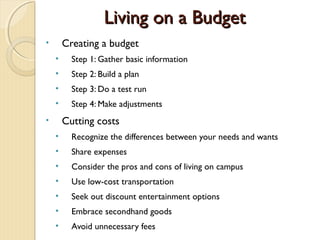

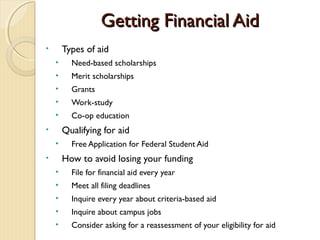

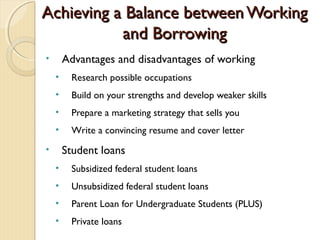

The document provides advice on managing money in college including creating a budget, cutting costs, applying for financial aid, balancing work and loans, managing credit wisely, and planning for the future. It discusses creating a budget with a 4 step process, ways to cut costs like recognizing needs vs wants and using discounts, types of financial aid and how to qualify, advantages and disadvantages of working and taking student loans, understanding credit scores and reports, and tips for financing life after graduation like saving regularly.