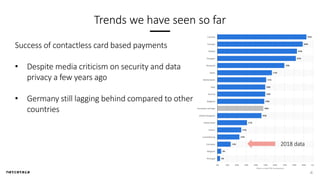

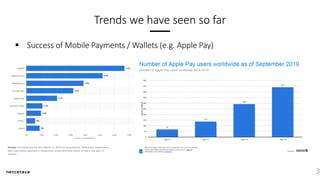

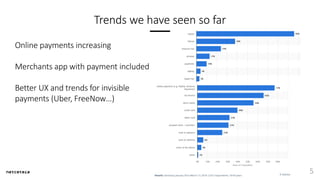

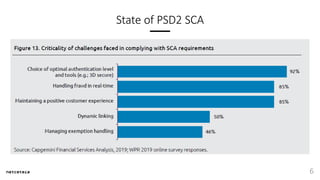

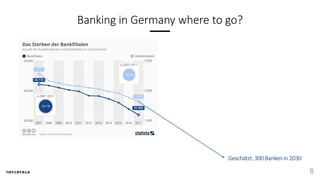

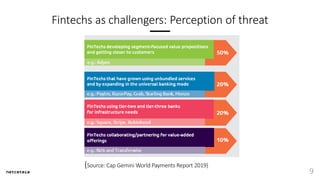

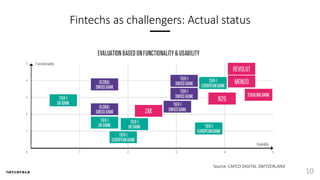

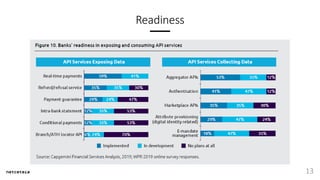

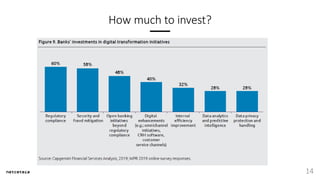

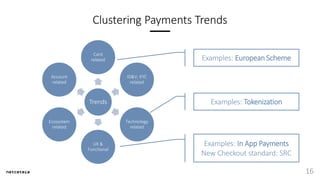

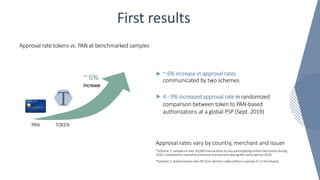

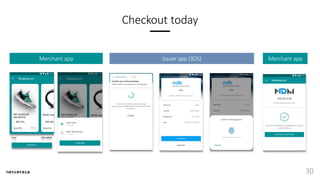

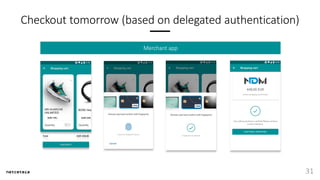

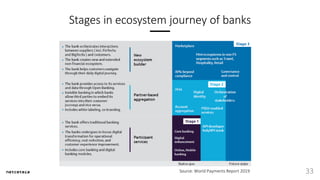

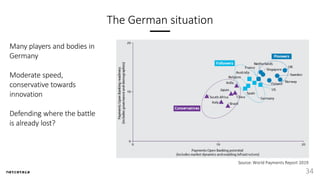

The document discusses various payment trends that have emerged or shown potential. It notes the success of contactless card payments in some countries and mobile wallets. Other trends discussed include use of biometrics for authentication, open banking interfaces, increasing online payments, and merchants integrating payments into their apps. The document also examines blockchain applications that have yet to breakthrough, as well as ideas around IoT payments, walk out retail payments, and banking ecosystems. It invites attendees to a workshop to brainstorm on trends, assess top trends, and discuss the German payments landscape and challenges for banks.