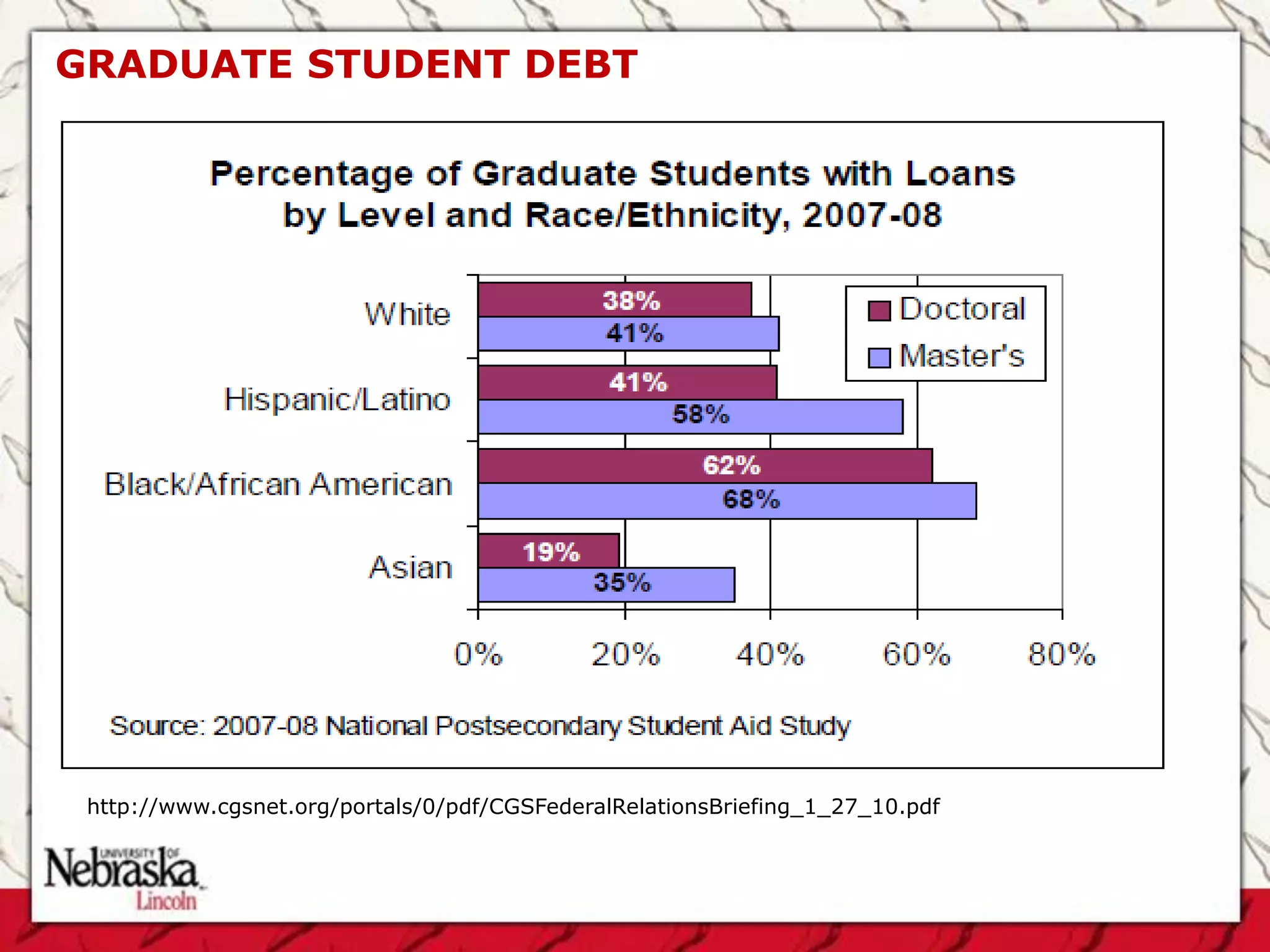

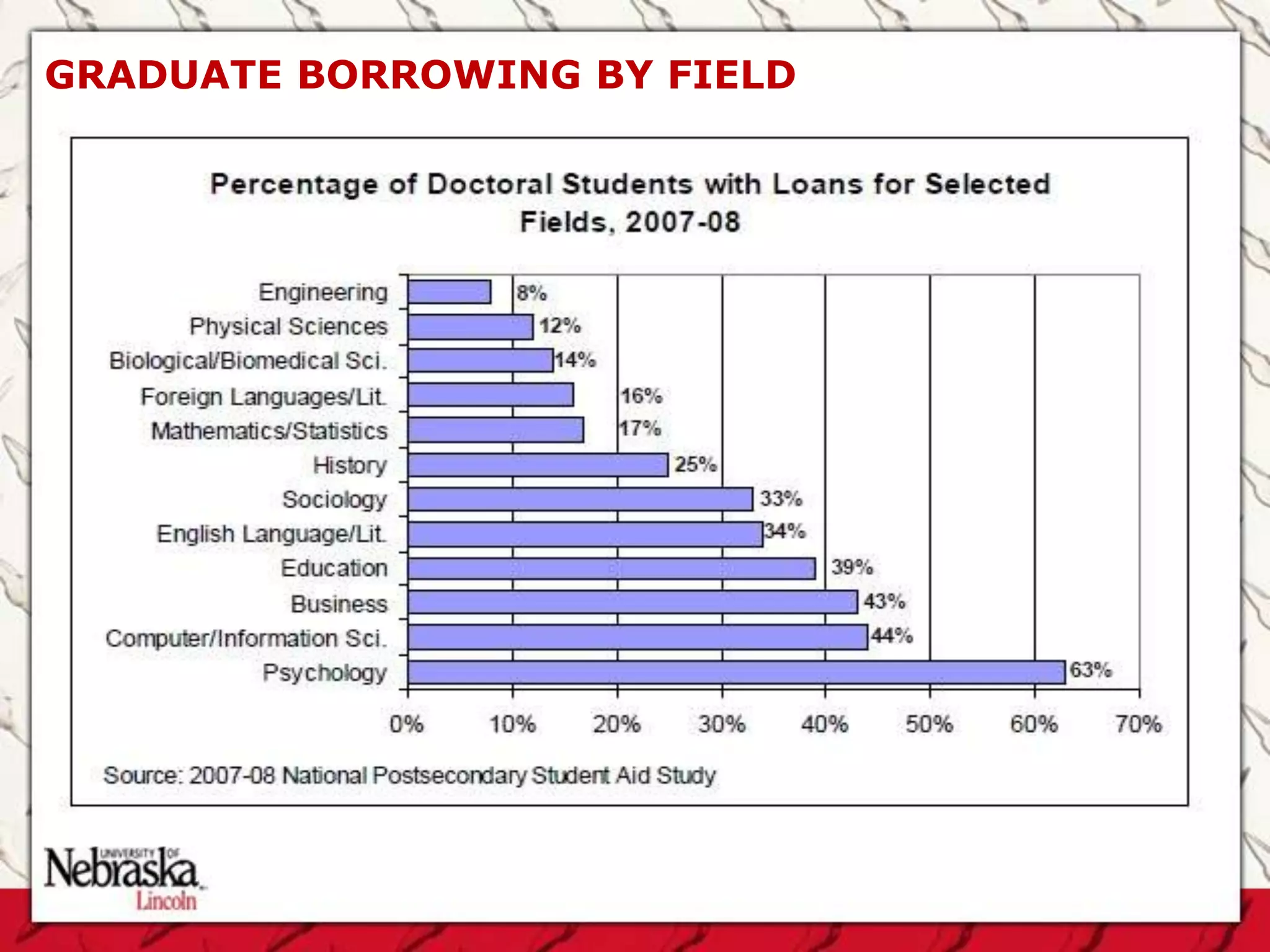

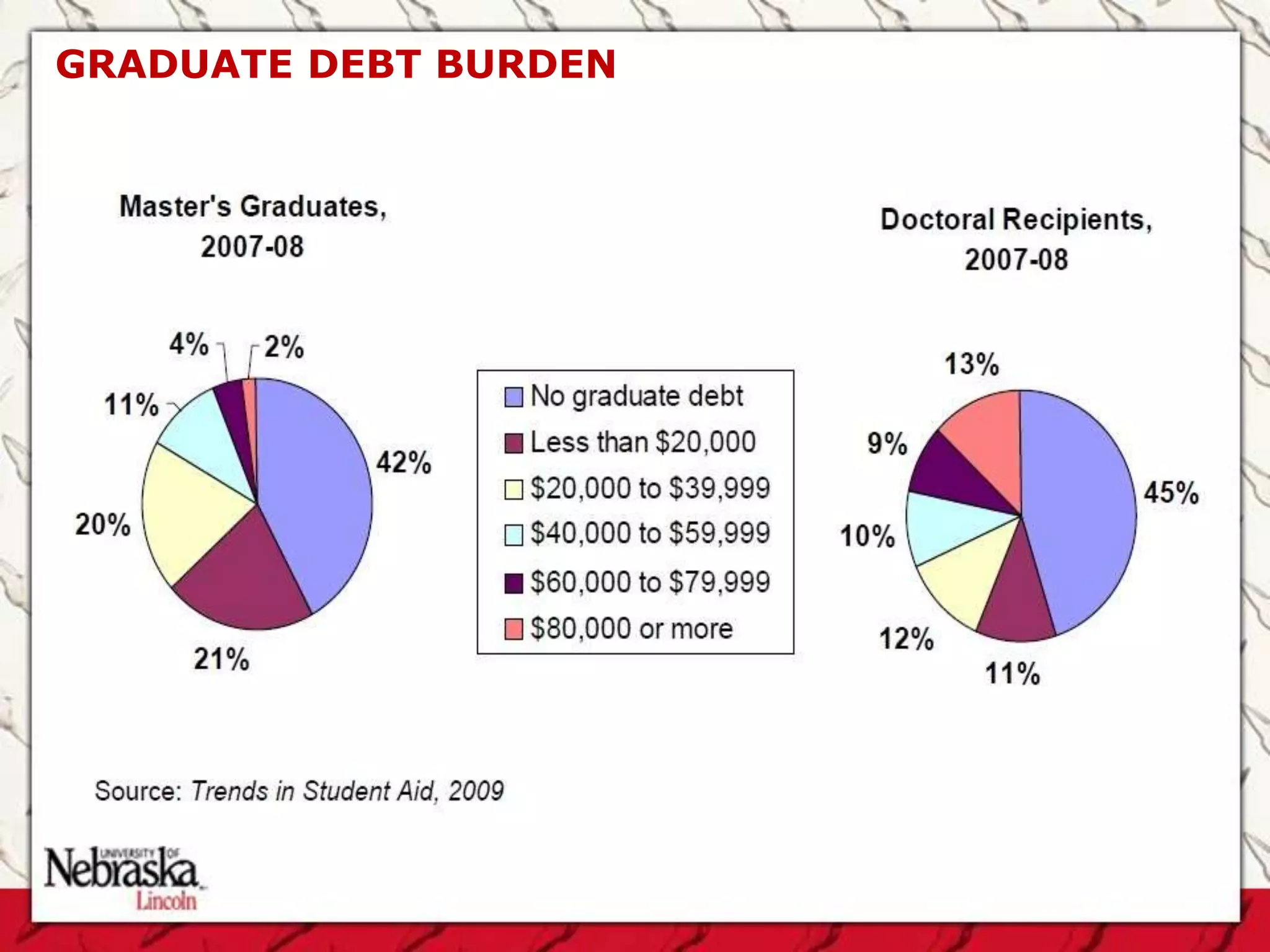

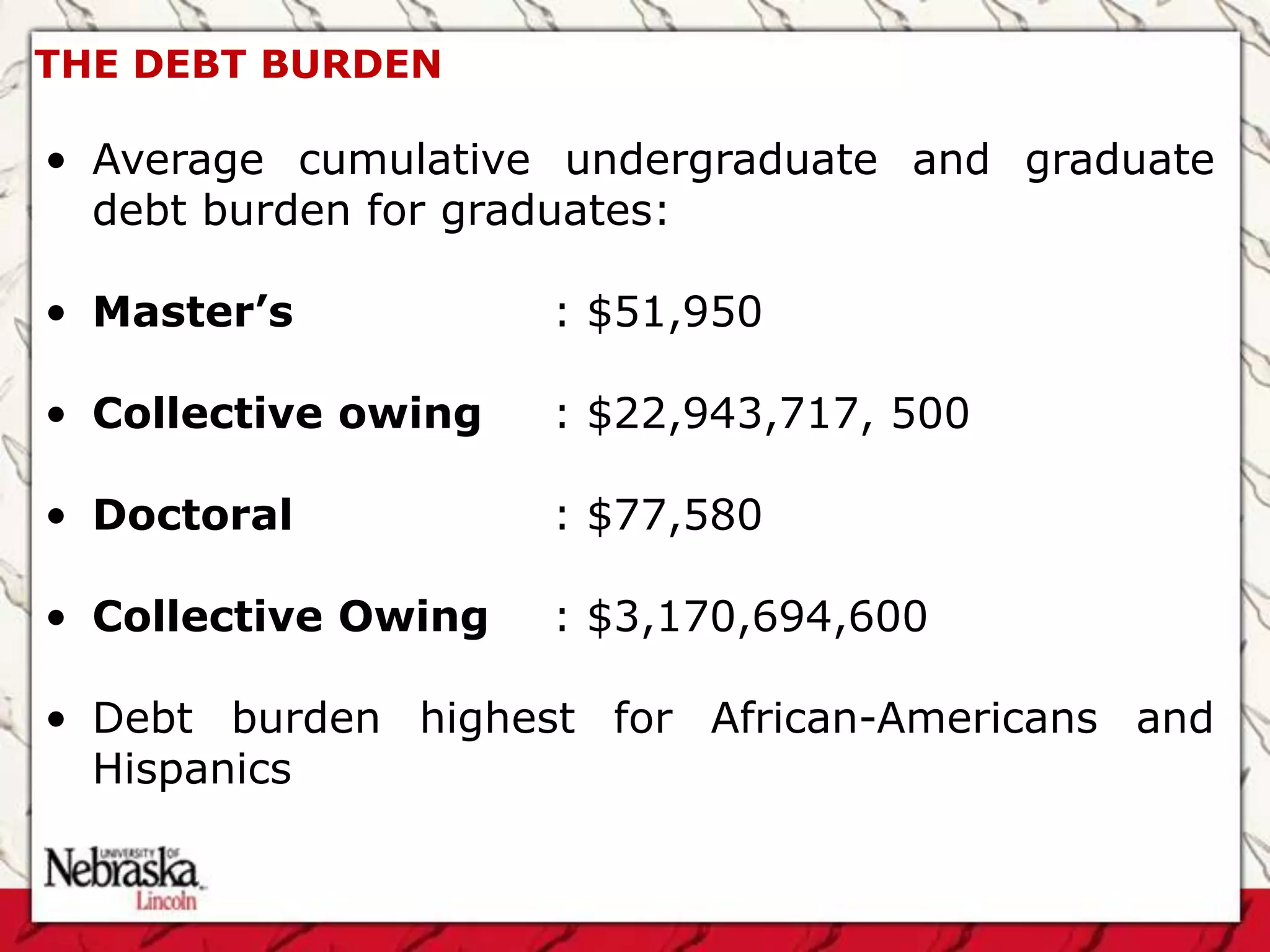

This document provides an overview of funding and budgeting for graduate students. It discusses various sources of funding such as grants, scholarships, fellowships, teaching assistantships, and research assistantships. It notes that the average debt burden for master's and doctoral students is around $50,000-$80,000. The document outlines strategies for budgeting, saving money for emergencies, and avoiding common mistakes like not saving or incurring too much debt. It emphasizes weighing different funding options, stacking multiple sources of support, and considering how funding relates to faculty advisors.