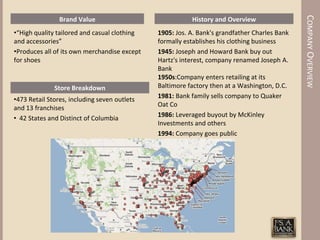

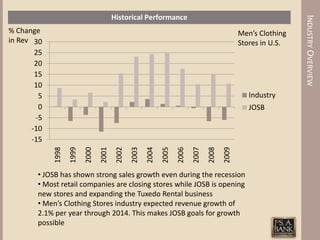

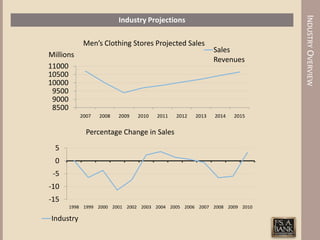

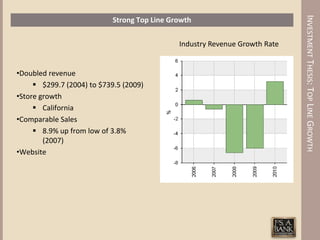

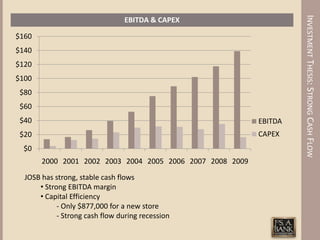

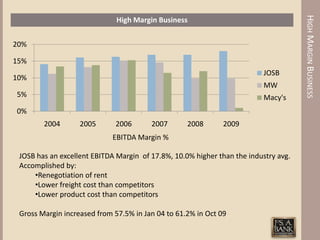

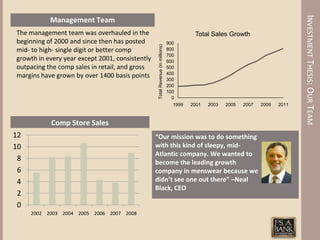

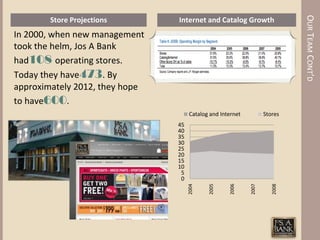

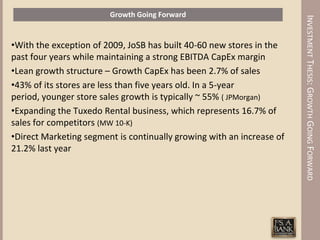

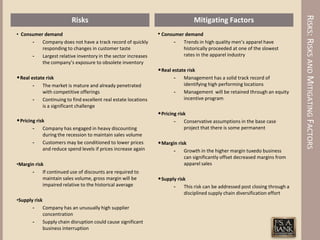

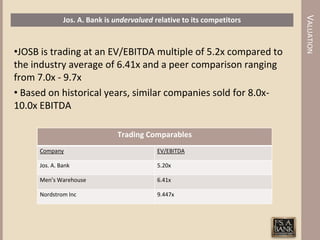

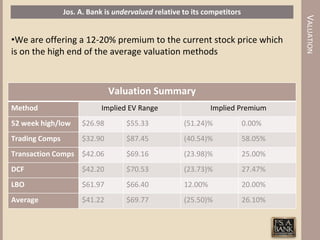

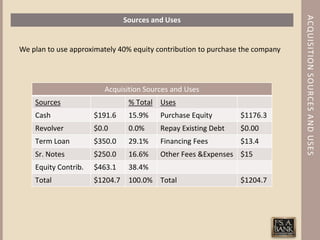

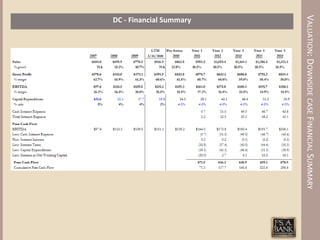

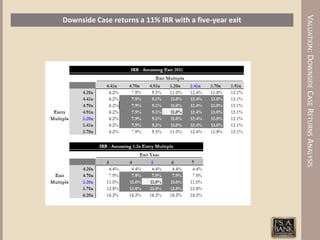

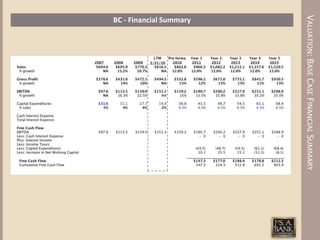

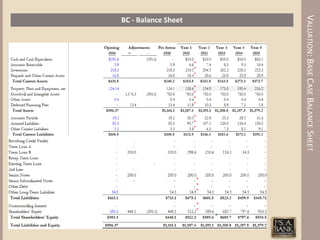

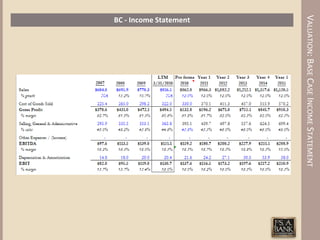

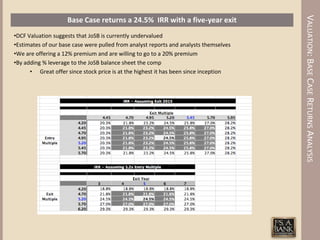

The document provides an overview and investment thesis for an LBO of Joseph A. Banks, a men's clothing retailer. Key points include: Joseph A. Banks has shown strong top-line growth and cash flows. The management team was overhauled in 2000 and has posted consistent comp sales growth. Risks include consumer demand changes and real estate challenges, but these are mitigated by the company's track record. The valuation compares Joseph A. Banks to competitors, finding it currently undervalued. Financial projections in a downside and base case show potential returns of 11-24% IRR with a 5-year exit.