The document summarizes several key retail trends for 2016, including:

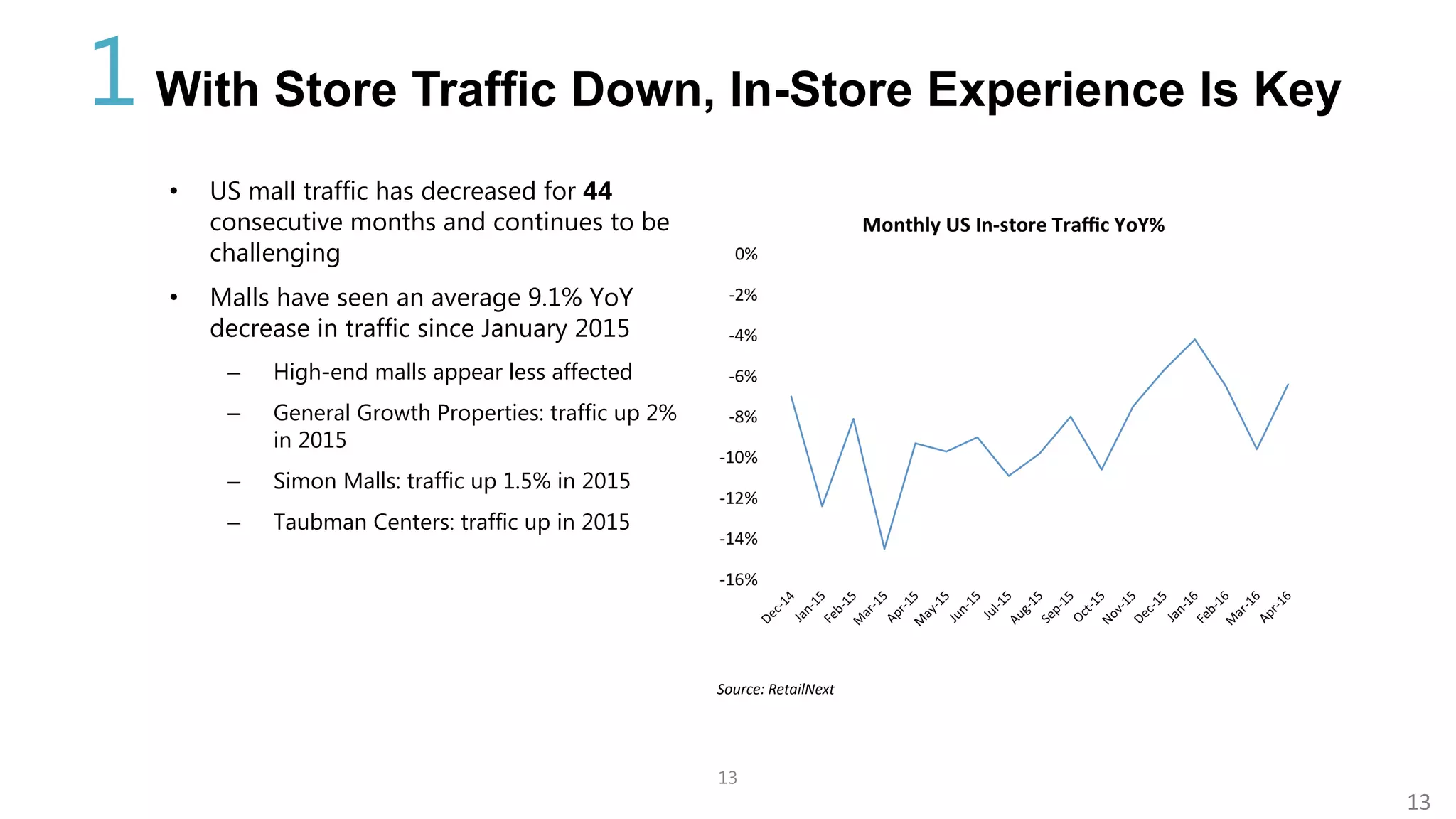

- Store traffic continuing to decline, making in-store experience more important.

- Growth of virtual reality (VR) and its potential impact on retail through VR experiences.

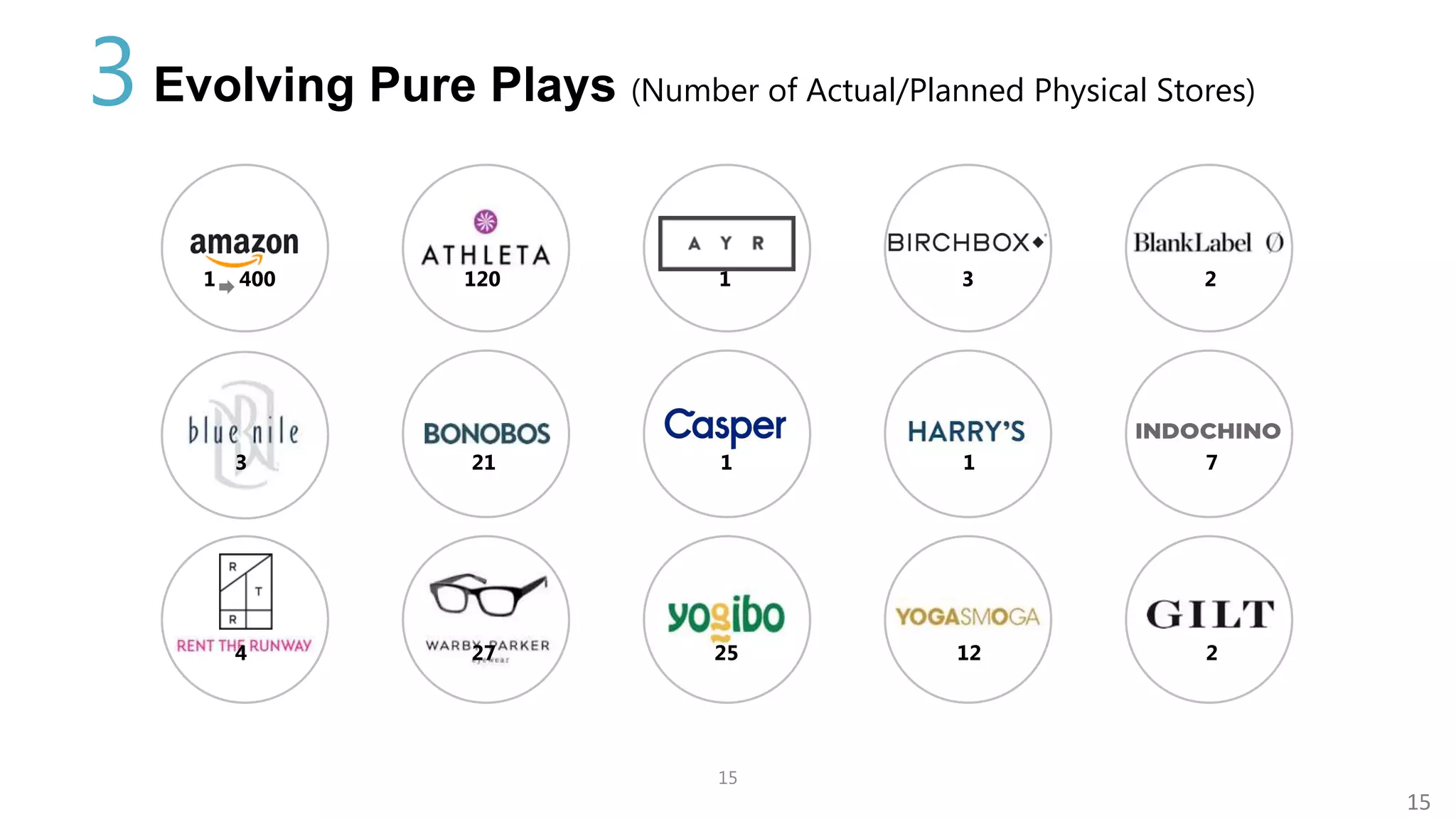

- Evolution of pure online retailers to open some physical stores.

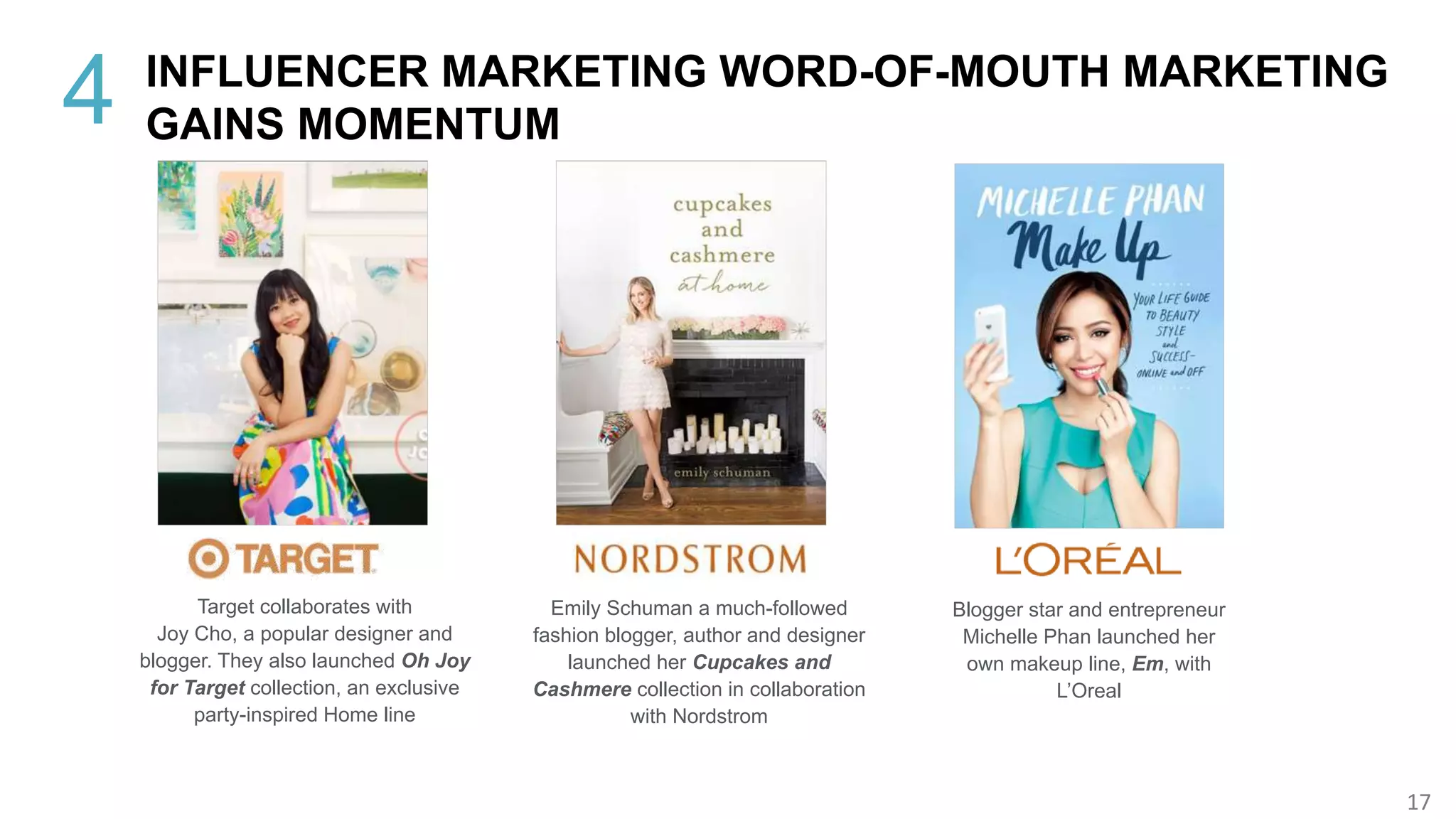

- Influencer marketing gaining momentum as brands partner with popular social media figures.

- Secondary markets and resale platforms growing in popularity among consumers.

- Subscription models emerging in categories like beauty and fashion.