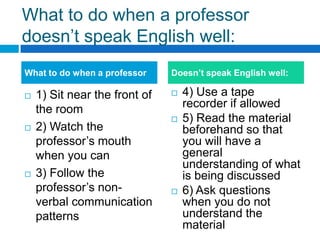

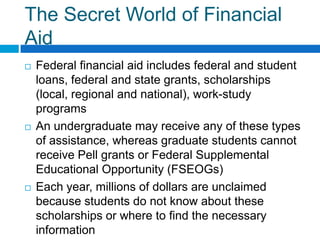

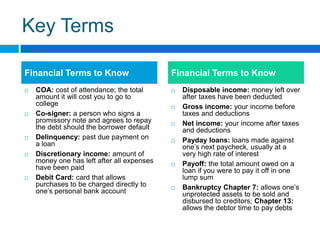

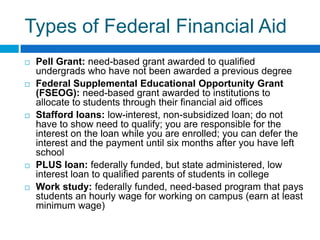

This document provides a summary of key information students need to know about college courses, professors, financial aid, loans, and protecting themselves. It discusses interacting respectfully with professors, understanding their responsibilities, and seeking help when needed. It outlines types of financial aid and scholarships, stresses minimizing loans, and warns against payday loans. It also provides tips for safeguarding personal information and avoiding identity theft.