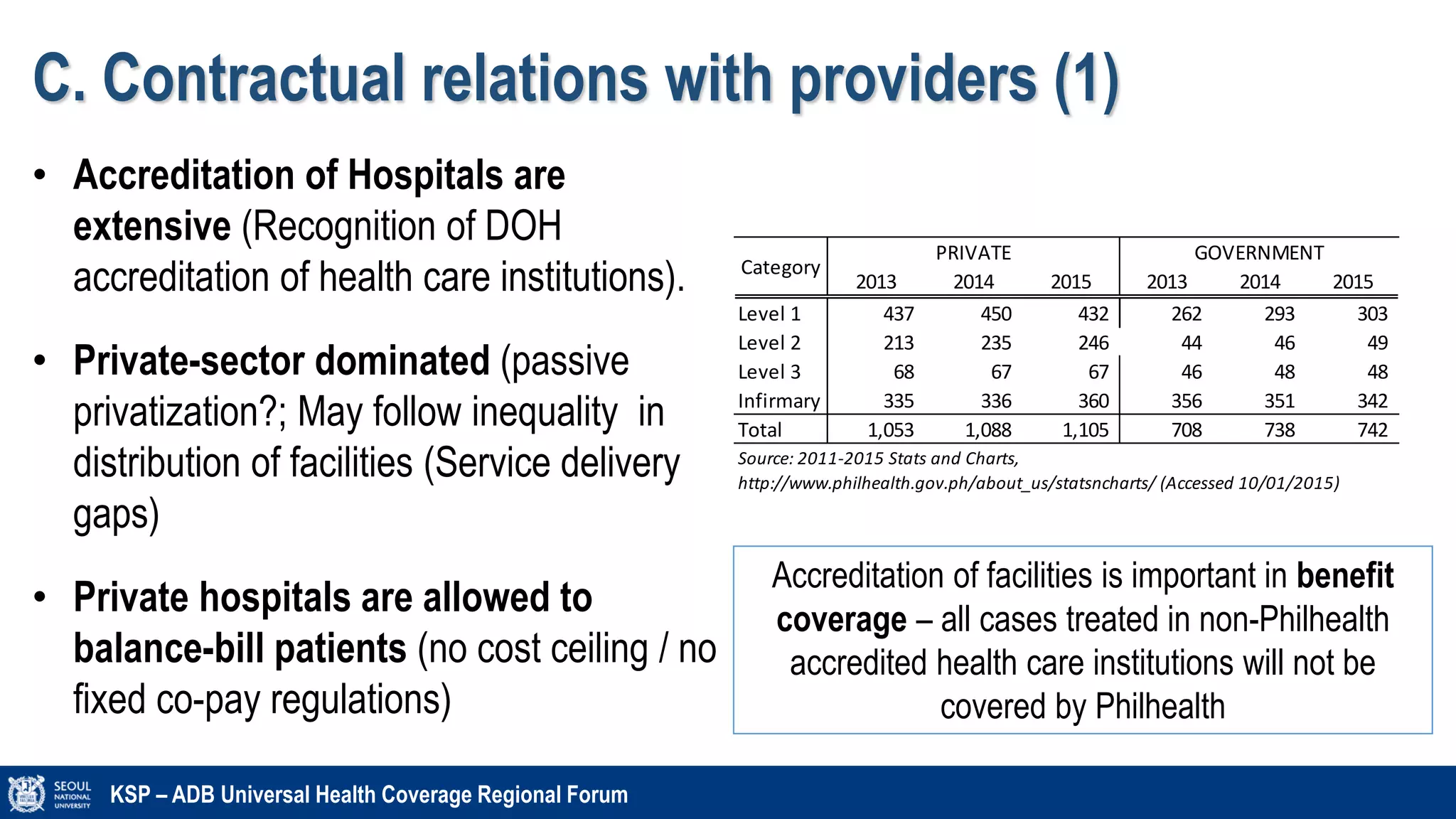

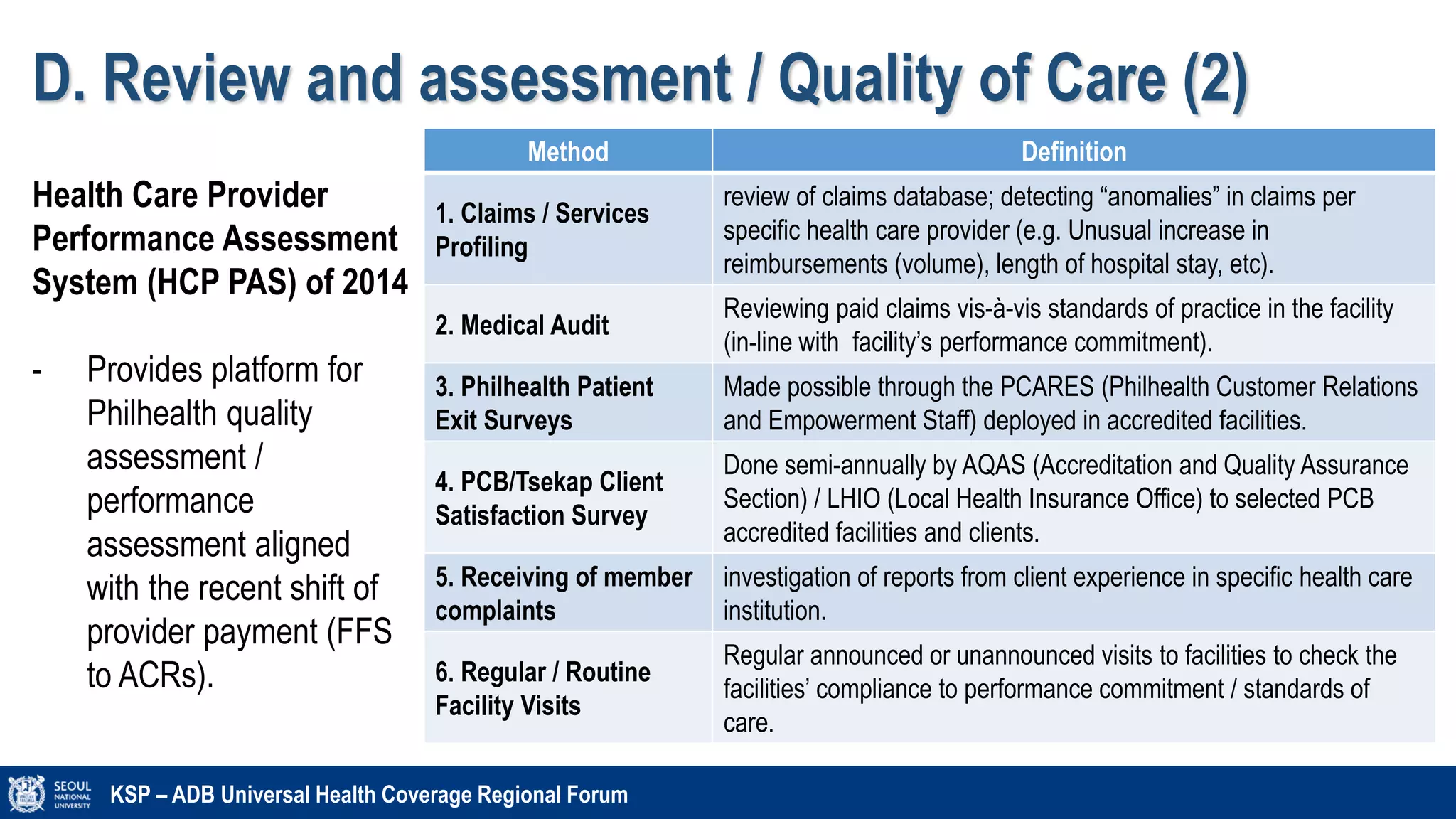

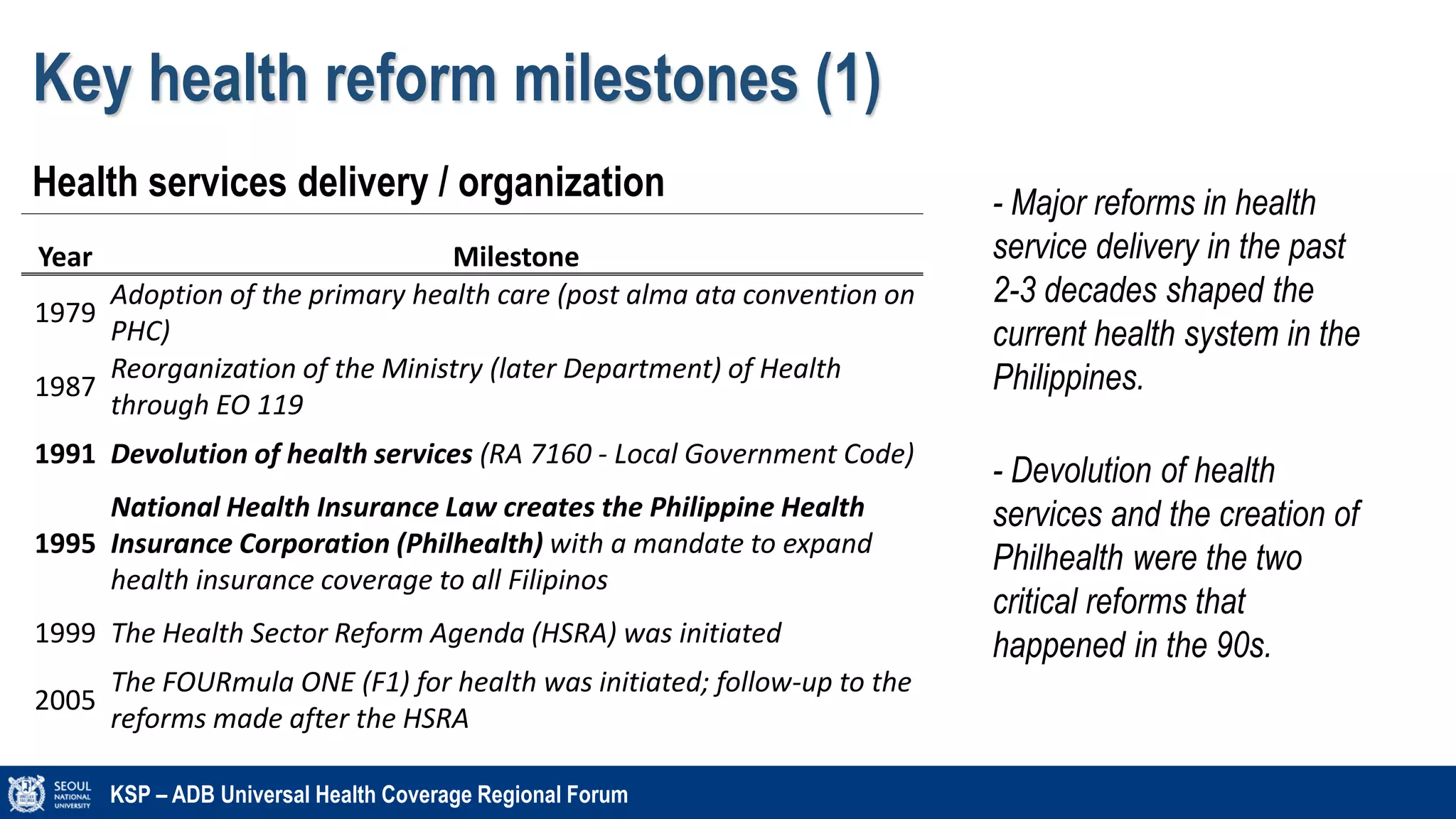

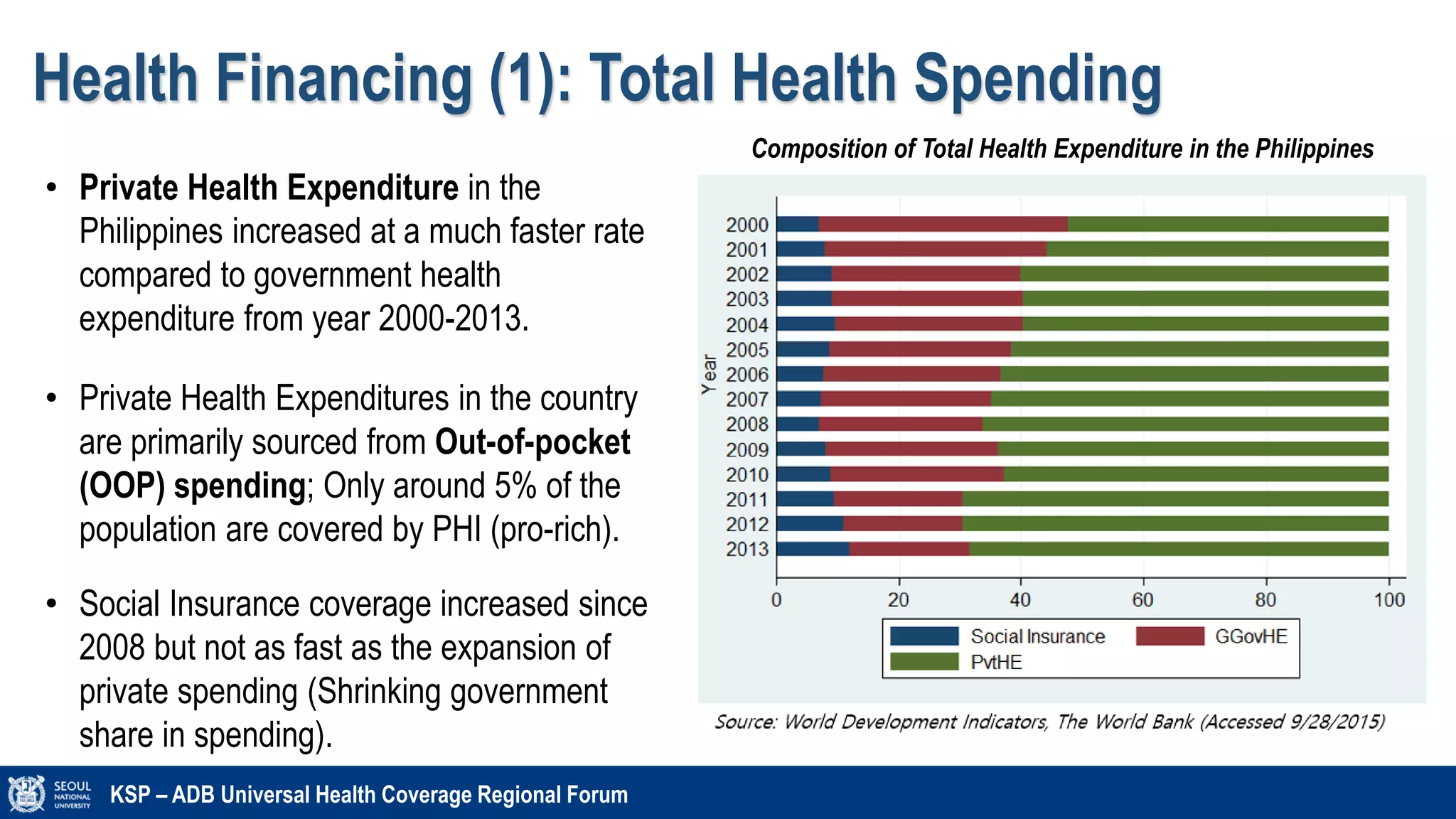

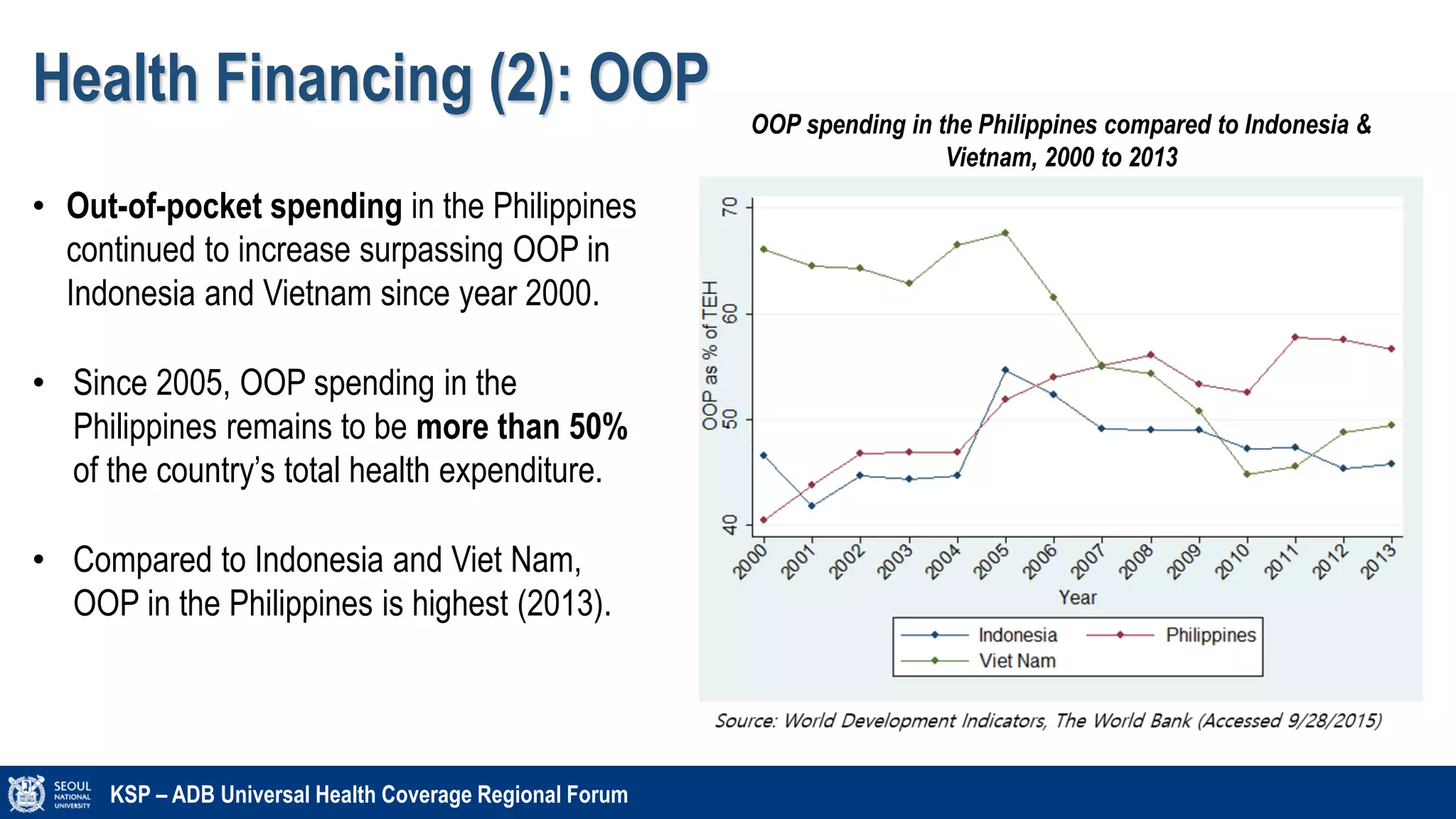

The document discusses the Philippines' health system and financing, detailing growth trends in health expenditure alongside challenges like disease transitions and out-of-pocket spending. Key reform milestones since the 1970s, such as the establishment of PhilHealth and the push for universal health coverage (UHC), are highlighted, along with strategic purchasing and payment systems for health providers. The document also emphasizes disparities in health facility distribution and coverage gaps, particularly among different income sectors.

![A. Benefit Coverage (2)

KSP – ADB Universal Health Coverage Regional Forum

• Out-patient benefit packages are designed

per specific services provided in out-

patient facility. For example, RHUs can be

accredited in one or all of the PCB

(Tsekap), MCP, TB-DOTS, Malaria, etc.

In-

patient

benefits

• Shift from FFS to All

Care Rate (ACR)

• More pronounced

benefits (ACR)

Out-

patient

benefits

• Out-patient benefit

packages for RHUs/HCs

(OPB, MCP, TB-DOTS)

• Other OP benefits (ASC,

RT, OBT, DC)

• Other accredited out-patient services by

Philhealth includes (1) Ambulatory

Surgical Clinics (ACS) [private facilities],

(2) Dialysis centers (DC) [private & public];

Others: Outpatient blood centers and

Radiotherapy](https://image.slidesharecdn.com/philippinesksp-adb10262015-160222021258/75/Philippines-Health-system-and-Financing-2015-14-2048.jpg)